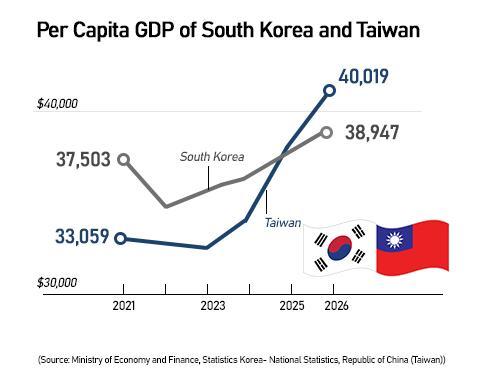

Taiwan's economy is projected to grow 5.3 percent this year, upgraded from 4.5 percent in a consensus of eight global banks in late August. South Korea, by contrast, is expected to eke out growth of just 1.1 percent after a modest 2 percent expansion in 2024.

Both resource-poor economies remain export-driven and dependent on high-tech manufacturing. But Taiwan's all-in bet on semiconductors — and its ability to capture the AI upcycle — has sharply widened the gap.

"Semiconductors are definitely the main reason for the differing performance of the two economies," said Wang Shu-feng, professor of business administration at Ajou University in South Korea and National Chengchi University in Taiwan.

Taiwan Semiconductor Manufacturing Co. (TSMC), the world's largest contract chipmaker and often described as the country's "benchmark stock index," accounts for nearly 10 percent of Taiwan's GDP and serves as the key driver of its economic momentum.

Semiconductors contribute roughly 15 percent of Taiwan's GDP, compared with 7 to 8 percent in South Korea, although the sector represents about one-fifth of Korea's total exports.

Korea has concentrated on mass-market memory chips, while Taiwan has focused on customized logic chips — a strategy that shields producers from cyclical volatility through long-term contracts and close client relationships.

"Taiwan goes all in on chipmaking. Most top students join TSMC or other semiconductor firms after graduation, whereas many South Korean students pursue medical or biochemistry fields, with broader career options," said Ko Jong-wan, head of strategy at the Korea Semiconductor Industry Association.

Taiwan's bipartisan political support has also bolstered its semiconductor ascendancy. Seoul's efforts, in contrast, are often mired in debate over favoritism toward large conglomerates. Korea's special semiconductor law, which would have exempted chip workers from the 52-hour workweek limit, stalled in the National Assembly, while Taiwan passed legislation in 2017 allowing chipmakers to exceed the standard 40-hour week.

When the United States, Japan, and the European Union rolled out massive subsidies to build local chip industries, Taiwan formally designated semiconductors as a "core national industry" in 2023 and introduced tax credits covering 25 percent of R&D investments. Korea's parliament only passed a moderate "K-Chips Act" in January this year, raising tax credits for facility investments from 15 percent to 20 percent.

"With the AI boom driving demand for advanced packaging and chipmaking capabilities led by Taiwan's TSMC, it may be difficult for South Korea to close the gap in the near term," Wang said.

Copyright ⓒ Aju Press All rights reserved.