This marks the first time the fast-growing sector has crossed the 200 trillion won threshold.

The achievement underscores the ETF market’s rapid ascent in the country. Net assets have nearly doubled since June 2023, when the figure first topped 100 trillion won, and have more than tripled since May 2020, when assets stood at just 61.95 trillion won.

Long favored for their low fees and ease of access, ETFs have cemented their status as a mainstream investment vehicle among South Korean retail investors. The number of listed ETF products reached 989 as of the end of May. The market’s expansion is striking, considering that Korea’s first ETF — the KODEX 200 — launched only 23 years ago.

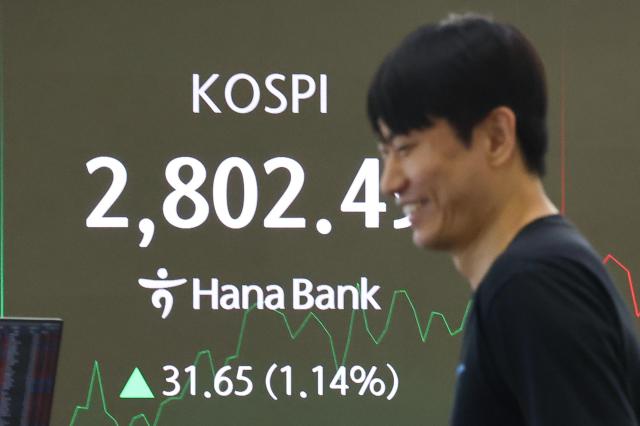

Domestic equity ETFs have been among the standout performers in 2024, buoyed by investor enthusiasm for local policy-driven themes amid a sluggish U.S. stock market. Sectors such as defense, aerospace, and conglomerates like Hanwha Group have drawn significant inflows.

The top five performers through May were all focused on domestic themes. Leading the pack was the PLUS K-Defense ETF, which returned 116 percent from January through May. It was followed by TIGER K-Defense & Space (106 percent), PLUS Hanwha Group (99 percent), SOL K-Defense (86 percent), and PLUS Global Defense (62 percent).

Retail investors have been central to the market’s expansion, with net purchases totaling 10.32 trillion won through May 29. Two fund managers dominate the space: Samsung Asset Management’s KODEX brand commands 38.81 percent of the market, while Mirae Asset Global Investments’ TIGER brand holds 33.41 percent — effectively creating a duopoly.

The market’s growth has also sparked innovation, with a proliferation of products extending beyond traditional passive index funds. New offerings include actively managed ETFs, thematic funds tied to specific industries or government policies, monthly dividend ETFs, downside buffer ETFs, and strategies employing covered calls.

Still, analysts caution that the rapid expansion carries risks. A flood of similarly themed products could oversaturate the market, while “zombie ETFs” — funds with low assets and trading volume — may undermine investor confidence if left unchecked.

Copyright ⓒ Aju Press All rights reserved.