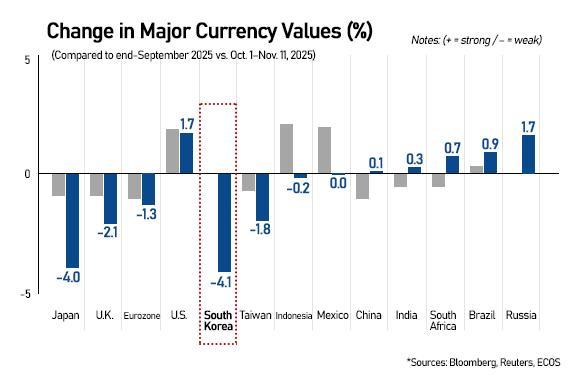

SEOUL, November 27 (AJP) - Koreans tightened their belts through most of the year as stubborn inflation and the steepest depreciation of the won eroded purchasing power, government data showed Thursday.

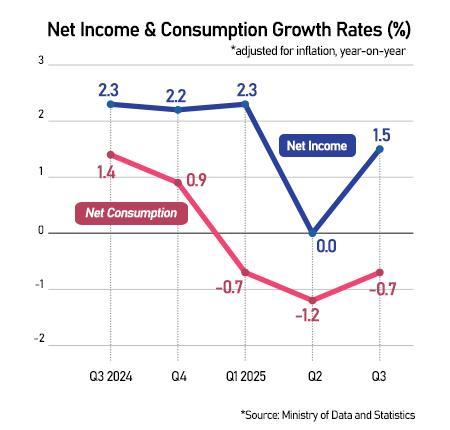

Nominal household income rose 3.5 percent on year in the July–September period to 5,439,000 won ($3,713), while real income—adjusted for inflation—grew 1.5 percent, supported largely by government stimulus handouts, according to the Ministry of Data and Statistics. But the aid program did little to lift actual spending.

Real household consumption fell for a third straight quarter, the longest downturn since the pandemic-hit year of 2020, underscoring the gap between chilled domestic demand and the hot stock, housing, and chip-export markets powering broader economic data.

The income boost was driven mainly by government-issued consumption coupons distributed between July and November. Earned income inched up 1.1 percent, and business income rose just 0.2 percent, while public transfer income — government benefits and subsidies — surged 40 percent to 744,000 won, the highest since records began in 2020.

With income growth stagnating and inflation proving sticky, families cut back on their biggest discretionary burden — private education — and scaled down recreational spending. Household expenditures centered on essentials and summer vacations.

Consumer sentiment improved sharply in November, reaching its highest level in eight years, but the optimism has yet to translate into stronger consumption.

Debt remains a heavy drag. Households are unlikely to see further relief after Bank of Korea Governor Rhee Chang-yong signaled an end to the easing cycle to curb leveraged asset investment and defend the sinking won. As of Nov. 20, outstanding household loans at the five major commercial banks stood at 769.27 trillion won, up 2.65 trillion won in November alone — already exceeding October's full-month increase. Daily loan growth has climbed to its fastest pace since July.

"Given the three- to six-month lag in the pass-through from a weak won to import prices and then consumer prices, inflation pressure is likely to build during the first half of next year," said Kim Myung-sil, analyst at iM Securities.

"The rise in market rates and diminished expectations for a rate cut will weigh on business investment — particularly in construction — and hurt household consumption," added Park Ju-noo, analyst at Hana Securities.

Copyright ⓒ Aju Press All rights reserved.