SEOUL, November 26 (AJP) - South Korea must establish a new management framework for the National Pension Service (NPS) — the world’s third-largest pension fund and a market force amplified by an aging population already accounting for 20 percent of the nation — as its outsized footprint increasingly shapes both the capital market and the Korean won’s plunge to record-weak levels, the country’s top financial chief warned Wednesday.

In a rare press briefing devoted largely to the foreign-exchange issue, Finance and Economy Minister Koo Yun-cheol described the NPS as the “single largest player” in Korea’s FX market.

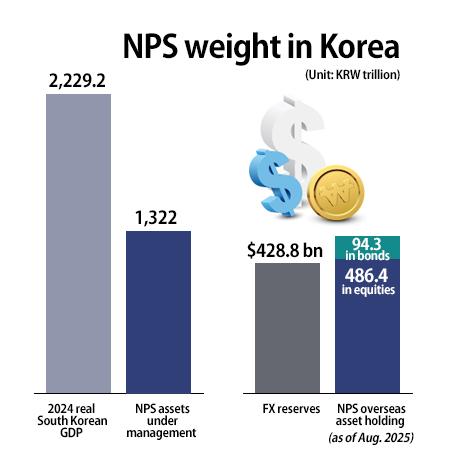

As of August, the NPS managed 1,322 trillion won in assets, roughly half of Korea’s 2024 real GDP of 2,292.2 trillion won. Its overseas holdings — 486.4 trillion won in equities and 94.3 trillion won in bonds — roughly on par with the Bank of Korea’s foreign-exchange reserves of $428.8 billion at end-September at current exchange rate. SEC filings show the fund holding $128.8 billion in U.S. equities alone.

The government has held a flurry of meetings with the NPS and major brokerages this week as the dollar moved toward the unfamiliar four-digit zone of 1,500 won.

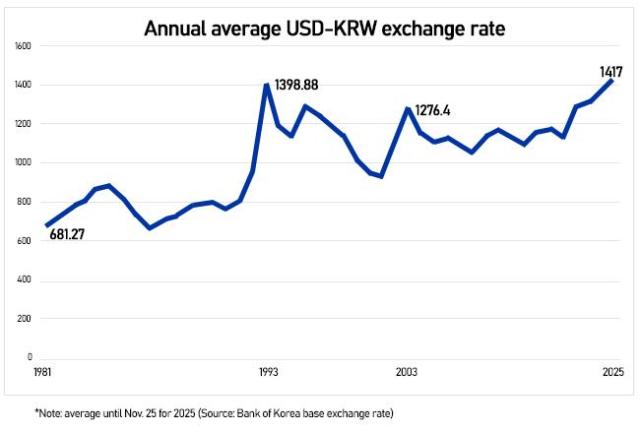

Bank of Korea data show this year’s volume-weighted average dollar-won rate reaching 1,417 won as of Tuesday — surpassing the previous record of 1,398.88 won set in 1998 when the country was under international bailout. The annual average was 1,276.4 won in 2009 after the global financial crisis.

The won has grown structurally weak against the greenback since the 2021–2022 pandemic years, driven by a surge in retail day-trading and overseas stock purchases — a shift amplified this year by the AI-fueled rally in U.S. tech equities.

“The dollar can become structurally short in our market,” Koo said, noting NPS reserves are projected to nearly triple to 3,600 trillion won by 2071, with overseas investment rising in parallel.

He warned that overshooting in the dollar-won rate — despite robust underlying fundamentals — could hurt the economy if inflation and diminished purchasing power erode real incomes.

Koo stressed the need for a long-term FX-protection roadmap for NPS reserves, warning that severe two-way volatility could erupt if the fund ever had to convert large volumes of dollars into won at once.

“We need a fundamental, long-term solution to operate the fund without undermining returns for pensioners,” he said.

He emphatically denied speculation that the government may tap the NPS’s dollar holdings to artificially prop up the won, but cautioned against “excessive one-sided” volatility and speculative trading.

The government has met with exporters as well as brokerage houses and will “meet with anyone” and “use all possible options” to stabilize the FX market — signaling interventionist intent while avoiding actions that could draw scrutiny from Washington.

On hedging, Koo said the decision remains with the NPS, which is permitted to hedge up to 10 percent of overseas assets with investment-committee approval. But he added the finance ministry will raise its voice as a committee member to better balance the fund’s safety and profitability.

He added that the government may consider incentives for exporters to convert part of their dollar revenue into won if necessary. Korea is not currently reviewing taxes to curb foreign stock investment, he said, but left the door open, noting policy “can change depending on circumstances.”

The market took a wait-and-see attitude to gauge how serious Seoul's resolve can be, with the dollar edging up 0.4 won to 1,466.8 won as of 2:00 p.m.

Copyright ⓒ Aju Press All rights reserved.