New and familiar faces among APEC leaders will descend on South Korea's southern ancient city carrying fully loaded diplomatic and economic agendas — each aiming to redefine its position in the emerging post-globalization trade order.

From the fate of Seoul's $350 billion investment pledge in the United States to the escalating U.S.–China tariff standoff and Japan's expansionary policy shift, every bilateral engagement is set to influence how Asia's next trade architecture will evolve.

South Korea–U.S.: $350 billion investment and tariff negotiations

For the host country, the top priority will be finalizing the structure of its $350 billion investment pledge in the U.S. — a package covering EV plants, battery gigafactories, and semiconductor facilities.

Talks have entered the final stretch ahead of U.S. President Donald Trump's arrival in Gyeongju. South Korea's Deputy Prime Minister and Finance Minister Koo Yun-cheol said Seoul is "making every effort to reach an agreement during the summit period."

The U.S. maintains that only direct cash investments should qualify for tariff concessions, while Seoul argues that loan guarantees and joint-funded vehicles carry equal economic value.

Discussions have also expanded to include a phased reduction of the 25 percent U.S. tariff on South Korean automobiles and the creation of a joint semiconductor-supply-chain infrastructure fund.

After months of back-and-forth, both sides are still ironing out details — including the cash ratio, installment schedule, and profit-sharing structure — effectively negotiating an investment-for-tariff swap.

Tensions between Washington and Beijing have intensified over rare-earth elements, essential for electric vehicles, semiconductors, and defense systems.

President Trump has threatened to impose an additional 100 percent tariff on Chinese imports beginning Nov. 1, in response to Beijing's tighter export controls on rare-earth materials and related technologies. If implemented, the total tariff burden on Chinese goods entering the U.S. could rise to as high as 157 percent.

Beijing, which commands over 90 percent of global rare-earth supply and nearly all refining capacity, has expanded its export bans from seven to twelve elements — including dysprosium and terbium, for which the U.S. depends on China for more than 97 percent of imports.

Rare-earths are indispensable across U.S. industries, from iPhones to Tesla EVs. China's new restrictions on the transfer of extraction and refining technologies, set to take effect Dec. 1, will further tighten the squeeze on Washington.

Given the stakes, global attention will focus on whether the leaders of the two superpowers will hold a face-to-face meeting in Gyeongju and whether any progress can be made toward de-escalating tariff tensions at APEC.

South Korea–Japan: Pragmatic supply-chain repair

For Seoul and Tokyo, APEC offers a fresh opportunity to consolidate industrial cooperation and restore trust in strategic sectors.

Both governments are preparing to resume joint R&D and standardization talks on semiconductor and battery materials, as they seek to rebuild mutual confidence in technology and supply-chain partnerships. Japan aims to reassert its position as a reliable supplier of high-purity chemicals, while South Korea looks to solidify its role as a global foundry hub.

Recent exchanges between South Korean President Lee Jae Myung and Japan's new Prime Minister Sanae Takaichi signaled shared intent to pursue pragmatic collaboration and develop stable industrial frameworks in Northeast Asia.

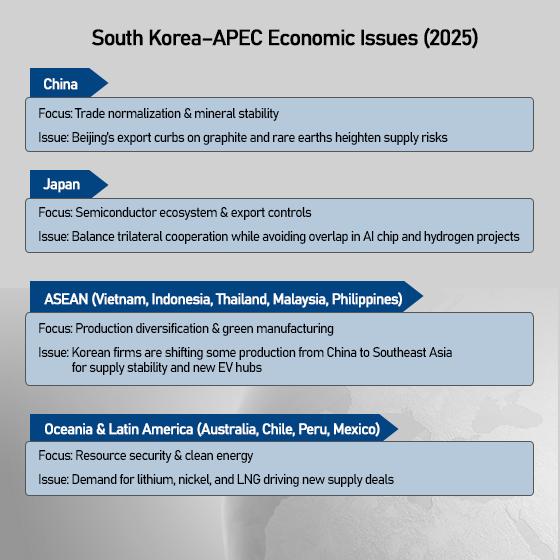

Beyond the major powers, South Korea is widening its economic outreach across emerging and resource-rich partners to strengthen its strategic footing in the region.

In Southeast Asia, Seoul is advancing projects in hydrogen energy, renewable power, and digital trade. Vietnam and Indonesia are emerging as pivotal partners, with South Korean firms establishing EV and battery production lines to diversify supply chains away from China. The aim is to transform ASEAN from a manufacturing base into a green and digital growth partner.

At the same time, South Korea is deepening cooperation with Australia, Chile, and Peru to secure stable, long-term supplies of lithium, nickel, and LNG — resources critical to its clean-energy transition.

These partnerships, coupled with Seoul's initiatives to improve transparency in green investment and harmonize digital trade standards, reflect a broader push toward a more balanced and sustainable regional economy — one designed to reduce dependence on Chinese materials while expanding Korea's industrial influence across the Indo-Pacific.

Behind the ceremony, APEC 2025 is shaping up as a stress test for how far economic cooperation can stretch amid intensifying geopolitical rivalry. The discussions in Gyeongju — spanning tariffs, supply chains, and technology standards — underscore a region recalibrating its balance between competition and interdependence.

Copyright ⓒ Aju Press All rights reserved.