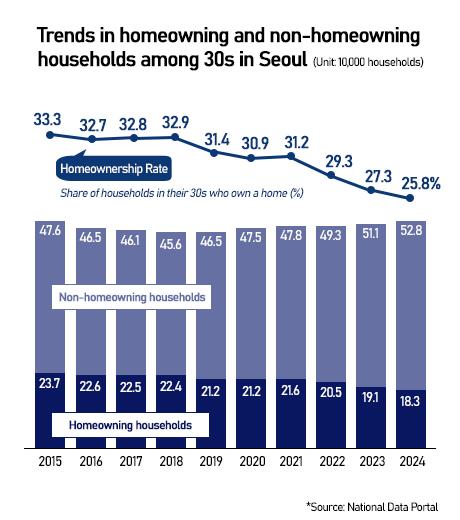

SEOUL, November 25 (AJP) - Only one in four Seoul residents in their 30s owns a home — the lowest rate on record — fueling the rise of "kangaroo tribes" who cannot afford to move out of their parents' home, let alone imagine starting their own family in a city where apartment prices are nearly three times higher than in other regions.

New data released Tuesday by the National Data Portal shows 527,729 households in their 30s in Seoul lived in rental housing last year, an increase of 17,215 from a year earlier and the largest jump since records began in 2015. The number of homeowners in the same age group fell to 183,456, pushing the ratio of renters to owners to nearly three to one.

The trend overlaps directly with marriage patterns.

Seoul now reports the highest share of unmarried people in their 30s at 37.1 percent, a rate that has risen, along with the jobless rate.

Lee Hong-ki, a 34-year-old, lives in a rented space paid for by his father, unable to secure a public-sector job despite four attempts. "I feel indebted and guilty, but I have no choice. It's not that I'm not trying," he said.

Demographers note that household formation — not financial handouts — is the most decisive factor in whether young adults marry or have children, and that housing sits at the center of Korea's fertility crisis.

"Marriage hasn't even crossed my mind, let alone dreaming of owning a home in Seoul," said 31-year-old Lee Ji-won, who commutes to work from Gyeonggi Province.

Homeownership data also reveals widening structural divides. Of Korea's 16 million homeowners, 85.1 percent own a single property, while 14.9 percent — or 2.4 million people — are multi-homeowners.

The share of multi-homeowners is highest far from Seoul, reaching 20 percent in Jeju, 17.4 percent in South Chungcheong Province, and 17 percent in Gangwon Province, compared with lower shares of around 13 percent in Gwangju, Incheon, and Gyeonggi Province.

The pattern underscores a contradiction in Korea's real-estate landscape: Seoul residents struggle to buy even one home, while falling prices in regional markets allow property owners there to accumulate multiple homes.

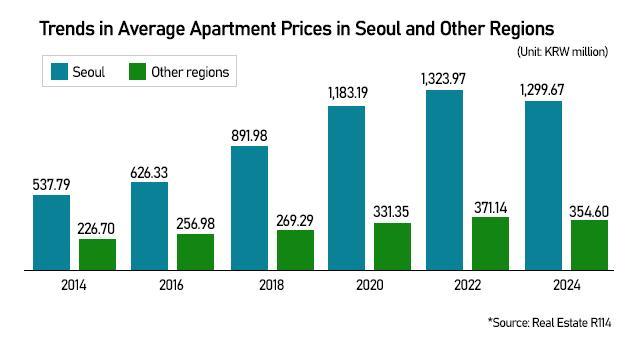

The affordability gap has widened most dramatically in the past decade. According to Real Estate R114, the average Seoul apartment price reached 1.3 billion won ($881,595), versus 354.6 million won in non-capital regions, leaving a 945.1 million won gap that has remained in record territory for four straight years.

A decade ago, the gap was just 311 million won — meaning the disparity has nearly tripled in ten years — driven by steady price increases in Seoul and broad declines outside the capital. Analysts expect the gulf to widen further.

Government measures rolled out this year have also raised entry barriers for first-time buyers. Tighter loan-to-value and debt-service ratio rules now require more cash upfront to qualify for mortgages, effectively shutting out younger buyers who rely on borrowing to enter the market.

The frustration is particularly acute for Seoul residents in their 20s and 30s, who face stagnant wages, rising rents, and shrinking prospects of catching up with housing inflation.

Young Koreans, however, cannot let go of the homeownership dream.

A Korea Land & Housing Institute survey of 700 single-person renters aged 19 to 39 found that 83.2 percent believe homeownership is essential for financial security and stable living. When asked which policies would help most, respondents cited home-purchase financing support (24.3 percent), long-term jeonse deposit assistance (22.3 percent), expanded public rental housing (18.6 percent), and publicly subsidized apartment sales (14.4 percent).

The findings point to a consistent reality: Korea's demographic future will depend on whether young adults can afford to leave their parents' homes and form households — something increasingly out of reach in Seoul without a structural shift in housing affordability.

Copyright ⓒ Aju Press All rights reserved.