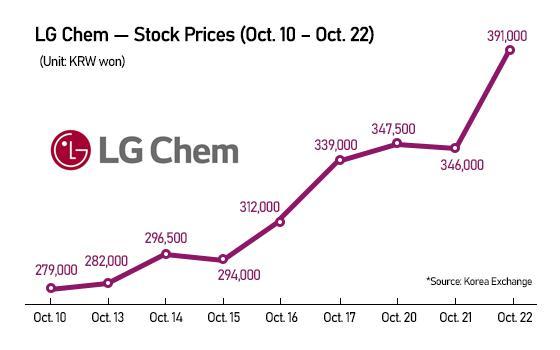

SEOUL, October 23 (AJP) - Shares of LG Chem set a new ceiling this week as the Korean chemical giant defied industrial headwinds after being spotlighted by a major foreign shareholder for excessive undervaluation.

LG Chem closed Thursday at 389,500 won ($271), down after a 13 percent surge in the previous session. The rally followed a public statement by British activist fund Palliser Capital, which argued that “LG Chem’s stock is significantly undervalued, currently trading at just 74 percent of its intrinsic value.”

Palliser urged the company to sell part of its stake in battery affiliate LG Energy Solution and use the proceeds for share buybacks to boost shareholder value.

Founded in 2021 by James Smith, former chief investment officer of Elliott Management’s Hong Kong office, Palliser holds about 1 percent of LG Chem and ranks among its top ten shareholders. Smith is already well-known to Korea’s corporate scene for his past challenges to succession and governance structures at Samsung Electronics and Hyundai Motor during his Elliott tenure. Palliser has since pushed for shareholder-friendly actions at Samsung C&T in 2023 and SK Square in 2024.

However, local analysts remain unconvinced that LG Chem’s rally can be sustained.

“LG Chem remains overly reliant on internal business from its affiliate LG Energy Solution,” said Roh Woo-ho, analyst at Meritz Securities, in a report on October 16. He estimated that only 8.6 percent — or 56.3 billion won — of the company’s estimated 657.6 billion won third-quarter operating profit will come from non-LGES operations. “The lack of meaningful external revenue raises questions about business sustainability,” Roh noted.

Petrochemicals, once the company’s core business, continue to weigh on earnings. According to second-quarter results released in August, the petrochemical division generated 4.696 trillion won in revenue — about 41.1 percent of the company’s total 11.47 trillion won — but posted losses of 56.5 billion won in Q1 and 90.4 billion won in Q2. The downturn reflects mounting competition from Chinese producers flooding the global market with cheaper, higher-quality output. Even the country’s third-largest player, Yeochun NCC, has faced liquidity strains and the threat of insolvency.

LG Chem is seeking to offset the weakness by expanding into advanced materials and life sciences. The company supplies cathode materials for LG Energy Solution’s EV batteries, develops photo imageable dielectric (PID) materials for semiconductor packaging, and is broadening its pharmaceutical R&D pipeline.

Still, much of its near-term sentiment hinges on LG Energy Solution’s performance, whose third-quarter operating profit jumped 34.1 percent year-on-year — offering a temporary boost to LG Chem’s outlook, if not yet a structural turnaround.

Copyright ⓒ Aju Press All rights reserved.