SEOUL, October 23 (AJP) - South Korea's major pharmaceutical companies are racing to enter the global weight-loss drug market, upgrading drug delivery formats and formulations to tap a segment projected to grow more than 15 percent over the next five years.

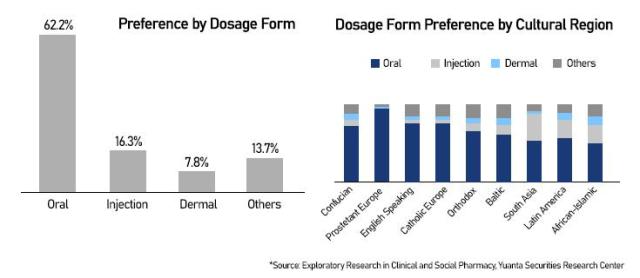

A recent survey by Exploratory Research in Clinical and Social Pharmacy, cited by Yuanta Securities, showed that 62.2 percent of 4,400 respondents across 21 countries preferred oral weight-loss drugs — far ahead of injectables (16.3 percent) and dermal patches (7.8 percent). Convenience and ease of adherence were cited as key factors.

"Oral formulations will create new demand by improving convenience and coverage potential," said one industry analyst. "As adherence improves, weight-loss drugs could evolve beyond single-use therapies into full-scale management tools for metabolic diseases."

At present, GLP-1-based injectables such as Novo Nordisk's Wegovy and Eli Lilly's Mounjaro dominate the market. Despite their explosive success, their injectable form remains a hurdle for long-term use. Concerns also persist over rebound weight gain after discontinuation and gastrointestinal side effects. Korean drugmakers are targeting this gap by developing oral and patch-based alternatives.

Global frontrunners are also pivoting to oral formulations. Novo Nordisk's oral semaglutide — a pill version of Wegovy — is in Phase III trials and expected to receive FDA approval for weight management in late 2025, reaching the market in 2026. Lilly's oral candidate Orforglipron is also in Phase III.

Among Korean firms, Il-Dong Pharmaceutical has reported promising results for its oral candidate ID110521156, which also demonstrated glucose-lowering effects. In multiple ascending-dose trials, the 200-milligram group achieved an average 9.9 percent weight reduction — and up to 13.8 percent in some cases — with no serious adverse events or dropouts. The company plans to begin Phase II trials next year.

Hanmi Pharmaceutical has filed an Investigational New Drug (IND) application with the U.S. FDA for its compound HM17321 (LA-UCN2), designed to increase muscle mass while selectively reducing fat — addressing one of the key drawbacks of GLP-1 therapies, which often cause muscle loss. "Our goal is to enable healthy weight management, even for elderly or sarcopenic patients," said Choi In-young, head of Hanmi's R&D center. The company aims for commercialization by 2031.

Daewoong Pharmaceutical and its subsidiary Daewoong Therapeutics have also entered the race, recently receiving Korean regulatory approval for a semaglutide microneedle patch. Using the company's Clopam platform, the patch delivers more than 80 percent bioavailability — outperforming existing microneedle systems — and offers a painless, once-a-week option.

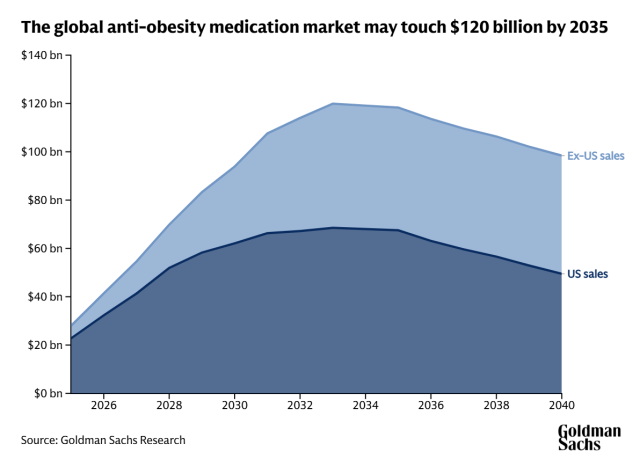

According to Goldman Sachs, the global anti-obesity drug market is expected to exceed $120 billion by 2035, with more than 170 drug candidates currently under development worldwide. Korean drugmakers, armed with formulation technology and competitive manufacturing capability, are moving fast to capture the next wave of innovation — reshaping the country's pharmaceutical footprint in one of the world's most lucrative therapeutic frontiers.

Copyright ⓒ Aju Press All rights reserved.