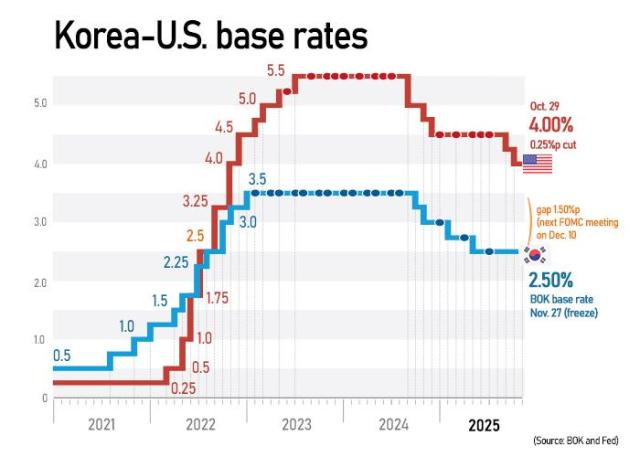

SEOUL, November 27 (AJP) - The Bank of Korea kept the base rate unchanged at 2.50 percent at its final monetary policy meeting of 2025 on Thursday and signaled that the latest easing cycle may be nearing an end as a persistently weak won fans inflation while simultaneously eroding household purchasing power.

Governor Rhee Chang-yong said the decision was “almost unanimous,” with five of the six board members voting for a freeze due to heightened foreign-exchange volatility and unresolved uncertainty in the housing market.

One member sought a cut to shore up the fragile economy. Three members also argued the central bank should preserve room for another reduction in three months, depending on how risks evolve.

Bond prices fell on the perceived hawkish tilt. The three-year government bond yield rose 5.3 basis points to 2.948 percent, while the five-year gained 4.8 basis points to 3.132 percent. (Bond yields move inverse to prices.)

The won strengthened 5.6 won to 1,464.9 per dollar following repeated verbal interventions. The KOSPI slipped back below 4,000 after a brief rebound.

Rhee declined to confirm market speculation that the BOK’s easing cycle — which began in October 2024 after rates peaked at 3.50 percent — was effectively over as the market noted the tweaks in the BOK statement after the rate meeting – the replacement of the phrase “easing stance” with the softer “possibility of easing.”

“How this is interpreted is up to individuals,” Rhee said. “It is difficult to predict what lies ahead when both upward and downward pressures exist.”

The BOK made mild revisions to its growth forecast: raising this year’s projection to 1.0 percent from 0.9 percent and next year’s to 1.8 percent from 1.6 percent. Growth in 2027 is expected to edge slightly above the potential rate of 1.8 percent, at 1.9 percent.

Rhee warned of a buildup in inflationary pressure next year due to the weak currency and firmer global oil prices.

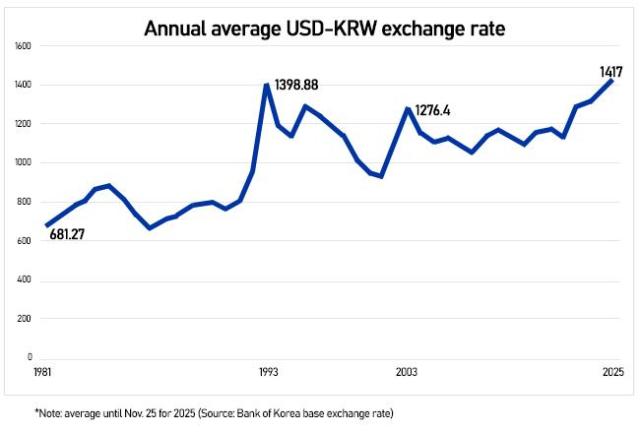

The won is projected to average above 1,400 per dollar this year — a level unseen even during the Asian Financial Crisis or the Global Financial Crisis.

To stabilize the currency, fiscal and monetary authorities have formed an emergency council with the National Pension Service, Korea’s largest holder of dollar-denominated assets, hoping to better manage supply-demand dynamics in the FX market.

Rhee called the won’s weakness extraordinary, attributing it to a deep structural tilt toward overseas investments rather than crisis-level stress. He pointed to the stability of Korea’s external borrowing conditions: the five-year credit default swap premium stood at 24 basis points in October, down from 31 in May.

“We could send a positive signal to the foreign-exchange and real economy if we halt the easing cycle,” he said, though he emphasized that both monetary and fiscal policy options are limited because the imbalance is structural rather than cyclical.

“That the won remains weak despite the narrowing Korea-U.S. rate gap suggests the core issue lies in the imbalance between domestic and overseas investment flows,” he added.

Rhee rejected claims that the NPS is being pressured to defend the currency, arguing that an excessively weak won already erodes returns from the fund’s overseas portfolio — ultimately undermining retirement assets.

Copyright ⓒ Aju Press All rights reserved.