SEOUL, November 19 (AJP) - Hyundai AutoEver and Samsung Electro-Mechanics were among a selective KOSPI stocks that managed to survive this week’s sharp rout triggered by fears of an AI-driven bubble ahead of Nvidia’s earnings release scheduled for Thursday.

Hyundai AutoEver — the Hyundai Motor Group affiliate responsible for software development and next-generation mobility strategy — gained 2.92 percent to close Wednesday at 186,500 won ($127.1). Its rally was buoyed by Hyundai Motor Group’s pledge of a record 125 trillion won in domestic investment over the next five years. Of the total, 50 trillion won has been allocated for AI, software-defined vehicles (SDVs) and robotics — all core areas under AutoEver’s purview.

The company is also expected to participate in the government’s planned “Physical AI” initiative, designed to support Korea’s foundational industries such as shipbuilding and defense.

Another key catalyst was AutoEver’s inclusion in the KOSPI 200 index. The Korea Exchange (KRX) announced Tuesday that its stock-exchange steering committee approved the removal of eight constituents and the addition of seven new names, including AutoEver. The index represents roughly 80 percent of the KOSPI’s total market capitalization, firmly establishing AutoEver as a representative blue-chip stock.

The company is on track to achieve revenue of 5 trillion won by 2027, said Kim Sung-rae, a researcher at Hanwha Investment & Securities, noting that “SI (system integration) is leading growth this year through higher-margin projects such as next-generation ERP and cloud services.”

Samsung Electro-Mechanics also surged, climbing 5.39 percent to 215,000 won, boosted by overlapping tailwinds across its core businesses. The company is a major supplier of multilayer ceramic capacitors (MLCCs) and flip-chip ball-grid-array (FC-BGA) substrates — essential components for AI servers and automotive electronics — and demand has risen sharply.

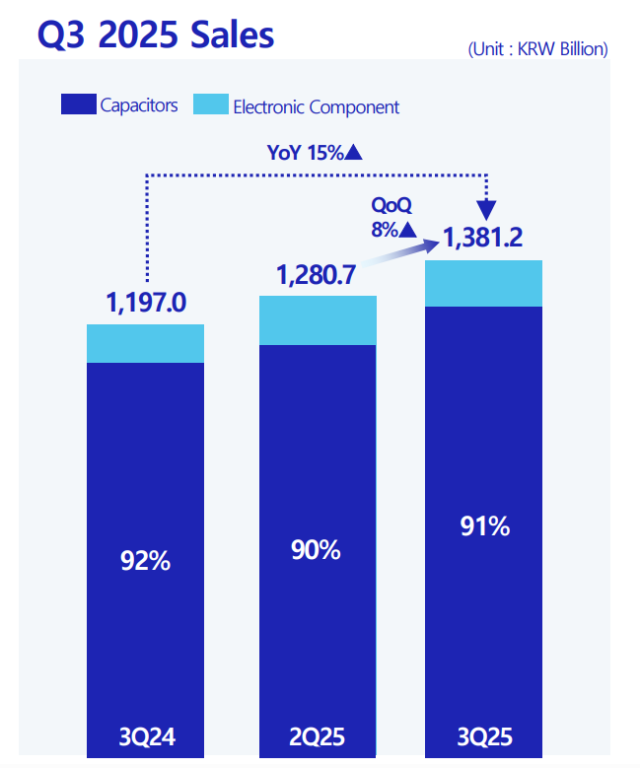

According to its Oct. 29 earnings release, the Components division, responsible for circuit-board production including MLCCs, posted 1.38 trillion won in revenue in the third quarter, up 8 percent quarter-on-quarter and 15 percent year-on-year. Operating profit also climbed to 260.3 billion won, up 22 percent quarter-on-quarter and 16 percent year-on-year.

Factory utilization is nearly maxed out, jumping from 86 percent in Q3 2024 to approximately 99 percent this quarter, as demand from AI and automotive customers exceeded supply.

Samsung Electro-Mechanics holds roughly 25 percent of the global MLCC market, second only to Murata Manufacturing’s 40 percent. However, in the AI-optimized MLCC segment, Samsung’s share is estimated at around 40 percent — effectively matching Murata and signaling growing competitiveness in next-generation components.

The company is also strengthening its position in FC-BGA substrates, which connect high-performance semiconductors to motherboards and are well suited for AI data centers and automotive electronics due to their superior signal-transmission performance.

“FC-BGA substrates are expected to remain fully booked through 2027,” said Park Jun-seo, a researcher at Mirae Asset Securities, adding that MLCC demand “will continue to increase as power requirements for AI processing expand.”

Copyright ⓒ Aju Press All rights reserved.