Journalist

Kim Yeon-jae

duswogmlwo77@ajunews.com

-

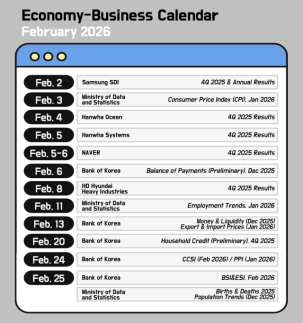

Korean Economy/Business Calendar SEOUL, January 30 (AJP) - Feb 2 (Mon) 4Q 2025 & Annual Results - Samsung SDI Feb 3 (Tue) Jan. 2026 Consumer Price Index (CPI) - Ministry of Data and Statistics Feb 4 (Wed) 4Q 2025 Results - Hanwha Ocean Feb 5 (Thu) 4Q 2025 Results - Hanwha Systems Feb 5–6 (Thu–Fri) 4Q 2025 Results - NAVER Feb 6 (Fri) Dec. 2025 Balance of Payments (Preliminary) - Bank of Korea Feb 8 (Sun) 4Q 2025 Results - HD Hyundai Heavy Industries Feb 11 (Wed) Jan. 2026 Employment Trends - Ministry of Data and Statistics Feb 13 (Fri) Dec. 2025 Money & Liquidity / Jan. 2026 Export & Import Prices - Bank of Korea Feb 20 (Fri) 4Q 2025 Household Credit (Preliminary) - Bank of Korea Feb 24 (Tue) Feb. 2026 CCSI / Jan. 2026 PPI - Bank of Korea Feb 25 (Wed) Feb. 2026 BSI & ESI - Bank of Korea Annual 2025 Births & Deaths / Dec. 2025 Population Trends - Ministry of Data and Statistics 2026-01-30 14:46:13

Korean Economy/Business Calendar SEOUL, January 30 (AJP) - Feb 2 (Mon) 4Q 2025 & Annual Results - Samsung SDI Feb 3 (Tue) Jan. 2026 Consumer Price Index (CPI) - Ministry of Data and Statistics Feb 4 (Wed) 4Q 2025 Results - Hanwha Ocean Feb 5 (Thu) 4Q 2025 Results - Hanwha Systems Feb 5–6 (Thu–Fri) 4Q 2025 Results - NAVER Feb 6 (Fri) Dec. 2025 Balance of Payments (Preliminary) - Bank of Korea Feb 8 (Sun) 4Q 2025 Results - HD Hyundai Heavy Industries Feb 11 (Wed) Jan. 2026 Employment Trends - Ministry of Data and Statistics Feb 13 (Fri) Dec. 2025 Money & Liquidity / Jan. 2026 Export & Import Prices - Bank of Korea Feb 20 (Fri) 4Q 2025 Household Credit (Preliminary) - Bank of Korea Feb 24 (Tue) Feb. 2026 CCSI / Jan. 2026 PPI - Bank of Korea Feb 25 (Wed) Feb. 2026 BSI & ESI - Bank of Korea Annual 2025 Births & Deaths / Dec. 2025 Population Trends - Ministry of Data and Statistics 2026-01-30 14:46:13 -

UPDATE: Korea's factory output strongest in four months in December, slows for full 2025 *Updated with additional information and market response SEOUL, January 30 (AJP) - South Korea’s factory output grew at its fastest pace in four months in December, driven by chip-led exports and a sharp rebound in construction, though growth slowed for full-year 2025 amid prolonged weakness in building activity. Mining and manufacturing production rose 1.7 percent from the previous month, rebounding from two consecutive contractions and accelerating from a 0.8 percent gain in November, according to data released Friday by the Ministry of Data and Statistics. Services output increased 1.1 percent on month, with retail sales rising 0.9 percent. Capital investment fell 3.6 percent, while construction investment surged 12.1 percent. Gains in manufacturing were primarily driven by semiconductors, where production rose 2.9 percent on month, marking a second straight month of expansion. The pace moderated from November’s 8.8 percent surge as the base effect from October’s slump began to fade. The most significant sector-specific rebound occurred in pharmaceuticals. After a 10.5 percent decline in November, output jumped 10.2 percent in December. Conversely, automobile production — a major pillar of the manufacturing base — fell 2.8 percent, marking its second consecutive monthly decrease. On a year-on-year basis, production of “other transport equipment,” including ships, surged 26.4 percent, driven by strong orders for specialized vessels such as LNG carriers. However, facility investment in this segment plunged 16.1 percent from the previous month, contributing to an overall 3.6 percent decline in total capital expenditure. Overall manufacturing shipments rose 2.5 percent. While shipments of automobiles and pharmaceuticals declined, semiconductors and electrical equipment anchored the aggregate gain. Both domestic and export demand showed strength, with domestic shipments rising 1.2 percent and export shipments climbing 4.0 percent. Korean markets were mixed. The KOSPI was trading at 5,273, up 1.0 percent, while the KOSDAQ remained virtually flat at 1,165. The dollar added 3.8 won to 1,438.8 won. Domestic front improves The retail sales index edged up 0.5 percent year on year, driven by a 4.5 percent increase in durable goods, particularly passenger cars. Still, sticky inflation weighed on spending. Semi-durable goods, such as clothing, fell 2.2 percent, while non-durable goods, including cosmetics, decreased 0.3 percent. Retail patterns also showed a stark divergence. Year-on-year sales at supermarkets and general stores fell 4.3 percent, department stores dropped 4.4 percent, and convenience stores declined 2.6 percent. In contrast, the retail index for passenger cars and fuel stations rose 5.3 percent. This suggests that while households are tightening their belts on food and daily necessities, spending on automotive-related items has remained elevated. A standout figure in the latest report was the performance of the construction sector. Construction output surged 12.1 percent from the previous month, reversing a downturn that had persisted for 19 months. The recovery was led by a 13.7 percent increase in building construction and a 7.4 percent rise in civil engineering. Construction orders also climbed 18.7 percent on month. Building orders, particularly in the residential segment, rose 21.2 percent, while civil engineering orders increased 13.0 percent. The surge in orders, however, was heavily concentrated in the public sector, which recorded a 65.2 percent jump in contracts. In contrast, private-sector orders — a key gauge of organic market demand — fell 1.3 percent. Analysts say that while output figures point to a short-term rebound, the divergence between public and private orders suggests the sector has yet to achieve a structural recovery. Five-year streak continues, but momentum falters For the full year of 2025, South Korea’s total industrial production edged up 0.5 percent, supported by synchronized gains in manufacturing and services. This marked the fifth consecutive year of expansion since 2021. Mining and manufacturing output rose 1.6 percent for the year, with semiconductors again leading the gains and other transport equipment providing a notable tailwind. Momentum, however, weakened toward year-end, with fourth-quarter production falling 3.2 percent from the previous quarter, signaling a cooling trend in late 2025. The service sector grew 1.9 percent for the year, supported by increased activity in health and social welfare as well as wholesale and retail trade. By contrast, the education sector contracted, weighing on overall service-sector growth. Despite the continued expansion, the pace of growth has slowed markedly. After surging 5.5 percent in 2021 on post-pandemic base effects, growth decelerated to 4.8 percent in 2022, 1.2 percent in 2023 and 1.5 percent in 2024. Last year’s 0.5 percent gain marked the first time since the recovery began that growth slipped below the 1 percent threshold. 2026-01-30 09:21:59

UPDATE: Korea's factory output strongest in four months in December, slows for full 2025 *Updated with additional information and market response SEOUL, January 30 (AJP) - South Korea’s factory output grew at its fastest pace in four months in December, driven by chip-led exports and a sharp rebound in construction, though growth slowed for full-year 2025 amid prolonged weakness in building activity. Mining and manufacturing production rose 1.7 percent from the previous month, rebounding from two consecutive contractions and accelerating from a 0.8 percent gain in November, according to data released Friday by the Ministry of Data and Statistics. Services output increased 1.1 percent on month, with retail sales rising 0.9 percent. Capital investment fell 3.6 percent, while construction investment surged 12.1 percent. Gains in manufacturing were primarily driven by semiconductors, where production rose 2.9 percent on month, marking a second straight month of expansion. The pace moderated from November’s 8.8 percent surge as the base effect from October’s slump began to fade. The most significant sector-specific rebound occurred in pharmaceuticals. After a 10.5 percent decline in November, output jumped 10.2 percent in December. Conversely, automobile production — a major pillar of the manufacturing base — fell 2.8 percent, marking its second consecutive monthly decrease. On a year-on-year basis, production of “other transport equipment,” including ships, surged 26.4 percent, driven by strong orders for specialized vessels such as LNG carriers. However, facility investment in this segment plunged 16.1 percent from the previous month, contributing to an overall 3.6 percent decline in total capital expenditure. Overall manufacturing shipments rose 2.5 percent. While shipments of automobiles and pharmaceuticals declined, semiconductors and electrical equipment anchored the aggregate gain. Both domestic and export demand showed strength, with domestic shipments rising 1.2 percent and export shipments climbing 4.0 percent. Korean markets were mixed. The KOSPI was trading at 5,273, up 1.0 percent, while the KOSDAQ remained virtually flat at 1,165. The dollar added 3.8 won to 1,438.8 won. Domestic front improves The retail sales index edged up 0.5 percent year on year, driven by a 4.5 percent increase in durable goods, particularly passenger cars. Still, sticky inflation weighed on spending. Semi-durable goods, such as clothing, fell 2.2 percent, while non-durable goods, including cosmetics, decreased 0.3 percent. Retail patterns also showed a stark divergence. Year-on-year sales at supermarkets and general stores fell 4.3 percent, department stores dropped 4.4 percent, and convenience stores declined 2.6 percent. In contrast, the retail index for passenger cars and fuel stations rose 5.3 percent. This suggests that while households are tightening their belts on food and daily necessities, spending on automotive-related items has remained elevated. A standout figure in the latest report was the performance of the construction sector. Construction output surged 12.1 percent from the previous month, reversing a downturn that had persisted for 19 months. The recovery was led by a 13.7 percent increase in building construction and a 7.4 percent rise in civil engineering. Construction orders also climbed 18.7 percent on month. Building orders, particularly in the residential segment, rose 21.2 percent, while civil engineering orders increased 13.0 percent. The surge in orders, however, was heavily concentrated in the public sector, which recorded a 65.2 percent jump in contracts. In contrast, private-sector orders — a key gauge of organic market demand — fell 1.3 percent. Analysts say that while output figures point to a short-term rebound, the divergence between public and private orders suggests the sector has yet to achieve a structural recovery. Five-year streak continues, but momentum falters For the full year of 2025, South Korea’s total industrial production edged up 0.5 percent, supported by synchronized gains in manufacturing and services. This marked the fifth consecutive year of expansion since 2021. Mining and manufacturing output rose 1.6 percent for the year, with semiconductors again leading the gains and other transport equipment providing a notable tailwind. Momentum, however, weakened toward year-end, with fourth-quarter production falling 3.2 percent from the previous quarter, signaling a cooling trend in late 2025. The service sector grew 1.9 percent for the year, supported by increased activity in health and social welfare as well as wholesale and retail trade. By contrast, the education sector contracted, weighing on overall service-sector growth. Despite the continued expansion, the pace of growth has slowed markedly. After surging 5.5 percent in 2021 on post-pandemic base effects, growth decelerated to 4.8 percent in 2022, 1.2 percent in 2023 and 1.5 percent in 2024. Last year’s 0.5 percent gain marked the first time since the recovery began that growth slipped below the 1 percent threshold. 2026-01-30 09:21:59 -

Asian shares struggle for direction amid Fed signals, Middle East tensions SEOUL, January 29 (AJP) - Asian markets closed mixed on Thursday as investors struggled to find direction amid conflicting signals from corporate earnings, central bank policy and rising geopolitical tensions, a combination that kept volatility elevated across the region. Currency markets reflected the uncertainty. The South Korean won was quoted at 1,428.9 per dollar at 4:40 p.m., down 4.6 won from the previous close. While the won pared earlier losses as the U.S. dollar weakened in late trading, it remained volatile amid competing global factors. Market sentiment was initially buoyed by comments from U.S. Treasury Secretary Scott Bessent, who dismissed the possibility of intentional intervention to weaken the Japanese yen, alongside the U.S. Federal Reserve’s decision to hold rates at 3.5–3.75 percent with a hawkish tone. The dollar later reversed course after media reports said President Donald Trump was weighing military options against Iran. The U.S. Dollar Index fell 0.16 percent to 96.20 by late afternoon. The benchmark 10-year U.S. Treasury yield rose 3.9 basis points to 3.557 percent, reflecting investor unease over the Fed’s stance and heightened geopolitical risks. South Korean stocks recovered from early losses, with the benchmark KOSPI closing up 0.98 percent at 5,221.25, supported by strong earnings and corporate investment announcements that offset macroeconomic concerns. Samsung Electronics fell 1.05 percent to 160,700 won despite reporting fourth-quarter operating profit of 20.1 trillion won ($14 billion). Investors were cautious after the company warned that rising memory prices could weigh on demand for smartphones and personal computers, while losses in its home appliances business also dampened sentiment. SK hynix climbed 2.38 percent to 861,000 won after overtaking Samsung in semiconductor profitability for the first time. The chipmaker posted quarterly operating profit of 19.2 trillion won and announced a shareholder return plan that includes the cancellation of 15.3 million treasury shares. Shares in SK Square, a major shareholder, jumped 5.36 percent. Hyundai Motor surged 7.21 percent to 528,000 won, extending gains that have lifted the stock more than 150 percent from late January last year. Investors welcomed the automaker’s commitment to complete real-world testing of its humanoid robot “Atlas” and smart-car prototypes by late 2026, despite a nearly 20 percent year-on-year decline in operating profit. LG Energy Solution fell 3.36 percent to 416,500 won after confirming a fourth-quarter operating loss of 122 billion won. Weakness in its energy storage system business and recent contract cancellations weighed on the stock, pushing it out of the top three by market capitalization. The tech-heavy KOSDAQ outperformed, rising 2.73 percent to 1,164.41, driven by technology shares and government-backed “value-up” initiatives. Rainbow Robotics jumped 9.35 percent following Samsung’s pledge to accelerate robotics investments, while EcoPro BM gained 7.42 percent. Biotech firm Alteogen slipped 1.15 percent ahead of its planned move to the KOSPI. In Japan, the Nikkei 225 ended flat at 53,375.60 after a volatile session. Early losses linked to yen strength were offset by gains in automakers, though safe-haven demand for the yen amid Middle East tensions capped the index’s advance. The yen was quoted at 153.30 per dollar late in the day. Toyota Motor rose 3.02 percent after reporting record sales for 2025, while Honda gained 2.17 percent on strong guidance led by hybrid vehicles. Chip tester Advantest climbed 5.17 percent after posting an earnings beat. Taiwan’s TAIEX fell 0.82 percent to 32,536.27 on profit-taking and concerns over the impact of a weaker dollar on foreign exchange reserves. TSMC slipped 0.82 percent, Foxconn fell 0.67 percent, and MediaTek ended flat after erasing early gains. Mainland Chinese markets were steadier, with the Shanghai Composite edging up 0.16 percent to 4,157.98. In Hong Kong, the Hang Seng Index reversed early losses to trade 0.36 percent higher at 27,928 in late afternoon dealings, supported by gains in gold-related shares. 2026-01-29 17:08:02

Asian shares struggle for direction amid Fed signals, Middle East tensions SEOUL, January 29 (AJP) - Asian markets closed mixed on Thursday as investors struggled to find direction amid conflicting signals from corporate earnings, central bank policy and rising geopolitical tensions, a combination that kept volatility elevated across the region. Currency markets reflected the uncertainty. The South Korean won was quoted at 1,428.9 per dollar at 4:40 p.m., down 4.6 won from the previous close. While the won pared earlier losses as the U.S. dollar weakened in late trading, it remained volatile amid competing global factors. Market sentiment was initially buoyed by comments from U.S. Treasury Secretary Scott Bessent, who dismissed the possibility of intentional intervention to weaken the Japanese yen, alongside the U.S. Federal Reserve’s decision to hold rates at 3.5–3.75 percent with a hawkish tone. The dollar later reversed course after media reports said President Donald Trump was weighing military options against Iran. The U.S. Dollar Index fell 0.16 percent to 96.20 by late afternoon. The benchmark 10-year U.S. Treasury yield rose 3.9 basis points to 3.557 percent, reflecting investor unease over the Fed’s stance and heightened geopolitical risks. South Korean stocks recovered from early losses, with the benchmark KOSPI closing up 0.98 percent at 5,221.25, supported by strong earnings and corporate investment announcements that offset macroeconomic concerns. Samsung Electronics fell 1.05 percent to 160,700 won despite reporting fourth-quarter operating profit of 20.1 trillion won ($14 billion). Investors were cautious after the company warned that rising memory prices could weigh on demand for smartphones and personal computers, while losses in its home appliances business also dampened sentiment. SK hynix climbed 2.38 percent to 861,000 won after overtaking Samsung in semiconductor profitability for the first time. The chipmaker posted quarterly operating profit of 19.2 trillion won and announced a shareholder return plan that includes the cancellation of 15.3 million treasury shares. Shares in SK Square, a major shareholder, jumped 5.36 percent. Hyundai Motor surged 7.21 percent to 528,000 won, extending gains that have lifted the stock more than 150 percent from late January last year. Investors welcomed the automaker’s commitment to complete real-world testing of its humanoid robot “Atlas” and smart-car prototypes by late 2026, despite a nearly 20 percent year-on-year decline in operating profit. LG Energy Solution fell 3.36 percent to 416,500 won after confirming a fourth-quarter operating loss of 122 billion won. Weakness in its energy storage system business and recent contract cancellations weighed on the stock, pushing it out of the top three by market capitalization. The tech-heavy KOSDAQ outperformed, rising 2.73 percent to 1,164.41, driven by technology shares and government-backed “value-up” initiatives. Rainbow Robotics jumped 9.35 percent following Samsung’s pledge to accelerate robotics investments, while EcoPro BM gained 7.42 percent. Biotech firm Alteogen slipped 1.15 percent ahead of its planned move to the KOSPI. In Japan, the Nikkei 225 ended flat at 53,375.60 after a volatile session. Early losses linked to yen strength were offset by gains in automakers, though safe-haven demand for the yen amid Middle East tensions capped the index’s advance. The yen was quoted at 153.30 per dollar late in the day. Toyota Motor rose 3.02 percent after reporting record sales for 2025, while Honda gained 2.17 percent on strong guidance led by hybrid vehicles. Chip tester Advantest climbed 5.17 percent after posting an earnings beat. Taiwan’s TAIEX fell 0.82 percent to 32,536.27 on profit-taking and concerns over the impact of a weaker dollar on foreign exchange reserves. TSMC slipped 0.82 percent, Foxconn fell 0.67 percent, and MediaTek ended flat after erasing early gains. Mainland Chinese markets were steadier, with the Shanghai Composite edging up 0.16 percent to 4,157.98. In Hong Kong, the Hang Seng Index reversed early losses to trade 0.36 percent higher at 27,928 in late afternoon dealings, supported by gains in gold-related shares. 2026-01-29 17:08:02 -

Asian equities swing flat in post-FOMC early trade; KOSDAQ unfazed SEOUL, January 29 (AJP) - Asian equities traded unevenly in early Thursday sessions following the Federal Open Market Committee (FOMC) decision, with key indices swinging between gains and losses as investors struggled to digest a flood of corporate earnings alongside a renewed rebound in the U.S. dollar. The previous rally in South Korea and Taiwan gave way to choppy, directionless trading, while mainland China and Japan remained clouded by uncertainty, making it difficult for investors to establish a clear near-term trend. As of 10:30 a.m. Seoul time, the Korean won strengthened, with the dollar down 4 won at 1,429.50. As widely expected, the Federal Reserve on Wednesday entered a new holding pattern on interest rates, signaling little urgency to resume cuts following contentious reductions at its previous three meetings. The decision to keep the benchmark federal funds rate unchanged at 3.50–3.75 percent was approved by a 10–2 vote. Fed Chair Jerome Powell said recent data had painted a somewhat brighter picture than at the last meeting, citing firmer economic growth and tentative signs of stabilization in the labor market. Despite U.S. President Donald Trump’s continued endorsement of a weaker dollar as “great,” the greenback found firm support in offshore trading. This followed Treasury Secretary Scott Bessent’s emphatic “Absolutely not” when asked whether Washington was deliberately encouraging yen strength to prevent an unwinding of yen-carry trades. The remarks caused the won’s early gains to fade. South Korea’s benchmark KOSPI was trading at 5,143 as of 10:30 a.m., down 0.54 percent, as the market took a breather after a monthlong record-setting rally. After hitting all-time highs for two consecutive sessions on Tuesday and Wednesday, the index appeared to have entered a consolidation phase. Performance among South Korea’s semiconductor blue chips diverged. Samsung Electronics fell 1.7 percent to 159,600 won, as its record fourth-quarter and full-year chip earnings were overshadowed by those of its local rival. SK Hynix, by contrast, rose 0.5 percent to 845,000 won, continuing to benefit from record earnings and a stronger fundamental valuation. Hyundai Motor climbed 2.5 percent to 505,000 won ahead of its earnings release and conference call later in the day, where it is expected to outline its robotics roadmap. Market attention remained focused on the 2 p.m. announcement, with investors cautious after its key subsidiary Kia reported a nearly 30 percent year-on-year drop in operating profit. Secondary battery stocks came under heavier selling pressure. LG Energy Solution plunged 4.3 percent to 412,500 won, once again relinquishing its position as South Korea’s third-largest company by market capitalization to Hyundai Motor. Samsung SDI also slid 4.0 percent to 380,500 won. In contrast, the tech-heavy KOSDAQ defied the broader cautious mood, rising 1.2 percent to 1,147, buoyed by government stimulus expectations and renewed momentum in robotics-related shares. Rainbow Robotics, in which Samsung Electronics is the largest shareholder, surged 11.0 percent to 772,000 won after Samsung publicly reaffirmed its commitment to the humanoid robot market. Robotics optimism also lifted EcoPro BM, which jumped 6.1 percent to 243,000 won, reclaiming the top spot in KOSDAQ market capitalization for the first time in four months. In Tokyo, the Nikkei 225 hovered in positive territory, up 0.2 percent at 53,480. After a weak open, the index reversed course following Bessent’s dismissal of bets against the yen. The yen stood at 153.30 per dollar, up 0.15 yen, though it is expected to weaken again as the dollar regains momentum offshore. Japanese exporters rallied on the currency shift. Toyota Motor rose 2.1 percent to 3,417 yen, while Honda Motor gained 1.5 percent to 1,522 yen. Among semiconductor stocks, Advantest stood out, surging after reporting operating profit of 78.7 billion yen, beating market consensus by 65 percent. Taiwan’s TAIEX slipped 0.6 percent to 32,610, paring part of Wednesday’s 2 percent surge. TSMC edged down 0.55 percent to 1,810 Taiwan dollars, while Foxconn fell 1.1 percent to 223 Taiwan dollars. MediaTek, however, rose 0.85 percent to 1,795 Taiwan dollars on forecasts that it will remain the world’s top mobile chip shipper through 2026. Mainland Chinese markets were mixed. The Shanghai Composite eased 0.15 percent to 4,145, while the Shenzhen Composite added 0.35 percent to 14,396. In Hong Kong, the Hang Seng Index slipped 0.4 percent to 27,707, cooling after the previous session’s nearly 3 percent rally driven by safe-haven demand for gold. 2026-01-29 11:23:11

Asian equities swing flat in post-FOMC early trade; KOSDAQ unfazed SEOUL, January 29 (AJP) - Asian equities traded unevenly in early Thursday sessions following the Federal Open Market Committee (FOMC) decision, with key indices swinging between gains and losses as investors struggled to digest a flood of corporate earnings alongside a renewed rebound in the U.S. dollar. The previous rally in South Korea and Taiwan gave way to choppy, directionless trading, while mainland China and Japan remained clouded by uncertainty, making it difficult for investors to establish a clear near-term trend. As of 10:30 a.m. Seoul time, the Korean won strengthened, with the dollar down 4 won at 1,429.50. As widely expected, the Federal Reserve on Wednesday entered a new holding pattern on interest rates, signaling little urgency to resume cuts following contentious reductions at its previous three meetings. The decision to keep the benchmark federal funds rate unchanged at 3.50–3.75 percent was approved by a 10–2 vote. Fed Chair Jerome Powell said recent data had painted a somewhat brighter picture than at the last meeting, citing firmer economic growth and tentative signs of stabilization in the labor market. Despite U.S. President Donald Trump’s continued endorsement of a weaker dollar as “great,” the greenback found firm support in offshore trading. This followed Treasury Secretary Scott Bessent’s emphatic “Absolutely not” when asked whether Washington was deliberately encouraging yen strength to prevent an unwinding of yen-carry trades. The remarks caused the won’s early gains to fade. South Korea’s benchmark KOSPI was trading at 5,143 as of 10:30 a.m., down 0.54 percent, as the market took a breather after a monthlong record-setting rally. After hitting all-time highs for two consecutive sessions on Tuesday and Wednesday, the index appeared to have entered a consolidation phase. Performance among South Korea’s semiconductor blue chips diverged. Samsung Electronics fell 1.7 percent to 159,600 won, as its record fourth-quarter and full-year chip earnings were overshadowed by those of its local rival. SK Hynix, by contrast, rose 0.5 percent to 845,000 won, continuing to benefit from record earnings and a stronger fundamental valuation. Hyundai Motor climbed 2.5 percent to 505,000 won ahead of its earnings release and conference call later in the day, where it is expected to outline its robotics roadmap. Market attention remained focused on the 2 p.m. announcement, with investors cautious after its key subsidiary Kia reported a nearly 30 percent year-on-year drop in operating profit. Secondary battery stocks came under heavier selling pressure. LG Energy Solution plunged 4.3 percent to 412,500 won, once again relinquishing its position as South Korea’s third-largest company by market capitalization to Hyundai Motor. Samsung SDI also slid 4.0 percent to 380,500 won. In contrast, the tech-heavy KOSDAQ defied the broader cautious mood, rising 1.2 percent to 1,147, buoyed by government stimulus expectations and renewed momentum in robotics-related shares. Rainbow Robotics, in which Samsung Electronics is the largest shareholder, surged 11.0 percent to 772,000 won after Samsung publicly reaffirmed its commitment to the humanoid robot market. Robotics optimism also lifted EcoPro BM, which jumped 6.1 percent to 243,000 won, reclaiming the top spot in KOSDAQ market capitalization for the first time in four months. In Tokyo, the Nikkei 225 hovered in positive territory, up 0.2 percent at 53,480. After a weak open, the index reversed course following Bessent’s dismissal of bets against the yen. The yen stood at 153.30 per dollar, up 0.15 yen, though it is expected to weaken again as the dollar regains momentum offshore. Japanese exporters rallied on the currency shift. Toyota Motor rose 2.1 percent to 3,417 yen, while Honda Motor gained 1.5 percent to 1,522 yen. Among semiconductor stocks, Advantest stood out, surging after reporting operating profit of 78.7 billion yen, beating market consensus by 65 percent. Taiwan’s TAIEX slipped 0.6 percent to 32,610, paring part of Wednesday’s 2 percent surge. TSMC edged down 0.55 percent to 1,810 Taiwan dollars, while Foxconn fell 1.1 percent to 223 Taiwan dollars. MediaTek, however, rose 0.85 percent to 1,795 Taiwan dollars on forecasts that it will remain the world’s top mobile chip shipper through 2026. Mainland Chinese markets were mixed. The Shanghai Composite eased 0.15 percent to 4,145, while the Shenzhen Composite added 0.35 percent to 14,396. In Hong Kong, the Hang Seng Index slipped 0.4 percent to 27,707, cooling after the previous session’s nearly 3 percent rally driven by safe-haven demand for gold. 2026-01-29 11:23:11 -

South Korean equities log rare double win as decoupling fears grow SEOUL, January 28 (AJP) - South Korean equities are logging a rare double win, with both the main KOSPI and the tech-heavy KOSDAQ hitting historic highs, but the synchronized rally is increasingly stirring anxiety that markets are pulling away from economic reality. The benchmark KOSPI climbed to 5,170.81 on Wednesday, setting a fresh record, while the KOSDAQ advanced to 1,133.52. Both indices are up about 20 percent so far this year, extending last year’s outsized gains of 76 percent for the KOSPI and 36 percent for the KOSDAQ. The surge has lifted South Korea’s total equity market capitalization above that of Germany, underscoring the scale — and speed — of the rally. Leadership has been concentrated. Alongside heavyweight chipmakers Samsung Electronics and SK hynix, Hyundai Motor has joined the record-setting run, with its share price up more than 63 percent year to date. Optimism around semiconductor exports, autos and emerging technologies such as robotics has reinforced investor appetite. Yet beneath the headline strength, warning signs are accumulating. Markets diverge from the real economy For one, equity markets appear increasingly decoupled from underlying economic conditions. South Korea’s economy contracted 0.3 percent in the fourth quarter and 1 percent for the full year, according to the Bank of Korea — the weakest performance among major Asian economies. Even compared with Japan, which entered a low-growth era earlier, South Korea’s annual growth rate remained similar or lower, falling well short of the earlier consensus forecast of 1.8 percent. Leverage is adding to concerns. Margin debt reached approximately 29.35 trillion won ($20.6 billion) as of Jan. 26, according to the Korea Financial Investment Association, approaching the 30 trillion won mark — an all-time high for funds borrowed to purchase stocks. The pace of the increase has been particularly striking. Compared with about a year earlier, margin borrowing has surged by 12.51 trillion won, or 74.3 percent, amplifying fears that rising asset prices are being fueled by debt rather than earnings fundamentals. Household balance sheets remain stretched as well. Non-bank household debt increased by 37.6 trillion won over the course of 2025. Although it edged down by 1.5 trillion won in December, the ratio still stood at 89 percent of GDP at year-end — among the highest levels in major economies. Labor-market indicators offer little reassurance. Youth employment, a key barometer of long-term growth potential, remains mired in stagnation. The employment rate for those aged 15 to 29 stood at 44.3 percent in December, down 0.4 percentage points from a year earlier and marking the 20th consecutive month of decline, according to data released by the National Data Agency on Jan. 14. As the gap between asset prices and the real economy widens, volatility has risen sharply. The KOSPI Volatility Index (VKOSPI) closed Wednesday at 38.68, up 11.12 percent from the previous day and more than double its level a year earlier. Liquidity, not recovery This is not the first time South Korean equities have diverged from economic fundamentals. Similar patterns emerged in the aftermath of the global financial crisis, during the COVID-19 stimulus cycle and in the early stages of the dot-com boom — periods when abundant liquidity converged with compelling technology narratives. The current rally appears driven less by a broad-based recovery than by excess liquidity and concentrated inflows into specific sectors such as AI and semiconductors. According to a Bank of Korea report released Jan. 14, the M2 money supply grew 4.8 percent year on year as of November 2025. When beneficiary certificates — including ETFs, equity funds and bond funds — are included, effective liquidity growth reached 8 percent. Investor positioning reflects this trend. Investor deposits climbed to a record 97.54 trillion won as of Monday, highlighting the scale of capital circulating around the stock market. “The rally that began last year and continued into early this year reflects domestic liquidity conditions and expectations surrounding monetary accommodation by major economies such as Japan and the United States, rather than improvements in the real economy,” said Lee Kyung-min, a strategist at Daishin Securities. Lee added, however, that with forward earnings per share expected to trend upward, liquidity could eventually translate into corporate investment and growth. Others remain more cautious. J.P. Morgan, in its “2026 Market Outlook,” warned that downside risks remain elevated amid weak business sentiment and a cooling labor market, posing potential headwinds for global equities, including South Korea. Adding to concerns, the U.S. Consumer Confidence Index fell sharply to 84.5 in January, nearly 10 points lower than the previous month and well below market expectations. “We are not unaware that key real-economy indicators — including youth employment and construction activity — remain weak despite rising stock prices,” said a securities industry official, speaking on condition of anonymity. “But given the belief that a buoyant stock market can support corporate investment in R&D and facilities — and potentially lift the real economy — it is difficult to openly raise the prospect of a correction.” 2026-01-28 18:11:27

South Korean equities log rare double win as decoupling fears grow SEOUL, January 28 (AJP) - South Korean equities are logging a rare double win, with both the main KOSPI and the tech-heavy KOSDAQ hitting historic highs, but the synchronized rally is increasingly stirring anxiety that markets are pulling away from economic reality. The benchmark KOSPI climbed to 5,170.81 on Wednesday, setting a fresh record, while the KOSDAQ advanced to 1,133.52. Both indices are up about 20 percent so far this year, extending last year’s outsized gains of 76 percent for the KOSPI and 36 percent for the KOSDAQ. The surge has lifted South Korea’s total equity market capitalization above that of Germany, underscoring the scale — and speed — of the rally. Leadership has been concentrated. Alongside heavyweight chipmakers Samsung Electronics and SK hynix, Hyundai Motor has joined the record-setting run, with its share price up more than 63 percent year to date. Optimism around semiconductor exports, autos and emerging technologies such as robotics has reinforced investor appetite. Yet beneath the headline strength, warning signs are accumulating. Markets diverge from the real economy For one, equity markets appear increasingly decoupled from underlying economic conditions. South Korea’s economy contracted 0.3 percent in the fourth quarter and 1 percent for the full year, according to the Bank of Korea — the weakest performance among major Asian economies. Even compared with Japan, which entered a low-growth era earlier, South Korea’s annual growth rate remained similar or lower, falling well short of the earlier consensus forecast of 1.8 percent. Leverage is adding to concerns. Margin debt reached approximately 29.35 trillion won ($20.6 billion) as of Jan. 26, according to the Korea Financial Investment Association, approaching the 30 trillion won mark — an all-time high for funds borrowed to purchase stocks. The pace of the increase has been particularly striking. Compared with about a year earlier, margin borrowing has surged by 12.51 trillion won, or 74.3 percent, amplifying fears that rising asset prices are being fueled by debt rather than earnings fundamentals. Household balance sheets remain stretched as well. Non-bank household debt increased by 37.6 trillion won over the course of 2025. Although it edged down by 1.5 trillion won in December, the ratio still stood at 89 percent of GDP at year-end — among the highest levels in major economies. Labor-market indicators offer little reassurance. Youth employment, a key barometer of long-term growth potential, remains mired in stagnation. The employment rate for those aged 15 to 29 stood at 44.3 percent in December, down 0.4 percentage points from a year earlier and marking the 20th consecutive month of decline, according to data released by the National Data Agency on Jan. 14. As the gap between asset prices and the real economy widens, volatility has risen sharply. The KOSPI Volatility Index (VKOSPI) closed Wednesday at 38.68, up 11.12 percent from the previous day and more than double its level a year earlier. Liquidity, not recovery This is not the first time South Korean equities have diverged from economic fundamentals. Similar patterns emerged in the aftermath of the global financial crisis, during the COVID-19 stimulus cycle and in the early stages of the dot-com boom — periods when abundant liquidity converged with compelling technology narratives. The current rally appears driven less by a broad-based recovery than by excess liquidity and concentrated inflows into specific sectors such as AI and semiconductors. According to a Bank of Korea report released Jan. 14, the M2 money supply grew 4.8 percent year on year as of November 2025. When beneficiary certificates — including ETFs, equity funds and bond funds — are included, effective liquidity growth reached 8 percent. Investor positioning reflects this trend. Investor deposits climbed to a record 97.54 trillion won as of Monday, highlighting the scale of capital circulating around the stock market. “The rally that began last year and continued into early this year reflects domestic liquidity conditions and expectations surrounding monetary accommodation by major economies such as Japan and the United States, rather than improvements in the real economy,” said Lee Kyung-min, a strategist at Daishin Securities. Lee added, however, that with forward earnings per share expected to trend upward, liquidity could eventually translate into corporate investment and growth. Others remain more cautious. J.P. Morgan, in its “2026 Market Outlook,” warned that downside risks remain elevated amid weak business sentiment and a cooling labor market, posing potential headwinds for global equities, including South Korea. Adding to concerns, the U.S. Consumer Confidence Index fell sharply to 84.5 in January, nearly 10 points lower than the previous month and well below market expectations. “We are not unaware that key real-economy indicators — including youth employment and construction activity — remain weak despite rising stock prices,” said a securities industry official, speaking on condition of anonymity. “But given the belief that a buoyant stock market can support corporate investment in R&D and facilities — and potentially lift the real economy — it is difficult to openly raise the prospect of a correction.” 2026-01-28 18:11:27 -

Korean large firms turn confident about business prospects for the first time in nearly 4 yrs SEOUL, January 27 (AJP) -South Korea’s large manufacturers — most of them export-oriented — turned optimistic about business conditions on strong orders in semiconductors and shipbuilding, even as overall business sentiment softened at the start of 2026, a Bank of Korea survey showed Tuesday. The business sentiment index for large manufacturing firms rose to 101.8 in January, up from 97.7 a month earlier, marking the first time the reading topped the neutral 100 threshold in three years and seven months, according to the central bank’s January business survey and economic sentiment index. A reading above 100 signals optimism, while a figure below that level indicates pessimism. The rebound was led by shipbuilders, whose business conditions index climbed to 107, reflecting strong order books, while sentiment among electronic equipment makers stood at 97, supported by robust semiconductor exports. By contrast, sentiment among small manufacturers remained subdued. Their index rose 1.7 points month on month but stayed at 91.8, underscoring a widening confidence gap between large and small firms. The gap between the two expanded to 10.0 points, the widest since September 2023. “Sentiment improved among large firms led by primary metals, other machinery and equipment, and electronic, video and communications equipment,” said Lee Hye-young, head of the Bank of Korea’s economic sentiment survey team. Industry-level data showed sharp divergence. In terms of current business conditions, shipbuilding and other transportation equipment posted a reading of 112, the only manufacturing sector above 100, buoyed by expectations of increased exports linked to cooperation with the United States. Electronic, video and communications equipment recorded a relatively high reading of 87, reflecting sustained semiconductor demand. Across all industries, however, the composite business sentiment index edged down 0.2 points to 94.0, slipping after three consecutive monthly gains. Manufacturing and nonmanufacturing sectors moved in opposite directions. The manufacturing CBSI rose 2.8 points to 97.5, supported by improvements in production and new orders. The nonmanufacturing CBSI fell 2.1 points to 91.7, weighed down by weaker funding conditions and profitability. Looking ahead, the outlook index for February improved modestly, rising to 95.0 for manufacturing and 88.4 for nonmanufacturing, while the all-industry outlook stood at 91.0. Lee said sentiment in nonmanufacturing sectors often peaks at year-end due to seasonal order concentration, with a slowdown typically emerging early in the year. She added that signs of improvement are emerging for February, led by wholesale and retail trade and arts, sports and leisure-related services, reflecting the Lunar New Year holiday effect. The economic sentiment index, which combines corporate and consumer sentiment, rose 0.5 points to 94.0 in January, while the seasonally adjusted cyclical indicator increased 0.6 points to 95.8. The survey was conducted between Jan. 12 and 19 among 3,524 companies nationwide, with 3,255 firms responding, including 1,815 manufacturers and 1,440 nonmanufacturers. 2026-01-27 08:09:00

Korean large firms turn confident about business prospects for the first time in nearly 4 yrs SEOUL, January 27 (AJP) -South Korea’s large manufacturers — most of them export-oriented — turned optimistic about business conditions on strong orders in semiconductors and shipbuilding, even as overall business sentiment softened at the start of 2026, a Bank of Korea survey showed Tuesday. The business sentiment index for large manufacturing firms rose to 101.8 in January, up from 97.7 a month earlier, marking the first time the reading topped the neutral 100 threshold in three years and seven months, according to the central bank’s January business survey and economic sentiment index. A reading above 100 signals optimism, while a figure below that level indicates pessimism. The rebound was led by shipbuilders, whose business conditions index climbed to 107, reflecting strong order books, while sentiment among electronic equipment makers stood at 97, supported by robust semiconductor exports. By contrast, sentiment among small manufacturers remained subdued. Their index rose 1.7 points month on month but stayed at 91.8, underscoring a widening confidence gap between large and small firms. The gap between the two expanded to 10.0 points, the widest since September 2023. “Sentiment improved among large firms led by primary metals, other machinery and equipment, and electronic, video and communications equipment,” said Lee Hye-young, head of the Bank of Korea’s economic sentiment survey team. Industry-level data showed sharp divergence. In terms of current business conditions, shipbuilding and other transportation equipment posted a reading of 112, the only manufacturing sector above 100, buoyed by expectations of increased exports linked to cooperation with the United States. Electronic, video and communications equipment recorded a relatively high reading of 87, reflecting sustained semiconductor demand. Across all industries, however, the composite business sentiment index edged down 0.2 points to 94.0, slipping after three consecutive monthly gains. Manufacturing and nonmanufacturing sectors moved in opposite directions. The manufacturing CBSI rose 2.8 points to 97.5, supported by improvements in production and new orders. The nonmanufacturing CBSI fell 2.1 points to 91.7, weighed down by weaker funding conditions and profitability. Looking ahead, the outlook index for February improved modestly, rising to 95.0 for manufacturing and 88.4 for nonmanufacturing, while the all-industry outlook stood at 91.0. Lee said sentiment in nonmanufacturing sectors often peaks at year-end due to seasonal order concentration, with a slowdown typically emerging early in the year. She added that signs of improvement are emerging for February, led by wholesale and retail trade and arts, sports and leisure-related services, reflecting the Lunar New Year holiday effect. The economic sentiment index, which combines corporate and consumer sentiment, rose 0.5 points to 94.0 in January, while the seasonally adjusted cyclical indicator increased 0.6 points to 95.8. The survey was conducted between Jan. 12 and 19 among 3,524 companies nationwide, with 3,255 firms responding, including 1,815 manufacturers and 1,440 nonmanufacturers. 2026-01-27 08:09:00 -

Korea tops Japan in exports, but growth engine overly reliant on chips SEOUL, Jan 23 (AJP) - East Asia emerged as the standout winner in global trade last year, with the region’s major exporters all setting new records as demand surged for artificial intelligence–related hardware. South Korea posted a record $709.5 billion in exports in 2025, up 3.8 percent from the previous year and overtaking Japan’s $696 billion in data released Thursday by Japan’s Ministry of Finance. It marked the first time South Korea surpassed Japan in total export volume. Taiwan followed closely with $640.7 billion. China earlier reported a record $3.77 trillion in exports. Beneath the headline figures, however, South Korea’s performance warrants a more sober assessment. In Korea’s case, semiconductors accounted for roughly one-quarter of total exports, or $173.4 billion, underscoring the economy’s growing dependence on a single sector. That dominance becomes even more pronounced when viewed through the lens of economic growth. According to the Bank of Korea’s 2025 GDP data released Thursday, the semiconductor sector contributed 0.6 percentage points to last year’s annualized growth rate of 1 percent—more than half of the total expansion. Excluding chips, the economy would have grown by just 0.4 percent. This concentration highlights what economists increasingly describe as South Korea’s “K-shaped” growth structure, particularly when contrasted with China and Japan, both of which retain broader industrial and domestic demand bases. China’s National Bureau of Statistics reported Monday that its 2025 manufacturing GDP was widely diversified, with machinery and equipment accounting for 16 percent, steel 13 percent, and semiconductors a comparatively modest 8 percent. Japan, while not a direct competitor in memory chips, also maintains a broad industrial mix. Automobiles—the largest segment of Japan’s secondary industry—account for 17 percent of output, far below Korea’s concentration, where 25 percent of exports are tied to a single category. Domestic demand further exposes the gap. South Korea’s retail sales growth has remained below 1 percent, while Japan’s is projected to reach around 2 percent, and China’s approximately 4 percent. Korea and Taiwan: twin chip engines, shared vulnerabilities South Korea’s closest economic parallel is Taiwan, which has built a similarly semiconductor-centric growth model. Despite differences in scale, the two economies share striking structural weaknesses. Taiwan recorded 5.3 percent export growth last year, but that expansion was driven overwhelmingly by advanced chipmaking. According to research from the Economic and Social Research Council (ESRC), TSMC alone accounts for about 8 percent of Taiwan’s GDP. This mirrors South Korea’s dependence on corporate heavyweights, where Samsung Electronics contributes roughly 5 percent of GDP, and the broader Samsung Group nearly 13 percent. In both economies, high-end semiconductor manufacturing has generated limited spillover effects into consumption and services. The imbalance is reflected in persistently weak domestic demand. Taiwan’s Directorate-General of Budget, Accounting and Statistics (DGBAS) reported private consumption growth of around 1 percent as of August 2025. South Korea’s retail sales growth is estimated at a similar level for the year. 2026-01-23 17:12:16

Korea tops Japan in exports, but growth engine overly reliant on chips SEOUL, Jan 23 (AJP) - East Asia emerged as the standout winner in global trade last year, with the region’s major exporters all setting new records as demand surged for artificial intelligence–related hardware. South Korea posted a record $709.5 billion in exports in 2025, up 3.8 percent from the previous year and overtaking Japan’s $696 billion in data released Thursday by Japan’s Ministry of Finance. It marked the first time South Korea surpassed Japan in total export volume. Taiwan followed closely with $640.7 billion. China earlier reported a record $3.77 trillion in exports. Beneath the headline figures, however, South Korea’s performance warrants a more sober assessment. In Korea’s case, semiconductors accounted for roughly one-quarter of total exports, or $173.4 billion, underscoring the economy’s growing dependence on a single sector. That dominance becomes even more pronounced when viewed through the lens of economic growth. According to the Bank of Korea’s 2025 GDP data released Thursday, the semiconductor sector contributed 0.6 percentage points to last year’s annualized growth rate of 1 percent—more than half of the total expansion. Excluding chips, the economy would have grown by just 0.4 percent. This concentration highlights what economists increasingly describe as South Korea’s “K-shaped” growth structure, particularly when contrasted with China and Japan, both of which retain broader industrial and domestic demand bases. China’s National Bureau of Statistics reported Monday that its 2025 manufacturing GDP was widely diversified, with machinery and equipment accounting for 16 percent, steel 13 percent, and semiconductors a comparatively modest 8 percent. Japan, while not a direct competitor in memory chips, also maintains a broad industrial mix. Automobiles—the largest segment of Japan’s secondary industry—account for 17 percent of output, far below Korea’s concentration, where 25 percent of exports are tied to a single category. Domestic demand further exposes the gap. South Korea’s retail sales growth has remained below 1 percent, while Japan’s is projected to reach around 2 percent, and China’s approximately 4 percent. Korea and Taiwan: twin chip engines, shared vulnerabilities South Korea’s closest economic parallel is Taiwan, which has built a similarly semiconductor-centric growth model. Despite differences in scale, the two economies share striking structural weaknesses. Taiwan recorded 5.3 percent export growth last year, but that expansion was driven overwhelmingly by advanced chipmaking. According to research from the Economic and Social Research Council (ESRC), TSMC alone accounts for about 8 percent of Taiwan’s GDP. This mirrors South Korea’s dependence on corporate heavyweights, where Samsung Electronics contributes roughly 5 percent of GDP, and the broader Samsung Group nearly 13 percent. In both economies, high-end semiconductor manufacturing has generated limited spillover effects into consumption and services. The imbalance is reflected in persistently weak domestic demand. Taiwan’s Directorate-General of Budget, Accounting and Statistics (DGBAS) reported private consumption growth of around 1 percent as of August 2025. South Korea’s retail sales growth is estimated at a similar level for the year. 2026-01-23 17:12:16 -

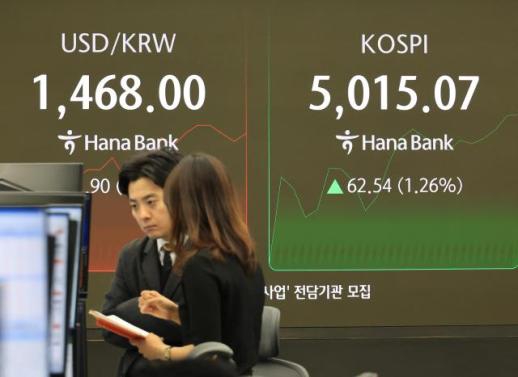

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48 -

Blunt FX language fuels speculation, but steadies the won — for now SEOUL, January 22 (AJP) - Alongside South Korea’s blistering equity rally, the foreign-exchange market has emerged as the economy’s most sensitive fault line, dominating monetary policy briefings and even the president’s New Year’s press conference. From U.S. Treasury Secretary Scott Bessent’s remark that the won’s level is “not in line with Korea’s strong economic fundamentals,” to Bank of Korea Governor Rhee Chang-yong’s blunt assertion that the currency’s slide has been “excessive,” policymakers have adopted unusually direct language to deter one-sided bets that could distort trade conditions and undermine financial stability. President Lee Jae Myung joined the verbal defense in a televised New Year’s news conference — and went a step further. What stirred markets was a rare attempt to sketch a future trading range for the won. Citing compound external factors behind the currency’s weakness, Lee said that if the won were to track the Japanese yen closely, it would be trading near 1,600 per dollar. He then predicted that the won would stabilize around 1,400 within one or two months, without elaborating on the basis for the forecast. The comment abruptly halted short positions and triggered a reversal, pulling the won back from near 1,480 to below 1,470. As of Thursday, the dollar was quoted at 1,469.30. Earlier on Thursday, Governor Rhee reinforced the message with his own forceful verbal intervention at an AI conference co-hosted with Naver. “By any objective measure, the dollar-won exchange rate is too high and has ample room for adjustment,” he said. Where does the confidence come from? Some point to the roaring stock market, with the KOSPI briefly breaching the 5,000-point threshold — a level increasingly discussed as a symbolic gateway toward eventual MSCI developed-market status. Others focus on the bond market. South Korean sovereign debt is set to enter the World Government Bond Index (WGBI) in stages from April through November. WGBI inclusion requires a minimum maturity of one year, excluding short-term debt entirely. More importantly, the index’s credibility attracts long-duration capital: its average holding period is about 9.6 years, far longer than that of most global bond benchmarks. Longer duration typically translates into lower volatility and higher perceived credit quality. With inclusion beginning in April — precisely one to two months from now — President Lee’s timeline has not gone unnoticed. “As the government expects capital inflows of $50 billion or more from WGBI inclusion, it likely views this as a key catalyst for won appreciation,” said a foreign-exchange trader, speaking on condition of anonymity. Potential inclusion in the MSCI Developed Markets (DM) Index is also viewed as a strategic defensive line. If upgraded, South Korea would likely carry a weight of around 2 percent, potentially drawing between $250 billion and $350 billion in inflows. Crucially, DM capital is “sticky”: funds typically remain invested for five to ten years, compared with roughly three years for emerging-market flows. That durability helps dampen capital flight and stabilize the exchange rate. “DM inclusion would anchor capital flows and enhance Korea’s international credibility, which would be supportive for the won,” said Kim Jong-young, a researcher at NH Investment & Securities. Still, few expect an immediate boost. South Korea must first be placed on MSCI’s watch list this June and maintain that status for at least a year. Realistic inclusion is widely seen as a 2028 story at the earliest. Temporary relief from delayed U.S. investment Another theory circulating in markets is that the government may be implicitly defending the won by slowing the execution of a $350 billion investment package promised to the United States during tariff negotiations. The package includes $200 billion in direct investment and $150 billion in shipbuilding cooperation. Deputy Prime Minister and Finance Minister Koo Yun-cheol hinted at such delays in an interview with Reuters last Friday. “It will be difficult to execute major investments in the U.S. during the first half of this year,” Koo said, adding that “given current foreign-exchange market conditions, it is unlikely that these investments will materialize within the year.” Whether President Lee and Governor Rhee had this specific lever in mind remains unclear. “The remarks likely refer to measures such as Repatriation Incentive Accounts (RIA), but as Minister Koo noted, deploying U.S. investment funds within the first half appears difficult,” a Ministry of Economy and Finance official said, requesting anonymity. The comments follow an earlier signal of “pace adjustment” from Trade Minister Kim Jung-kwan on Nov. 14, when he clarified: “The commitment was to proceed with investments by January 2029 — not necessarily to disburse the full amount by then.” 2026-01-22 17:55:42

Blunt FX language fuels speculation, but steadies the won — for now SEOUL, January 22 (AJP) - Alongside South Korea’s blistering equity rally, the foreign-exchange market has emerged as the economy’s most sensitive fault line, dominating monetary policy briefings and even the president’s New Year’s press conference. From U.S. Treasury Secretary Scott Bessent’s remark that the won’s level is “not in line with Korea’s strong economic fundamentals,” to Bank of Korea Governor Rhee Chang-yong’s blunt assertion that the currency’s slide has been “excessive,” policymakers have adopted unusually direct language to deter one-sided bets that could distort trade conditions and undermine financial stability. President Lee Jae Myung joined the verbal defense in a televised New Year’s news conference — and went a step further. What stirred markets was a rare attempt to sketch a future trading range for the won. Citing compound external factors behind the currency’s weakness, Lee said that if the won were to track the Japanese yen closely, it would be trading near 1,600 per dollar. He then predicted that the won would stabilize around 1,400 within one or two months, without elaborating on the basis for the forecast. The comment abruptly halted short positions and triggered a reversal, pulling the won back from near 1,480 to below 1,470. As of Thursday, the dollar was quoted at 1,469.30. Earlier on Thursday, Governor Rhee reinforced the message with his own forceful verbal intervention at an AI conference co-hosted with Naver. “By any objective measure, the dollar-won exchange rate is too high and has ample room for adjustment,” he said. Where does the confidence come from? Some point to the roaring stock market, with the KOSPI briefly breaching the 5,000-point threshold — a level increasingly discussed as a symbolic gateway toward eventual MSCI developed-market status. Others focus on the bond market. South Korean sovereign debt is set to enter the World Government Bond Index (WGBI) in stages from April through November. WGBI inclusion requires a minimum maturity of one year, excluding short-term debt entirely. More importantly, the index’s credibility attracts long-duration capital: its average holding period is about 9.6 years, far longer than that of most global bond benchmarks. Longer duration typically translates into lower volatility and higher perceived credit quality. With inclusion beginning in April — precisely one to two months from now — President Lee’s timeline has not gone unnoticed. “As the government expects capital inflows of $50 billion or more from WGBI inclusion, it likely views this as a key catalyst for won appreciation,” said a foreign-exchange trader, speaking on condition of anonymity. Potential inclusion in the MSCI Developed Markets (DM) Index is also viewed as a strategic defensive line. If upgraded, South Korea would likely carry a weight of around 2 percent, potentially drawing between $250 billion and $350 billion in inflows. Crucially, DM capital is “sticky”: funds typically remain invested for five to ten years, compared with roughly three years for emerging-market flows. That durability helps dampen capital flight and stabilize the exchange rate. “DM inclusion would anchor capital flows and enhance Korea’s international credibility, which would be supportive for the won,” said Kim Jong-young, a researcher at NH Investment & Securities. Still, few expect an immediate boost. South Korea must first be placed on MSCI’s watch list this June and maintain that status for at least a year. Realistic inclusion is widely seen as a 2028 story at the earliest. Temporary relief from delayed U.S. investment Another theory circulating in markets is that the government may be implicitly defending the won by slowing the execution of a $350 billion investment package promised to the United States during tariff negotiations. The package includes $200 billion in direct investment and $150 billion in shipbuilding cooperation. Deputy Prime Minister and Finance Minister Koo Yun-cheol hinted at such delays in an interview with Reuters last Friday. “It will be difficult to execute major investments in the U.S. during the first half of this year,” Koo said, adding that “given current foreign-exchange market conditions, it is unlikely that these investments will materialize within the year.” Whether President Lee and Governor Rhee had this specific lever in mind remains unclear. “The remarks likely refer to measures such as Repatriation Incentive Accounts (RIA), but as Minister Koo noted, deploying U.S. investment funds within the first half appears difficult,” a Ministry of Economy and Finance official said, requesting anonymity. The comments follow an earlier signal of “pace adjustment” from Trade Minister Kim Jung-kwan on Nov. 14, when he clarified: “The commitment was to proceed with investments by January 2029 — not necessarily to disburse the full amount by then.” 2026-01-22 17:55:42 -

Japanese bond yields trigger global tantrum, South Korea most sensitive SEOUL, Jan 21 (AJP) - Major sovereign bond yields, including South Korean treasuries, jumped on Tuesday after a sharp surge in Japanese government bond yields — bringing the elephant in the room back into focus: the massive yen carry trade. The benchmark 10-year JGB yield closed up 7 basis points at 2.34 percent, its highest level in nearly three decades. The move quickly spilled over abroad, pushing the U.S. 10-year Treasury yield up 7.5 basis points to 4.295 percent and Australia’s 10-year yield up 6.9 basis points to 4.799 percent. South Korea proved particularly sensitive. The 10-year Korean government bond yield surged 8.8 basis points to 3.653 percent, marking its highest level in almost two years. Japan has long functioned as a global liquidity provider, with near-zero borrowing costs encouraging yen-funded carry trades for decades. The recent rise in JGB yields is now prompting capital repatriation, as Japanese investors pull funds back home to capture higher domestic returns. Because the yen serves as a major funding and reserve currency, this reversal has acted as a destabilizing force for global bond markets. Notably, the latest spike in yields was driven less by monetary policy than by fiscal concerns. The Bank of Japan is set to announce its interest rate decision on Friday, and the advanced trigger came from political developments surrounding Prime Minister Sanae Takaichi’s policy agenda. On Tuesday, Takaichi announced plans to dissolve parliament on Jan. 23 and call snap elections for Feb. 8. Although the ruling coalition of the Liberal Democratic Party and Nippon Ishin no Kai already controls 233 seats, she is seeking at least 240 seats to consolidate legislative dominance. Markets reacted sharply to her populist stimulus pledges, particularly proposals to cut consumption taxes on food and beverages to 8 percent — a move estimated to create a 5 trillion yen ($31.6 billion) revenue shortfall — without clear funding measures. Bond yields retreated after Takaichi later pledged that “there will be no additional debt issuance,” with the 10-year JGB yield falling about 8 basis points by Wednesday morning. However, skepticism remains, as yields continue to hover above 2.3 percent and investors question whether stimulus can be financed without new borrowing. Demand for Japanese debt has already weakened. A recent 20-year JGB auction recorded a record-low bid-to-cover ratio, underscoring investor caution. The rise in government yields has filtered through to consumer lending. As of Wednesday, 10-year fixed mortgage rates at Japan’s megabanks — Mizuho, MUFG and SMBC — were approaching 3.8 percent, nearly double the roughly 2 percent ceiling seen a year earlier. Analysts have compared the episode to the U.K.’s 2022 “Truss Shock,” when unfunded tax cuts proposed by then–Prime Minister Liz Truss sent 10-year gilt yields soaring from about 3.5 percent to 4.5 percent in less than a week. After Japanese Finance Minister Satsuki Katayama urged markets to “maintain calm,” the 10-year JGB yield slipped further, down 8.6 basis points to 2.29 percent. The recovery in Korea has lagged. The 10-year Korean yield stood at 3.619 percent on Wednesday morning, still up 3.4 basis points and failing to fully reverse the previous day’s sharp jump. Part of the drag stemmed from Korea's own fiscal stimulus agenda. On Tuesday, President Lee Jae-myung mentioned the possibility of a supplementary budget, instructing Culture Minister Choi Hwi-young to review potential increases in arts and culture spending. Although Lee later clarified at a Wednesday press conference that there would be “no reckless supplementary budget,” the initial comment had already unsettled the bond market. U.S. Treasury yields also eased slightly, with the 10-year yield ending Wednesday at 4.275 percent, down 2 basis points, but still short of a full recovery. Persistent geopolitical risks — including Washington’s threat to impose a 10 percent tariff on countries opposing its push to acquire Greenland — continued to weigh on sentiment. Caution urged over expansionary fiscal trends While analysts say fears of a systemic shock in South Korea are overstated, they warn that a broader global tilt toward fiscal expansion among major currency issuers poses ongoing risks. “Mentioning a supplementary budget in January is unusual, but South Korea is likely to exceed its tax revenue targets this year, making large-scale bond issuance unlikely,” said Kang Seung-won, a researcher at NH Securities. Kang added that a projected 30 percent increase in earnings among KOSPI and KOSDAQ-listed companies should help buffer the domestic bond market. Still, expansionary fiscal policies elsewhere remain a concern. “We are seeing a recurring pattern where fiscal concerns push up bond yields and market rates, which then weigh on currencies,” said Kwon Ah-min, another researcher at NH Securities. Kwon pointed to Japan’s record 122.3 trillion yen budget for fiscal 2026 — with 29.6 trillion yen expected to be financed through debt — as a key risk factor. “Rising bond issuance among major economies remains a volatile variable for global financial markets,” she said. 2026-01-21 17:20:01