SEOUL, October 15 (AJP) - Investors are closely watching third-quarter earnings from Taiwan’s foundry leader TSMC and South Korea’s AI memory powerhouse SK hynix to gauge the depth of surging demand for artificial intelligence chips—especially after stronger-than-expected results from Samsung Electronics.

Samsung Electronics on Tuesday reported record quarterly revenue of 86 trillion won (approximately $62.4 billion) and an operating profit of 12.1 trillion won (approximately $8.78 billion), its highest in three years and double the previous quarter, buoyed by the rebound in memory prices and AI-related demand, even as the memory giant trails behind in high-bandwidth memory (HBM) production, a key component powering AI servers.

TSMC, which commands about 60 percent of the global foundry market and nearly 90 percent of advanced node chip production—covering most of Nvidia’s supply—sits at the center of the AI-driven datacenter expansion.

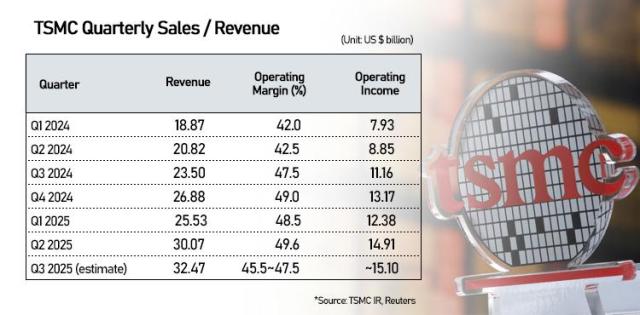

“TSMC’s third-quarter guidance suggests revenue of $32.4 billion and an operating profit margin of 46.5 percent,” said Lee Seung-woo of Eugene Investment & Securities. “Actual growth could exceed forecasts, potentially reaching the mid-30 percent range.”

SK hynix, which has overtaken Samsung in the HBM market, shares the glory of the AI upcycle.

“SK hynix’s third-quarter operating profit is estimated at 11.6 trillion won, supported by strong DRAM and NAND shipments amid sustained demand for HBM and DDR5,” said Son In-jun, analyst at Heungkuk Securities.

The unrelenting appetite for AI chips is pushing up prices across the memory spectrum. According to market tracker ICsmart, Micron has raised DDR4 and DDR5 prices by 20–30 percent, while Samsung increased contract prices for high-capacity DRAMs such as LPDDR4X and LPDDR5/5X by 15–30 percent as AI workloads shift from training to inference and edge devices tighten supply.

The AI boom is now spilling over to mid- and downstream chipmakers, who stand to gain from narrowing gaps between contract and spot prices as AI adoption spreads beyond hyperscale data centers.

Kim Dong-won, an analyst at KB Securities, projected that Samsung Electronics could post its highest operating profit in eight years next year on improved foundry utilization and stronger profitability in memory operations.

Shares of major Asian chipmakers extended gains on Wednesday, buoyed by strong earnings momentum and AI demand. TSMC rose NT$1,400 (about $43) in Taipei, while Samsung Electronics closed at 95,000 won ($69) and SK hynix ended at 422,500 won ($308).

Copyright ⓒ Aju Press All rights reserved.