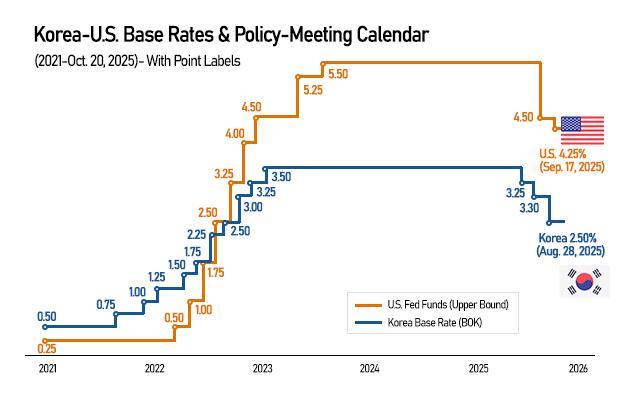

SEOUL, October 23 (AJP) - The Bank of Korea (BOK) held its key interest rate at 2.50 percent for October, keeping policy steady since the last 25-basis-point cut in May amid foreign exchange and housing market volatility, and signaled that the current easing cycle may be nearing its end unless major external shocks occur.

“We are maintaining an easing policy stance, but the pace and timing of additional rate cuts may have to be adjusted,” BOK Governor Rhee Chan-yong said at a press briefing following Thursday’s monetary policy board meeting.

Four of the six board members supported leaving room for another rate reduction over the next three months, while two favored holding rates steady. The share of members preferring a freeze rose to two from one at the August meeting, Rhee noted.

Whether the central bank delivers this year’s third 25-basis-point cut at its final policy meeting in November will depend largely on the outcome of ongoing trade negotiations between South Korea and the United States, as well as between Washington and Beijing — factors that could shape Korea’s growth outlook, he added.

The bond market showed a mixed response, with yields on short-term government bonds falling, while those on longer maturities edged higher. The three-year government bond yield declined by 2.4 basis points to 2.548 percent, while the 10-year yield inched up by 0.02 basis points to 2.871 percent.

Equities and currency markets reflected caution. The Kospi retreated nearly 1 percent after briefly touching the 3,900 milestone, while the won weakened toward 1,440 per dollar — its lowest level in six months.

The BOK’s policy inertia comes amid heightened political uncertainty, including the June presidential election and renewed tariff pressure under the second Donald Trump administration. The pause has extended as Seoul awaits the conclusion of a trade deal with Washington that could stabilize the won and cool speculative housing demand in the capital region following the latest government curbs.

The dollar revisited the 1,440-won threshold for the first time in six months, though Rhee attributed the movement to multiple geopolitical and market factors. “The dollar’s gain of about 35 won over the past month — roughly one-quarter from dollar strength itself — also reflects renewed U.S.–China trade tensions, potential monetary expansion in Japan, and Korea’s $350 billion investment pledge to the U.S.,” he said.

Rhee predicted that the foreign exchange market would regain stability once the details and funding structure of the U.S. investment package are finalized.

A steady recovery in Korea’s real economy also lessens the need for further easing. Despite global trade uncertainties, the current account surplus is projected to reach $110 billion this year, up sharply from the previous BOK estimate of $82 billion in May.

The central bank expects full-year growth to meet its earlier estimate of 0.9 percent. The economy, which contracted 0.2 percent quarter-on-quarter in the first three months of the year, expanded 0.7 percent in the second quarter and is projected to accelerate to 1.1 percent in the third. The BOK will release its preliminary third-quarter GDP data next Tuesday.

Copyright ⓒ Aju Press All rights reserved.