SEOUL, October 15 (AJP) - Foreign direct investment (FDI) in South Korea fell 18 percent in the first nine months of 2025 from a year earlier, hit by sluggish merger and acquisition (M&A) activity, political uncertainty, and the Korean won’s steep depreciation against the U.S. dollar, the Ministry of Trade, Industry and Energy said Tuesday.

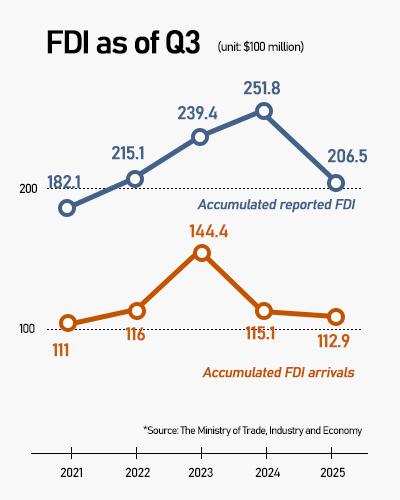

Cumulative FDI pledges as of the third quarter stood at $20.65 billion, down from $25.18 billion a year earlier. Actual arrivals also slipped 2 percent to $11.29 billion.

The biggest drag came from a 54-percent plunge in M&A investments amid a sluggish capital market and political instability stemming from the presidential impeachment trial and election earlier this year. The ministry added that last year’s record figures also created a high base effect. Despite the downturn, this year’s performance remained above the five-year average of $20.35 billion.

“There was a lack of large-scale M&A deals due to domestic political instability and uncertainties surrounding U.S. trade policy,” a ministry official said. The U.S. dollar strengthened 4.4 percent year-on-year against the Korean won during the period, further dampening investment sentiment, he added.

M&A commitments totaled $2.88 billion, down 54 percent, while greenfield investments—new and expanded facilities—fell 6.1 percent to $17.77 billion.

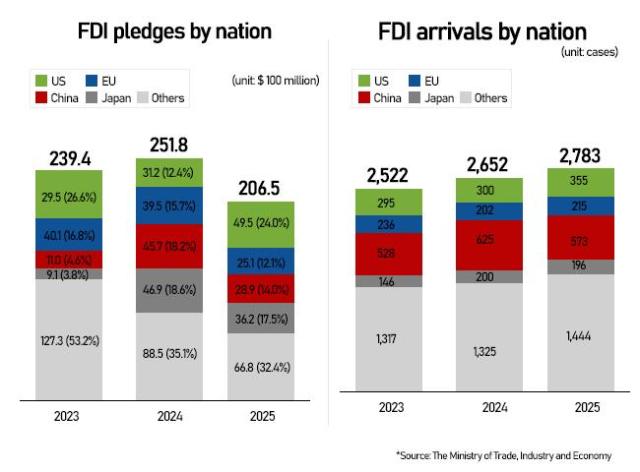

By source, the United States remained the top investor, pledging $4.95 billion as of September, up 59 percent from a year earlier, led by investment in artificial intelligence and data centers. Investments from other regions fell by double digits.

By sector, manufacturing saw a 29.1-percent drop to $8.73 billion due to declines in electronics and chemicals, while IT and retail sectors recorded growth, with IT investment jumping 25.7 percent, driven by AI and data centers.

FDI arrivals reached $11.29 billion, down 2 percent from a year earlier, reversing a 2.7-percent increase in the first half. Greenfield arrivals rose 23 percent to $8.21 billion, while M&A arrivals fell 36.5 percent to $3.07 billion. Arrivals from the United States nearly doubled, but those from the European Union and Japan dropped sharply.

The ministry said it will continue efforts to attract foreign investment through incentives such as cash grants and location support. It also plans to hold overseas investor relations (IR) sessions targeting advanced industries and regional IR programs to identify additional investment needs from foreign companies operating in Korea.

Copyright ⓒ Aju Press All rights reserved.