SEOUL, October 13 (AJP) - Beauty has joined chips and cars as another defining powerhouse for Korea, with K-beauty now shaping trends and commanding markets in two of the world's largest economies.

Korea ranked as the world’s third-largest cosmetics exporter last year, trailing only France and the United States. In both the U.S. and Japanese markets, Korean beauty products have overtaken long-dominant French labels to become the top imported cosmetics.

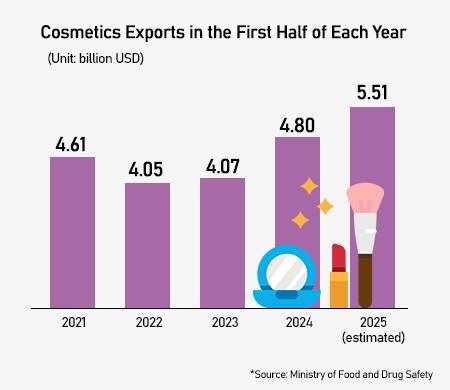

According to the Ministry of Food and Drug Safety, Korea's cosmetics exports hit a record $5.51 billion in the first half of this year, up 14.8 percent from a year earlier. Shipments have maintained a near-unbroken streak — $9.2 billion in 2021, $8 billion in 2022, $8.5 billion in 2023, and $10.2 billion in 2024 — weathering global slowdowns with only a brief dip during China’s market contraction in 2022.

Even as Korea's total exports fell 7.5 percent in 2023 before rebounding 8.1 percent last year, cosmetics shipments grew 6.3 percent and 20.3 percent, respectively, according to the Korea International Trade Association (KITA).

The rise of K-beauty has coincided with a strategic pivot away from China, where nationalist consumption trends and local favoritism squeezed out Korean products. The share of cosmetics exports to China plunged from 34.7 percent in 2023 to 19.6 percent ($1.08 billion) in the first half of this year — the first time it dropped into the 10-percent range. By contrast, exports to the U.S. and Japan climbed 17.7 percent and 15.7 percent, respectively.

In the U.S. market, Korean cosmetics exports surged to $1.71 billion last year, surpassing France's $1.26 billion, followed by Canada, Italy, China, Mexico, the United Kingdom, and Japan.

Building on this momentum, Korean beauty retailers are expanding aggressively overseas. CJ Olive Young, the country's largest health and beauty chain, established a local subsidiary in Los Angeles earlier this year after opening its Japanese branch in May 2024. Its first U.S. store is slated to open by year-end, signaling a deeper K-beauty push into the global mainstream.

Olive Young has become a major growth engine for CJ Group, maintaining double-digit expansion despite remaining unlisted. In the second quarter, the company reported 1.46 trillion won ($1.07 billion) in sales, up 21 percent from a year earlier, with 144 billion won in net profit — marking its eighth consecutive quarter surpassing the 1 trillion won revenue mark.

For the first half of 2025, sales rose 17.9 percent year-on-year to 2.7 trillion won, and net profit gained 17.1 percent to 270 billion won. Analysts forecast Olive Young's annual revenue could exceed 5 trillion won this year — a record for the retailer.

The government is also throwing its weight behind the beauty boom. The Ministry of SMEs and Startups plans to designate 500 innovative products across cosmetics, fashion, lifestyle, and food as "K-Export Strategy Items" by 2030. About 80 items will be selected this year, with similar additions annually over the next five years.

"The cosmetics industry now has a high proportion of exports driven by small and medium-sized enterprises," said Kim Do-wan, an official in charge of global growth policy. "To ensure continued expansion, we need to nurture these smaller brands. We're identifying promising companies with export potential and providing targeted support so they can strengthen their global competitiveness."

Copyright ⓒ Aju Press All rights reserved.