SEOUL, October 20 (AJP) - South Koreans are falling behind on their credit card bills at a record pace, as higher interest rates and tighter bank lending drive more households to rely on card loans to make ends meet.

According to data released by the office of Rep. Kang Min-kook of the main opposition People Power Party, citing the Financial Supervisory Service, credit card debt overdue for more than a month reached nearly 1.5 trillion won ($1.1 billion) as of the end of August — the highest level since records began.

The total amount of overdue card loans — including cash advances and card-based personal loans — has more than doubled over the past four years. At the end of 2021, outstanding overdue card loans stood at 718 billion won. That figure rose to 860 billion won in 2022, 983 billion won in 2023, and 1.1 trillion won last year. By August this year, the total had surged to 1.5 trillion won.

The delinquency rate — the share of overdue debt compared with total card loans — has climbed even more steeply. It rose from 1.9 percent at the end of 2021 to 2.2 percent in 2022, 2.4 percent in 2023 and 2024, and 3.3 percent as of this August, according to the data.

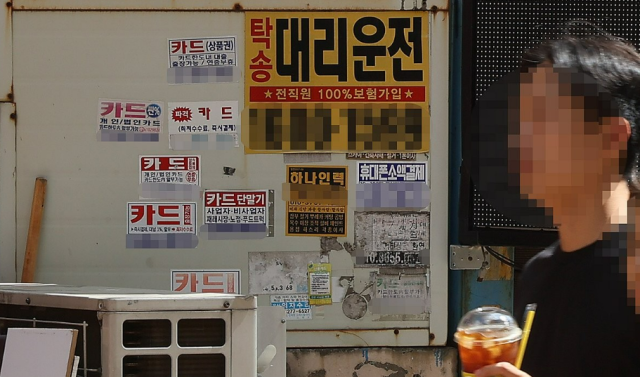

Analysts say the trend reflects growing pressure on low- and middle-income borrowers, who have struggled with rising living costs and a cooling job market. Many have turned to card-based borrowing as commercial banks tighten access to traditional loans amid concerns about household debt levels.

“With bank loans becoming harder to access, vulnerable borrowers are turning to card loans for funding,” Rep. Kang said in a press release. “This could pose a risk to the financial soundness of card companies, and financial authorities should provide guidance to manage bad debts and sales.”

South Korea’s household debt, among the highest in the world relative to GDP, has long been viewed as a vulnerability for Asia’s fourth-largest economy. Economists warn that the recent surge in credit card delinquencies could signal rising financial distress among consumers — and add pressure on regulators.

* This article, published by Aju Business Daily, was translated by AI and edited by AJP.

Copyright ⓒ Aju Press All rights reserved.