Major producers including CJ CheilJedang and Lotte Wellfood are expected to post disappointing third-quarter earnings despite the sharp decline in global commodity prices. Of eight major food companies tracked by FnGuide, five are projected to report year-on-year drops in operating profit, extending the first-half slump.

Official results are to come soon, Lotte Wellfood scheduled to announce its third-quarter results on Oct. 19, followed by Orion on Nov. 5, Samyang, Nongshim, Ottogi, and Pulumone on Nov. 12, CJ CheilJedang and Binggrae on Nov. 17.

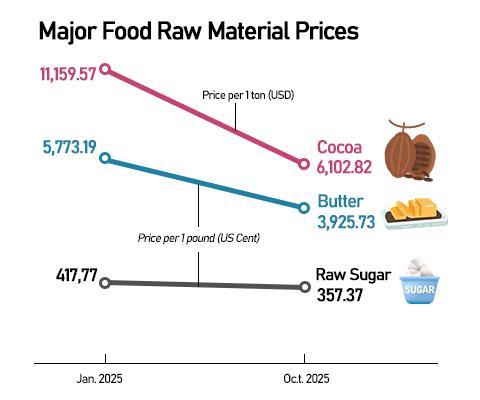

The setback comes even as supply conditions improve. Cocoa prices, which hit record highs earlier this year amid crop disease and extreme weather in West Africa, have fallen by nearly half to about $6,000 per ton. Butter and sugar prices have also eased as production rebounded in the United States, New Zealand, Brazil, and India.

Demand, meanwhile, has been buoyed by social-media enthusiasm for Korean cuisine. According to the Korea Agro-Fisheries & Food Trade Corp., exports to the United States totaled $1.7 billion as of Oct. 1, up 15.3 percent on-year, while shipments to Europe climbed 15.8 percent.

The won has weakened nearly 3 percent against the dollar over the past month to around 1,420 per dollar, touching 1,434 earlier in the week—its lowest in five months—raising import costs for raw materials.

Tariff tensions have intensified since U.S. President Donald Trump warned on Oct. 10 of an additional 100 percent duty on Chinese goods starting Nov. 1 after Beijing restricted rare-earth exports. A Goldman Sachs report said U.S. consumers, major buyers of Korean food, now bear roughly 55 percent of total tariff costs.

Food companies raised prices earlier this year to defend margins, but weak domestic demand has limited the effect, while the softer currency continues to erode profits.

Still, instant-noodle makers Samyang Foods and Nongshim remain resilient, expected to post double-digit operating-profit growth. Samyang's Buldak series continues to dominate overseas shelves, and Nongshim's collaboration with K-Pop Demon Hunters is keeping its products in global demand.

"Nongshim showcased its new kimchi-fried-noodle product at Germany's Anuga 2025, tailored to global consumers' growing appetite for Korea's spicy flavors," said Kang Eun-ji, researcher at Korea Investment & Securities. "The company may see stronger returns next year as its global strategy pays off."

Copyright ⓒ Aju Press All rights reserved.