SEOUL, October 24 (AJP) - South Korean refinery shares surged Friday as oil prices spiked following U.S. sanctions on Russia’s top refiners, Rosneft and Lukoil, elevating petrochemical sector long weighed down by overcapacity and an industrial slowdown.

SK innovation, the market leader, jumped 7.6 percent to 133,900 won ($93.2), while S-Oil gained 2.5 percent to about 74,900 won. The rally followed a sharp climb in West Texas Intermediate (WTI) and Brent crude prices after Washington’s move against Moscow’s oil giants. With Russia ranking as the world’s No. 3 producer after the U.S. and Saudi Arabia, any restriction on its exports threatens to tighten global supply and push prices higher.

Rising crude prices typically widen refining margins, improving profitability for refiners. This time, momentum also extended to petrochemical stocks, as higher feedstock costs tend to raise product prices. LG Chem hit a fresh high of 401,000 won after climbing 3 percent intraday, while smaller ISU Chemical soared by the daily limit for three straight sessions — leaping to 12,400 won from 5,850 won a week earlier.

Refiners are broadly expected to report stronger third-quarter earnings.

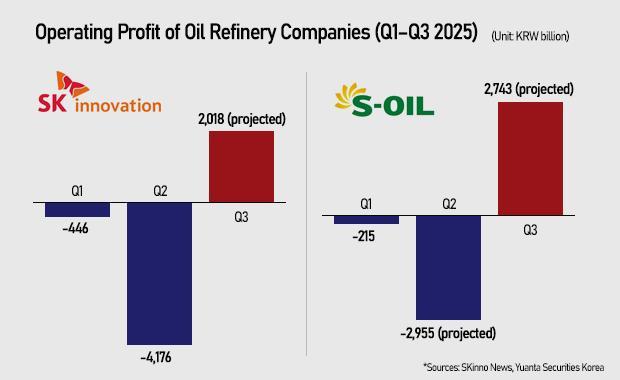

According to Yuanta Securities Korea analyst Hwang Kyu-won, SK innovation is likely to swing back to profit in the third quarter.

“Dubai crude prices rose by more than $3 a barrel, which appears to have boosted refinery margins,” Hwang said.

Consensus data from FnGuide projects SK innovation’s Q3 operating profit at about 201.8 billion won, driven mainly by its refining business.

S-Oil is also expected to return to profit this quarter. Hanwha Investment & Securities analyst Lee Yong-wook forecast operating profit of 274.3 billion won, noting that “refining-segment profit is projected to reach 144 billion won, marking a sharp rebound from a 440 billion won loss in the previous quarter.”

Despite rising competition from Chinese refiners, Korea’s oil refining industry remains among the world’s most competitive. In jet fuel alone, the country’s “Big Four” — SK innovation, S-Oil, HD Hyundai Oilbank, and GS Caltex — command roughly 30 percent of global market share, a position they have held for several years.

Most analysts agree that Korean refiners tend to benefit whenever concerns mount over tighter oil supply — and Friday’s rally offered a timely reminder.

Copyright ⓒ Aju Press All rights reserved.