This week, the South Korean government launched an inter-agency task force to investigate what officials now describe as a national crisis rather than a routine corporate incident. The task force brings together 10 ministries and agencies, including the Ministry of Science and ICT, the Personal Information Protection Commission and the Fair Trade Commission.

"The government views this not as a simple corporate data breach but as a serious social crisis that has undermined public trust," said Ryu Je-myung, second vice minister of science and ICT, at the task force's inaugural meeting, adding that Coupang's response to date was "deeply concerning."

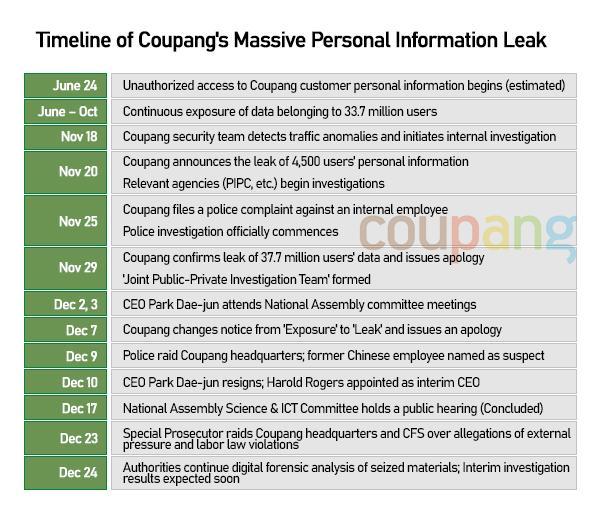

Coupang disclosed on Nov. 29 that a former employee had accessed customer data through overseas servers for about six months starting in late June without detection. The company initially reported the breach to authorities on Nov. 18, estimating 4,500 affected users. That figure later ballooned to 33.7 million — nearly its entire user base.

The e-commerce giant drew further criticism for initially referring to the incident as data "exposure" rather than "leakage," and for removing its apology notice from its homepage within days. Founder and executive chairman Bom Kim has yet to appear publicly despite repeated calls from lawmakers and regulators.

"Even the heads of far larger global companies such as Meta and Amazon have appeared before congressional hearings," said Rep. Choi Hyung-du of the ruling People Power Party, accusing Kim of showing disregard for Korean consumers.

A shareholder class action filed on Dec. 19 in California's Northern District federal court alleges Coupang made false or misleading statements and failed to disclose the breach in a timely manner, causing investor losses. The company's shares have fallen about 20 percent since the breach became public, closing at $22.43 on Wednesday.

In Seoul, the National Assembly's Science, ICT, Broadcasting and Communications Committee is scheduled to hold a two-day hearing starting Dec. 30 to examine the breach, alleged unfair trade practices and labor conditions.

Despite the regulatory and political pressure, industry analysts say Coupang's structural advantages remain formidable.

"From its logistics network to bundled services, there is still no competitor that matches Coupang in terms of customer value," said Shin Kwang-sun, a professor of e-commerce at Kyung Hee University's Graduate School of Business. "There may be short-term friction, but it will not be easy for rivals to alter this trajectory."

Recent precedents support that view. SK Telecom lost about four percent of its subscribers following a SIM-card data breach in April but stabilized within months, maintaining market share in the high-30-percent range.

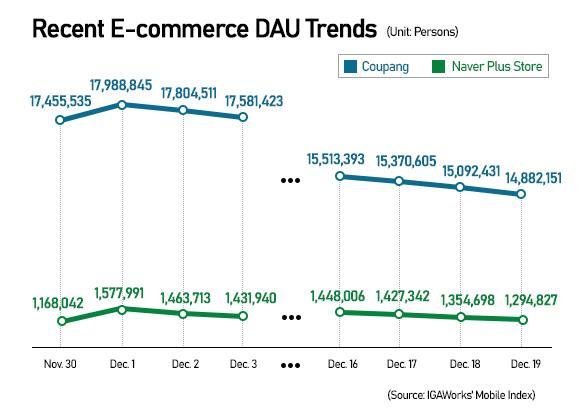

Still, competitors are moving quickly to exploit the opening. Naver has partnered with Market Kurly to launch a premium grocery service aimed at Coupang's Rocket Fresh. Naver Plus Store, its AI-driven shopping app launched in March, has become the fastest-growing e-commerce platform by downloads this year, according to Sensor Tower.

SSG.com, the online retail arm of Shinsegae Group, is revamping membership benefits and expanding premium offerings. CJ Logistics, which handles deliveries for Coupang's rivals, saw its shares hit a 52-week high this month on expectations that even a modest shift in consumer behavior could lift parcel volumes.

For now, hate it or not, Coupang remains the indispensable giant of Korean e-commerce — battered, besieged, and still without a clear successor waiting in the wings.

Copyright ⓒ Aju Press All rights reserved.