SKC and Kuwait's Petrochemical Industries Company (PIC) are reportedly seeking a buyer for their combined stake in joint venture SK picglobal, as market woes from Chinese oversupply and Middle Eastern competition have spilled over from basic petrochemicals to downstream products, threatening the viability of even high-value chemical makers.

SK picglobal, established in 2020 when SKC spun off its chemical operations, produces propylene oxide and other specialty chemicals used in automotive interiors, cosmetics, and pharmaceuticals. SKC holds a 51 percent stake, while PIC owns the remaining 49 percent, which it acquired for about 536 billion won shortly after the spinoff.

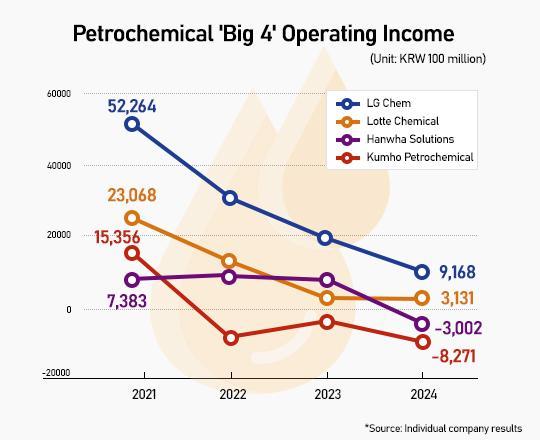

The downturn mirrors the broader struggles across South Korea’s petrochemical industry, where companies expanded aggressively even as profit margins deteriorated. The country currently operates 10 naphtha crackers — four each in Yeosu and Daesan and two in Ulsan — with annual ethylene capacity of about 13 million tons, ranking fourth globally after China, the United States, and Saudi Arabia.

Ethylene, a colorless and flammable gas with a faint sweet odor, is a fundamental building block for plastics and other petrochemical products. SK picglobal's flagship product, propylene oxide, is also a co-product of ethylene production.

Domestic ethylene capacity is expected to rise further to nearly 14.7 million tons once S-Oil completes its Shaheen project in late 2026, adding pressure to an industry already squeezed by Chinese overproduction and new Middle Eastern entrants.

In response, the government has brokered a "voluntary agreement" among producers to reduce naphtha cracking output by 2.7 to 3.7 million tons, or up to 25 percent of total capacity, as part of an industry restructuring effort.

"Chinese competition, Middle Eastern entry, and ethylene overproduction are all battering Korean producers. Ethylene is constantly losing profitability," said a spokesperson for the Korea Chemical Industry Association.

Alongside capacity cuts, companies are pursuing vertical integration to survive. By merging with naphtha producers, chemical manufacturers aim to lower costs and phase out excess capacity through facility closures.

Lotte Chemical and HD Hyundai Oilbank are leading the effort at the Daesan complex in South Chungcheong Province, where they are in talks to consolidate operations. The two companies already collaborate through their joint oil venture, HD Hyundai Chemical.

The Yeosu complex poses the biggest challenge, industry officials say, as it faces the largest required capacity cuts and involves multiple stakeholders, including Yeochun NCC, LG Chem, and Lotte Chemical. Negotiations have been slow and difficult.

"Now with the Middle East also rushing into the competition, we need advanced technology to gain the upper hand," said Koo Su-jin, professor of petrochemical process engineering at Korea Polytechnics. "Korean petrochemical firms and the government should invest more in cutting-edge refining and catalyst technology to reduce nitrogen oxide and sulfur oxide emissions, which can strengthen global competitiveness."

Copyright ⓒ Aju Press All rights reserved.