SEOUL, September 23 (AJP) - South Korea’s memory giants and investors are betting on a looming chip super cycle that could prove the most lucrative and enduring yet, fueled by the surging appetite for artificial intelligence (AI).

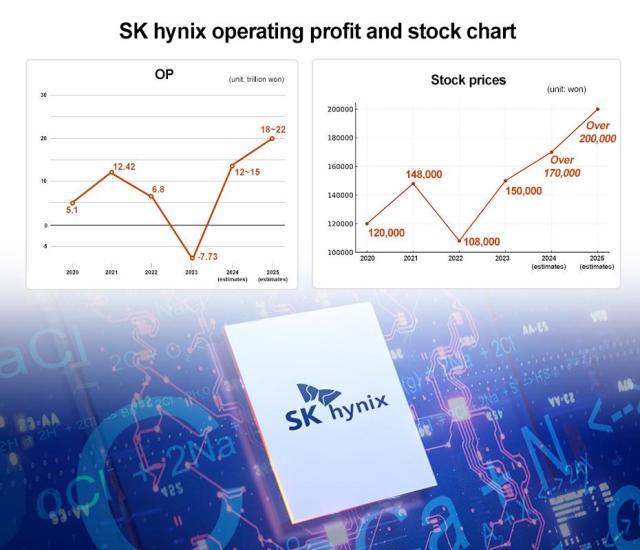

SK hynix is poised to lead the AI-driven memory race, having leapt ahead in conventional DRAM and seized the initiative in high-bandwidth memory (HBM), a critical component for powering AI chips. The company is expected to command at least half of the global HBM market through 2027 under its contract with NVIDIA. Its stock, already at historic highs, is projected to climb further as demand for HBM is forecast to grow more than 50 percent next year.

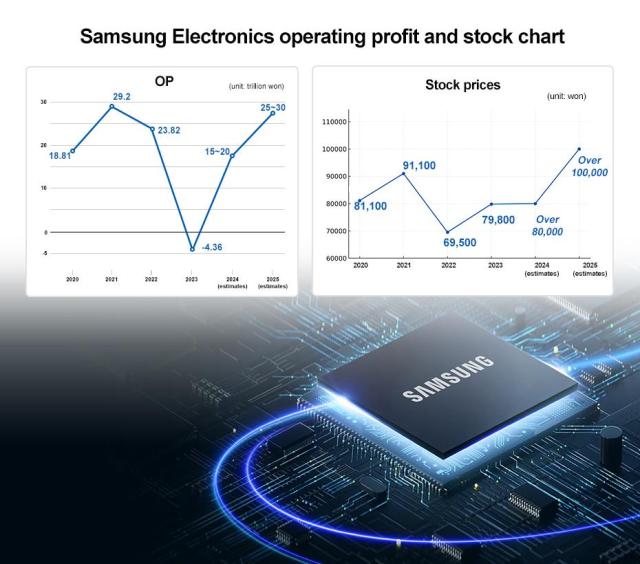

Samsung Electronics, dethroned by SK hynix in the HBM market due to its slower move, has nevertheless secured milestone foundry contracts that could lift its chip division earnings close to pandemic-era peaks. Samsung has won orders to produce 7-nanometer chips for IBM’s data center processors and 2-nanometer chips for Tesla’s sixth-generation AI processors.

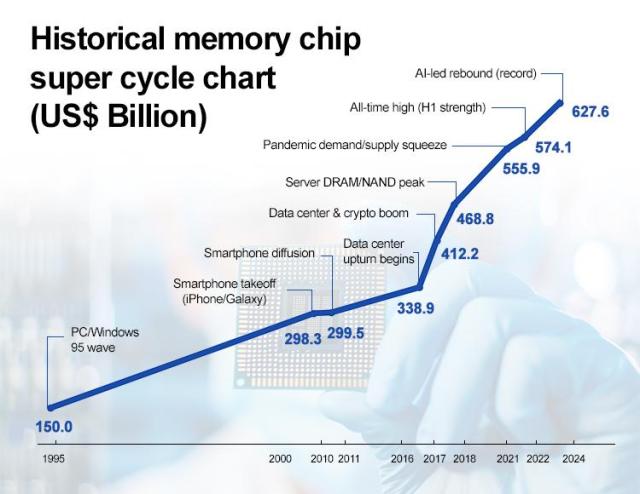

Chip super cycles typically emerge every three to four years when breakthrough technologies spark sustained demand surges lasting 18 to 24 months. The smartphone revolution of 2010–2011 marked the first major super cycle, driven by explosive demand for mobile DRAM and NAND flash memory. Cloud computing and cryptocurrency mining underpinned the 2017–2018 cycle, while the pandemic-driven remote work boom fueled the 2020–2022 surge, sending memory prices soaring amid supply shortages.

The upcoming bull cycle differs fundamentally from past booms, which were driven by supply shortages or consumer electronics adoption. AI data centers require specialized HBM chips capable of processing massive datasets with minimal latency, creating what industry executives describe as a structural shift toward higher-value products. “This AI boom has a bigger effect than data centers alone,” said Lee Seung-woo at Eugene Investment Securities. “We expect this cycle could break records that haven’t been touched since around 2016, roughly 10 years ago.”

HBM shipments are projected to rise about 70 percent year-on-year, with global sales jumping from an estimated $38 billion in 2025 to $58 billion in 2026, according to TechInsights and JPMorgan.

In a report titled “Memory Supercycle — Rising AI Tide Lifting All Boats”, Morgan Stanley named Korean chipmakers as prime beneficiaries, designating Samsung Electronics as its “top pick” and raising SK hynix’s target price by 58 percent to 410,000 won.

The AI-driven cycle may also last longer than the typical two-year span, depending on transitions by big-data giants Google, Amazon, and Meta. Recent developments suggest the cycle may have more momentum than initially expected, with Oracle's September 11 earnings announcement helping to dispel "AI peak" concerns.

Lee noted that mobile and PC manufacturers are now actively requesting increased supply, while the latest iPhone model launch has shown strong sales performance, suggesting pent-up smartphone demand may be emerging alongside AI growth. TechInsights projects more than 2.5 million AI models will be deployed in 2025—nearly double the number in 2024—while datacenter NAND demand could grow over 30 percent as operators shift from hard disk drives to high-capacity solid-state storage for faster data access.

Copyright ⓒ Aju Press All rights reserved.