SEOUL, November 28 (AJP) - South Korea’s factory output in October shrank at the steepest rate in five years, while facility investment tumbled by double digits — all tied to stalled chip activity — further underscoring the country’s heavy reliance on the semiconductor sector for economic performance, data showed Friday.

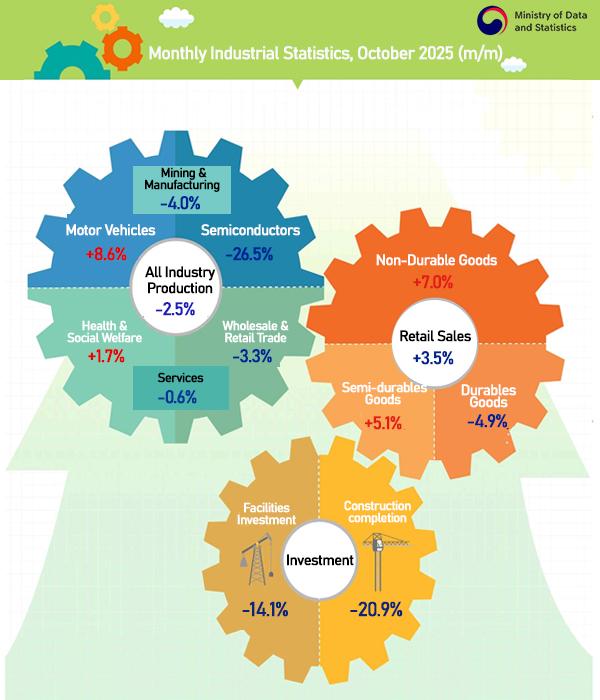

According to the Ministry of Data and Statistics, mining and manufacturing output fell 4 percent on month, the steepest drop since the 7.5 percent decline in May 2020. Output was also down 8.1 percent on year, the sharpest contraction since April 2023, when global supply disruptions hampered production lines.

The slump was led overwhelmingly by semiconductors. Chip output plunged 26.5 percent on year, marking the biggest contraction in 43 years amid tightening in supply of legacy chips as Korean foundries redirect capacity toward long-term AI and data-center clients and shift resources to higher-performance lines.

Excluding semiconductors, overall manufacturing output would have risen 1.1 percent.

The dismal figures reverberated through financial markets. As of 1:30 p.m., the KOSPI had retreated 1.5 percent, while the Korean won weakened 2.8 won against the U.S. dollar. The yield on three-year government bonds jumped 6.7 basis points to end the morning trade at 3.08 percent.

The downturn extended beyond manufacturing. Service-sector output slipped 0.6 percent on month, contributing to a 2.5-percent industry-wide decline, the steepest since February 2020 at the onset of the pandemic.

Facility investment posted an even sharper drop. Investment fell 14.7 percent on month, the largest decline in four years since the 16.7-percent plunge in October 2020.

Spending on machinery — including semiconductor equipment — decreased 12.2 percent, while investment in transportation equipment such as automobiles and ships fell 18.4 percent.

The ministry cited a high base effect and suspended capital expenditure amid delays in tariff negotiations between Seoul and Washington.

Construction investment was also weak, tumbling 20.9 percent, the largest contraction on record.

Signaling a protracted slowdown, industrial orders dropped 41.6 percent on year. The ministry attributed the fall to sharply higher procurement costs from the weakened currency and subdued housing demand following tighter real estate regulations.

Retail sales offered the sole bright spot, rising 3.5 percent on month partly driven by the second round of government stimulus vouchers.

Cyclical indicators pointed to continued weakness. The coincident index fell 0.4 percent, indicating an ongoing slowdown, while the leading index remained flat, suggesting that the economic outlook ahead remains uncertain.

Copyright ⓒ Aju Press All rights reserved.