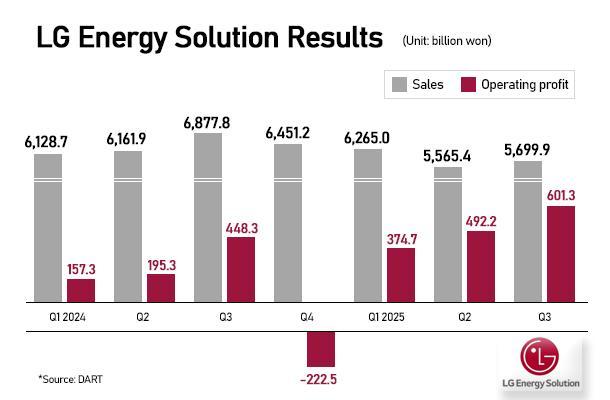

In a preliminary earnings estimate for the quarter ended September, the company projected an operating profit of 601.3 billion won ($422.8 million), up from 448.3 billion won a year earlier.

Sales during the same period, however, fell 17.1 percent to 5.7 trillion won, reflecting a broader slowdown in global EV demand.

LG Energy Solution, a key supplier to General Motors and Tesla, had earlier warned of possible pressure on its top and bottom lines following the termination of the $7,500 federal tax credit in September.

The company said its third-quarter operating profit included a 365.5 billion won subsidy from the U.S. Inflation Reduction Act (IRA), accounting for 60.8 percent of the total. Excluding the U.S. tax credit, the net operating profit stood at 235.8 billion won, marking a profit for the second consecutive quarter even without U.S. subsidies.

For the January–September period, the company estimated an operating profit of 1.46 trillion won, up a whopping 83.3 percent from a year earlier, while sales fell 8.5 percent to 15.73 trillion won.

Final quarterly results will be announced on October 30.

Beyond the EV market slowdown, LG Energy Solution faced a setback last month when its joint battery plant with Hyundai Motor in Georgia, U.S., was hit by a large-scale immigration raid, resulting in the arrest of hundreds of South Korean workers.

As of 10:00 a.m. Seoul time, LG Energy Solution shares were up 0.4 percent at 361,000 won.

* This article, published by Aju Business Daily, was translated by AI and edited by AJP.

Copyright ⓒ Aju Press All rights reserved.