Journalist

Kim Yeon-jae

duswogmlwo77@ajunews.com

-

South Korea celebrates record 18.5 million tourists SEOUL, December 23 (AJP) -Sharmaine Lee from Singapore became the 18.5 millionth foreign visitor to South Korea this year on Tuesday, greeted with fanfare at Incheon International Airport as the country’s inbound arrivals surpassed the pre-pandemic peak of 17.5 million recorded in 2019. Buoyed by the milestone, the government has moved up its long-term tourism ambition, setting a target of attracting 30 million foreign visitors by 2030. According to the Korea Tourism Organization, the surge reflects a synchronized recovery in travel demand across Asia, the Americas and Europe, reinforced by the global appeal of K-pop, K-dramas and Korean beauty culture. Yet behind the record headcount lies a persistent structural weakness: tourists are returning in force, but they are spending less. A recent report by Yanolja Research shows that average per-capita spending during the first nine months of 2025 stood at $1,010.4, down 15.3 percent from $1,193.1 in 2019. As a result, total tourism receipts reached $14.23 billion, recovering to just 92.2 percent of pre-pandemic levels despite inbound arrivals already exceeding the earlier peak. Industry experts increasingly point to Japan’s policy shift as a possible reference point. Since 2014, Tokyo has treated tourism as a pillar of national growth, prioritizing longer stays and spreading visitors beyond major cities. That strategy delivered 36.87 million foreign visitors and a $41.2 billion tourism surplus last year. By contrast, South Korea continues to run a structural deficit, as outbound spending by Korean travelers outpaces inbound tourism revenue. At the center of the challenge is the length of stay. Foreign visitors currently remain in South Korea for an average of three to four days — a duration experts say must be extended to a week or more to generate meaningful economic spillovers. “The essence lies in why they come, how long they stay, and what brings them back,” said Yoon Yoo-sik, a professor at Kyung Hee University’s College of Hotel and Tourism Management. He stressed that South Korea needs to move beyond generic sightseeing toward higher-value, experience-based offerings spanning K-pop, beauty and MICE (meetings, incentives, conferences and exhibitions). In response, the Ministry of Culture, Sports and Tourism plans to accelerate what it calls a “structural transformation” beginning in 2026. Measures under review include streamlined entry procedures, dedicated transit passes for foreign visitors and improvements to mobile payment systems to better serve the growing ranks of independent travelers. As South Korea’s tourism numbers push into uncharted territory, policymakers face a familiar question: whether the next phase of growth will be defined by how many visitors arrive — or by how long they stay and how deeply they spend. 2025-12-23 17:57:33

South Korea celebrates record 18.5 million tourists SEOUL, December 23 (AJP) -Sharmaine Lee from Singapore became the 18.5 millionth foreign visitor to South Korea this year on Tuesday, greeted with fanfare at Incheon International Airport as the country’s inbound arrivals surpassed the pre-pandemic peak of 17.5 million recorded in 2019. Buoyed by the milestone, the government has moved up its long-term tourism ambition, setting a target of attracting 30 million foreign visitors by 2030. According to the Korea Tourism Organization, the surge reflects a synchronized recovery in travel demand across Asia, the Americas and Europe, reinforced by the global appeal of K-pop, K-dramas and Korean beauty culture. Yet behind the record headcount lies a persistent structural weakness: tourists are returning in force, but they are spending less. A recent report by Yanolja Research shows that average per-capita spending during the first nine months of 2025 stood at $1,010.4, down 15.3 percent from $1,193.1 in 2019. As a result, total tourism receipts reached $14.23 billion, recovering to just 92.2 percent of pre-pandemic levels despite inbound arrivals already exceeding the earlier peak. Industry experts increasingly point to Japan’s policy shift as a possible reference point. Since 2014, Tokyo has treated tourism as a pillar of national growth, prioritizing longer stays and spreading visitors beyond major cities. That strategy delivered 36.87 million foreign visitors and a $41.2 billion tourism surplus last year. By contrast, South Korea continues to run a structural deficit, as outbound spending by Korean travelers outpaces inbound tourism revenue. At the center of the challenge is the length of stay. Foreign visitors currently remain in South Korea for an average of three to four days — a duration experts say must be extended to a week or more to generate meaningful economic spillovers. “The essence lies in why they come, how long they stay, and what brings them back,” said Yoon Yoo-sik, a professor at Kyung Hee University’s College of Hotel and Tourism Management. He stressed that South Korea needs to move beyond generic sightseeing toward higher-value, experience-based offerings spanning K-pop, beauty and MICE (meetings, incentives, conferences and exhibitions). In response, the Ministry of Culture, Sports and Tourism plans to accelerate what it calls a “structural transformation” beginning in 2026. Measures under review include streamlined entry procedures, dedicated transit passes for foreign visitors and improvements to mobile payment systems to better serve the growing ranks of independent travelers. As South Korea’s tourism numbers push into uncharted territory, policymakers face a familiar question: whether the next phase of growth will be defined by how many visitors arrive — or by how long they stay and how deeply they spend. 2025-12-23 17:57:33 -

Korea tightens treasury stock disclosures, lowering threshold to 1% SEOUL, December 23 (AJP) -South Korean listed companies will be required to disclose their treasury stock holdings once they exceed 1 percent of shares outstanding — down from the current 5 percent — under sweeping revisions to capital markets rules, as regulators move to strengthen shareholder protection and curb opaque share buybacks. The amendments to the enforcement decree of the Capital Markets Act were approved at a Cabinet meeting, the Financial Services Commission said Tuesday. The new rules will take effect on Dec. 30 and must be reflected in companies’ 2025 annual reports. Under the revised rules, listed firms holding treasury shares equal to at least 1 percent of total shares outstanding must disclose the size of their holdings, the purpose of holding them and future disposal plans. The disclosure frequency will double from once a year to twice a year, with companies required to attach a treasury stock report to both annual and semiannual filings. Companies will also be required to disclose a comparison between their most recently announced treasury stock plans and actual execution over the past six months. If the gap between the plan and implementation exceeds 30 percent, firms must explain the reasons in detail. Reporting requirements will also be tightened when companies decide to buy or sell treasury shares. Listed firms must file a major event report outlining the purpose, planned amount, number of shares, method and period of the transaction, and regularly disclose the status of treasury share holdings, purchases and sales in periodic filings. Companies holding treasury shares above a certain threshold must additionally disclose disposal plans in their annual reports. The FSC said it will actively apply sanctions for disclosure violations, including recommendations to dismiss executives, limits on securities issuance, administrative fines and criminal penalties. Repeated violations will face heavier punishment, it added. Beyond treasury stock, the amendments expand mandatory disclosures related to major industrial accidents. Companies will be required to include details such as the occurrence of incidents, damage, response measures and outlook in both annual and semiannual reports. Disclosure requirements for mergers and similar transactions will also be strengthened, with firms required to provide more detailed board opinion statements, including explanations given by management and specific issues discussed by directors at each board resolution. Financial authorities said the reforms are intended to foster a shareholder-value-focused corporate culture and reduce information asymmetry between controlling and minority shareholders by ensuring that material corporate actions are disclosed in a timely and transparent manner. Regulators also expect the changes to accelerate the use of treasury shares as a shareholder-return tool benefiting all investors rather than select shareholders. Treasury share buybacks and cancellations have already been on a sharp uptrend, with the value of canceled shares reaching 20.7 trillion won ($14 billion) through November 2025 — surpassing the full-year total of 13.9 trillion won recorded in 2024. 2025-12-23 16:00:32

Korea tightens treasury stock disclosures, lowering threshold to 1% SEOUL, December 23 (AJP) -South Korean listed companies will be required to disclose their treasury stock holdings once they exceed 1 percent of shares outstanding — down from the current 5 percent — under sweeping revisions to capital markets rules, as regulators move to strengthen shareholder protection and curb opaque share buybacks. The amendments to the enforcement decree of the Capital Markets Act were approved at a Cabinet meeting, the Financial Services Commission said Tuesday. The new rules will take effect on Dec. 30 and must be reflected in companies’ 2025 annual reports. Under the revised rules, listed firms holding treasury shares equal to at least 1 percent of total shares outstanding must disclose the size of their holdings, the purpose of holding them and future disposal plans. The disclosure frequency will double from once a year to twice a year, with companies required to attach a treasury stock report to both annual and semiannual filings. Companies will also be required to disclose a comparison between their most recently announced treasury stock plans and actual execution over the past six months. If the gap between the plan and implementation exceeds 30 percent, firms must explain the reasons in detail. Reporting requirements will also be tightened when companies decide to buy or sell treasury shares. Listed firms must file a major event report outlining the purpose, planned amount, number of shares, method and period of the transaction, and regularly disclose the status of treasury share holdings, purchases and sales in periodic filings. Companies holding treasury shares above a certain threshold must additionally disclose disposal plans in their annual reports. The FSC said it will actively apply sanctions for disclosure violations, including recommendations to dismiss executives, limits on securities issuance, administrative fines and criminal penalties. Repeated violations will face heavier punishment, it added. Beyond treasury stock, the amendments expand mandatory disclosures related to major industrial accidents. Companies will be required to include details such as the occurrence of incidents, damage, response measures and outlook in both annual and semiannual reports. Disclosure requirements for mergers and similar transactions will also be strengthened, with firms required to provide more detailed board opinion statements, including explanations given by management and specific issues discussed by directors at each board resolution. Financial authorities said the reforms are intended to foster a shareholder-value-focused corporate culture and reduce information asymmetry between controlling and minority shareholders by ensuring that material corporate actions are disclosed in a timely and transparent manner. Regulators also expect the changes to accelerate the use of treasury shares as a shareholder-return tool benefiting all investors rather than select shareholders. Treasury share buybacks and cancellations have already been on a sharp uptrend, with the value of canceled shares reaching 20.7 trillion won ($14 billion) through November 2025 — surpassing the full-year total of 13.9 trillion won recorded in 2024. 2025-12-23 16:00:32 -

Santa rally in Asia kicks off on wobbly note SEOUL, December 23 (AJP) - Asian equity markets opened Tuesday on a fragmented footing, as the first session of the traditional five-day “Santa rally” window failed to deliver a uniform year-end surge. With momentum cooling after recent gains, investors across the region adopted a wait-and-see stance. In Seoul, the benchmark KOSPI rose 0.57 percent to 4,129 as of 10:45 a.m., extending gains for a second day after Monday’s 2 percent rally. Foreign and institutional investors led the advance, with overseas funds net buying 227.4 billion won ($153.2 million) and institutions adding 302.0 billion won. Retail investors, meanwhile, locked in profits, selling a net 497.0 billion won. Despite solid equity inflows and a mild retreat in the dollar index, the Korean won weakened to 1,484 per dollar, down 3.2 won, breaching the 1,480-level that many traders view as a key psychological support level. Markets remained focused on the timing of potential currency-hedging operations by the National Pension Service and further foreign-exchange stabilization signals from authorities. Blue-chip technology stocks tracked higher. Samsung Electronics gained 1.5 percent to 112,000 won, while SK hynix rose 1.6 percent to 590,000 won, supported by strong earnings from U.S. peer Micron Technology and continued optimism over HBM4 development. Shipbuilding and defense stocks outperformed. Hanwha Ocean surged 9 percent to 119,700 won after reports that Donald Trump announced plans to collaborate with the company on U.S. domestic frigate construction. Defense-linked Hanwha Systems climbed 3.5 percent to 58,800 won. In contrast, the tech-heavy KOSDAQ slipped 0.7 percent to 922, pressured by a 157.0 billion won net sell-off by foreign investors. Aerospace stocks were hit hard, reversing gains driven by earlier SpaceX-related speculation. InnoSpace plunged 27 percent to 11,000 won after its HANBIT-Nano launch vehicle failed its mission, while satellite firm Nara Space Technology tumbled 23 percent to 35,500 won. In Japan, the Nikkei 225 was little changed at 50,376, as investors paused after recent advances. Automakers edged lower, with Toyota Motor down 0.3 percent and Honda Motor slipping 0.2 percent, weighed by lingering rate-hike effects and a lack of fresh catalysts. Japanese semiconductor stocks saw profit-taking, with Advantest down 2.2 percent and Tokyo Electron off 0.9 percent. Financials, however, extended gains on higher-rate expectations, as Mitsubishi UFJ Financial Group rose 0.9 percent and Mizuho Financial Group added 1.3 percent. Taiwan’s TAIEX advanced 0.5 percent to 28,290, led by a 1 percent gain in TSMC and a 0.65 percent rise in Foxconn. Mainland China markets were flat, with the Shanghai Composite at 3,922 and the Shenzhen Component at 13,356. Hong Kong’s Hang Seng Index was also little changed at 25,829, reflecting the region’s cautious tone. 2025-12-23 11:11:40

Santa rally in Asia kicks off on wobbly note SEOUL, December 23 (AJP) - Asian equity markets opened Tuesday on a fragmented footing, as the first session of the traditional five-day “Santa rally” window failed to deliver a uniform year-end surge. With momentum cooling after recent gains, investors across the region adopted a wait-and-see stance. In Seoul, the benchmark KOSPI rose 0.57 percent to 4,129 as of 10:45 a.m., extending gains for a second day after Monday’s 2 percent rally. Foreign and institutional investors led the advance, with overseas funds net buying 227.4 billion won ($153.2 million) and institutions adding 302.0 billion won. Retail investors, meanwhile, locked in profits, selling a net 497.0 billion won. Despite solid equity inflows and a mild retreat in the dollar index, the Korean won weakened to 1,484 per dollar, down 3.2 won, breaching the 1,480-level that many traders view as a key psychological support level. Markets remained focused on the timing of potential currency-hedging operations by the National Pension Service and further foreign-exchange stabilization signals from authorities. Blue-chip technology stocks tracked higher. Samsung Electronics gained 1.5 percent to 112,000 won, while SK hynix rose 1.6 percent to 590,000 won, supported by strong earnings from U.S. peer Micron Technology and continued optimism over HBM4 development. Shipbuilding and defense stocks outperformed. Hanwha Ocean surged 9 percent to 119,700 won after reports that Donald Trump announced plans to collaborate with the company on U.S. domestic frigate construction. Defense-linked Hanwha Systems climbed 3.5 percent to 58,800 won. In contrast, the tech-heavy KOSDAQ slipped 0.7 percent to 922, pressured by a 157.0 billion won net sell-off by foreign investors. Aerospace stocks were hit hard, reversing gains driven by earlier SpaceX-related speculation. InnoSpace plunged 27 percent to 11,000 won after its HANBIT-Nano launch vehicle failed its mission, while satellite firm Nara Space Technology tumbled 23 percent to 35,500 won. In Japan, the Nikkei 225 was little changed at 50,376, as investors paused after recent advances. Automakers edged lower, with Toyota Motor down 0.3 percent and Honda Motor slipping 0.2 percent, weighed by lingering rate-hike effects and a lack of fresh catalysts. Japanese semiconductor stocks saw profit-taking, with Advantest down 2.2 percent and Tokyo Electron off 0.9 percent. Financials, however, extended gains on higher-rate expectations, as Mitsubishi UFJ Financial Group rose 0.9 percent and Mizuho Financial Group added 1.3 percent. Taiwan’s TAIEX advanced 0.5 percent to 28,290, led by a 1 percent gain in TSMC and a 0.65 percent rise in Foxconn. Mainland China markets were flat, with the Shanghai Composite at 3,922 and the Shenzhen Component at 13,356. Hong Kong’s Hang Seng Index was also little changed at 25,829, reflecting the region’s cautious tone. 2025-12-23 11:11:40 -

Korean sets record 20-day exports Dec, chips make up a third of total exports SEOUL, December 22 (AJP) -South Korea posted a record for first 20-day monthly exports in December, driven by a 42-percent jump in chip shipments that now account for nearly a third of total exports, customs-cleared preliminary data showed Monday. According to the Korea Customs Service, exports for Dec. 1–20 climbed 6.8 percent from a year earlier to US$43.03 billion, marking a fresh record for the first 20-day period. Average daily exports, adjusted for working days, rose 3.6 percent to US$2.61 billion. At a daily average of about US$2.6 billion for the full year, annual exports are on track to set a new milestone of US$700 billion. Semiconductors led the gains, jumping 41.8 percent. Chips accounted for 27.1 percent of total exports, up 6.7 percentage points from a year earlier. Semiconductor exports have risen for nine consecutive months through November, supported by strong demand for high-value memory used in artificial intelligence data centers and by higher memory prices. Computer peripherals surged 49.1 percent, while wireless communications equipment rose 17.8 percent. Passenger car and ship exports fell 12.7 percent and 21.7 percent, respectively. Shipments to the United States slipped 1.7 percent, weighed down by higher tariffs. Exports increased to China by 6.5 percent, Vietnam by 20.4 percent and Taiwan by 9.6 percent. Imports totaled US$39.21 billion, up 0.7 percent from a year earlier. By item, imports of semiconductors rose 11.8 percent, machinery 3.5 percent and precision instruments 12.5 percent, while crude oil fell 3.2 percent and gas declined 15.0 percent. By source, imports from China rose 3.9 percent, the United States 14.7 percent and Taiwan 12.8 percent, while those from the European Union fell 3.8 percent and Japan 2.3 percent. The trade surplus so far in December stood at US$3.8 billion. 2025-12-22 13:34:18

Korean sets record 20-day exports Dec, chips make up a third of total exports SEOUL, December 22 (AJP) -South Korea posted a record for first 20-day monthly exports in December, driven by a 42-percent jump in chip shipments that now account for nearly a third of total exports, customs-cleared preliminary data showed Monday. According to the Korea Customs Service, exports for Dec. 1–20 climbed 6.8 percent from a year earlier to US$43.03 billion, marking a fresh record for the first 20-day period. Average daily exports, adjusted for working days, rose 3.6 percent to US$2.61 billion. At a daily average of about US$2.6 billion for the full year, annual exports are on track to set a new milestone of US$700 billion. Semiconductors led the gains, jumping 41.8 percent. Chips accounted for 27.1 percent of total exports, up 6.7 percentage points from a year earlier. Semiconductor exports have risen for nine consecutive months through November, supported by strong demand for high-value memory used in artificial intelligence data centers and by higher memory prices. Computer peripherals surged 49.1 percent, while wireless communications equipment rose 17.8 percent. Passenger car and ship exports fell 12.7 percent and 21.7 percent, respectively. Shipments to the United States slipped 1.7 percent, weighed down by higher tariffs. Exports increased to China by 6.5 percent, Vietnam by 20.4 percent and Taiwan by 9.6 percent. Imports totaled US$39.21 billion, up 0.7 percent from a year earlier. By item, imports of semiconductors rose 11.8 percent, machinery 3.5 percent and precision instruments 12.5 percent, while crude oil fell 3.2 percent and gas declined 15.0 percent. By source, imports from China rose 3.9 percent, the United States 14.7 percent and Taiwan 12.8 percent, while those from the European Union fell 3.8 percent and Japan 2.3 percent. The trade surplus so far in December stood at US$3.8 billion. 2025-12-22 13:34:18 -

Santa rally reaches Asia, led by chip stocks SEOUL, December 22 (AJP) - Asian markets opened the week on signs of a “Santa Claus rally,” as a key overhang — Japan’s long-anticipated rate hike — was cleared last week, reviving risk appetite across the region. Chip stocks led the advance after strong earnings from Micron Technology and fresh optimism around high-bandwidth memory (HBM), reinforcing the global AI-driven semiconductor rally. In Seoul, the benchmark KOSPI was up 1.97 percent at 4,099 as of 10 a.m., raising hopes the index could close above the psychologically important 4,100 mark for the first time in ten days. Institutional investors spearheaded the rally with net purchases of 776.4 billion won ($525 million), supported by foreign inflows of 344.0 billion won. Retail investors appeared to be locking in gains after recent volatility, net selling 1.1 trillion won. The Korean won strengthened modestly to 1,477 per dollar, up 4 won from the previous close. Market participants attributed the move to year-end currency hedging by the National Pension Service and institutional investors seeking to lock in exchange rates ahead of the Dec. 30 market close. Blue chips traded broadly higher. Samsung Electronics gained 3 percent to 110,000 won after reports that its HBM4 samples received top-tier evaluations in quality tests for Nvidia. Rival SK hynix, the market leader in HBM, surged 4.75 percent to 575,000 won, emerging as a primary beneficiary of the improving AI memory outlook alongside Micron’s upbeat results. Korea Zinc, the world’s leading non-ferrous metal smelter and a focal point of ongoing corporate governance disputes, rose 5.4 percent to 1,380,000 won. Uncertainty surrounding its U.S. refinery investment eased after the South Korean government expressed a favorable stance, while Chairman Choi Yoon-bum and the Young Poong–MBK alliance reaffirmed their commitment to the project. Doosan Enerbility, seen as a bellwether for nuclear power and small modular reactors (SMRs), rose 2.2 percent to 79,000 won, defying lingering caution over a potential AI-sector bubble. In Tokyo, the Nikkei 225 jumped 2.1 percent to 50,557, as the removal of Bank of Japan-related uncertainty combined with Micron-led tech optimism to trigger broad-based buying. Semiconductor equipment makers led the gains. Tokyo Electron surged 6.3 percent to 33,160 yen ($210.7), while Advantest rose 3.5 percent, DISCO gained 4.8 percent, and Ibiden climbed 5.2 percent. Financial and holding companies also found favor, with SoftBank Group Corp. jumping 6.4 percent to 18,210 yen, buoyed by the BOJ’s rate move and easing AI-bubble concerns in New York. Mitsubishi UFJ Financial Group advanced 2.3 percent. Taiwan’s TAIEX rose 1.4 percent to 28,084, anchored by a 2.1 percent gain in TSMC, which traded at 1,460 Taiwan dollars ($46.33). MediaTek slipped 0.7 percent, while Foxconn edged up 0.7 percent. Mainland China showed a tech-led divergence. The Shenzhen Component Index rose 1.1 percent to 13,285, outperforming the more domestically focused Shanghai Composite’s 0.5 percent gain and the Hang Seng Index’s 0.3 percent rise. 2025-12-22 11:51:42

Santa rally reaches Asia, led by chip stocks SEOUL, December 22 (AJP) - Asian markets opened the week on signs of a “Santa Claus rally,” as a key overhang — Japan’s long-anticipated rate hike — was cleared last week, reviving risk appetite across the region. Chip stocks led the advance after strong earnings from Micron Technology and fresh optimism around high-bandwidth memory (HBM), reinforcing the global AI-driven semiconductor rally. In Seoul, the benchmark KOSPI was up 1.97 percent at 4,099 as of 10 a.m., raising hopes the index could close above the psychologically important 4,100 mark for the first time in ten days. Institutional investors spearheaded the rally with net purchases of 776.4 billion won ($525 million), supported by foreign inflows of 344.0 billion won. Retail investors appeared to be locking in gains after recent volatility, net selling 1.1 trillion won. The Korean won strengthened modestly to 1,477 per dollar, up 4 won from the previous close. Market participants attributed the move to year-end currency hedging by the National Pension Service and institutional investors seeking to lock in exchange rates ahead of the Dec. 30 market close. Blue chips traded broadly higher. Samsung Electronics gained 3 percent to 110,000 won after reports that its HBM4 samples received top-tier evaluations in quality tests for Nvidia. Rival SK hynix, the market leader in HBM, surged 4.75 percent to 575,000 won, emerging as a primary beneficiary of the improving AI memory outlook alongside Micron’s upbeat results. Korea Zinc, the world’s leading non-ferrous metal smelter and a focal point of ongoing corporate governance disputes, rose 5.4 percent to 1,380,000 won. Uncertainty surrounding its U.S. refinery investment eased after the South Korean government expressed a favorable stance, while Chairman Choi Yoon-bum and the Young Poong–MBK alliance reaffirmed their commitment to the project. Doosan Enerbility, seen as a bellwether for nuclear power and small modular reactors (SMRs), rose 2.2 percent to 79,000 won, defying lingering caution over a potential AI-sector bubble. In Tokyo, the Nikkei 225 jumped 2.1 percent to 50,557, as the removal of Bank of Japan-related uncertainty combined with Micron-led tech optimism to trigger broad-based buying. Semiconductor equipment makers led the gains. Tokyo Electron surged 6.3 percent to 33,160 yen ($210.7), while Advantest rose 3.5 percent, DISCO gained 4.8 percent, and Ibiden climbed 5.2 percent. Financial and holding companies also found favor, with SoftBank Group Corp. jumping 6.4 percent to 18,210 yen, buoyed by the BOJ’s rate move and easing AI-bubble concerns in New York. Mitsubishi UFJ Financial Group advanced 2.3 percent. Taiwan’s TAIEX rose 1.4 percent to 28,084, anchored by a 2.1 percent gain in TSMC, which traded at 1,460 Taiwan dollars ($46.33). MediaTek slipped 0.7 percent, while Foxconn edged up 0.7 percent. Mainland China showed a tech-led divergence. The Shenzhen Component Index rose 1.1 percent to 13,285, outperforming the more domestically focused Shanghai Composite’s 0.5 percent gain and the Hang Seng Index’s 0.3 percent rise. 2025-12-22 11:51:42 -

Asian markets rally as BOJ ends policy uncertainty SEOUL, December 19 (AJP) - Asian equities closed higher on Friday as investors welcomed signs of cooling U.S. inflation and the Bank of Japan’s long-anticipated interest rate hike, which helped clear a major policy overhang across the region. The BOJ’s move allowed markets to look past fears of a disorderly yen carry-trade unwind — at least for now — lifting benchmark indices across Asia. In Seoul, the KOSPI rose 0.65 percent to close at 4,020.55, reclaiming the 4,000 level. Institutional investors led the advance, snapping up a net 858.3 billion won ($580 million) in shares, more than offsetting combined selling by foreign and retail investors. The Korean won, however, remained fragile, ending the session at 1,479.3 per dollar, down 2.8 won as of 3:45 p.m., despite a brief intraday rebound. The BOJ raised its short-term policy rate from 0.5 percent to 0.75 percent — the highest level in 30 years — supporting the yen and exerting residual pressure on the won. A temporary suspension of South Korea’s foreign-exchange stability levy, aimed at encouraging FX inflows including dollars, has yet to show a meaningful impact. Bond yields in Seoul edged higher, with the 10-year government bond yield rising three basis points to 3.342 percent. Stocks within the Hyundai Motor Group saw sharp rotation. Hyundai AutoEver surged 18.45 percent to 305,000 won, fueled by investor optimism that the group will accelerate its push into robotics and software-defined vehicles (SDVs). Hyundai Motor gained 2.12 percent, while Hyundai Mobis rose 4.12 percent. Semiconductor heavyweights lagged the broader market. Samsung Electronics fell 1.21 percent to 106,300 won, and SK hynix declined 0.91 percent, as sentiment was weighed down by concerns over a looming supply glut from Chinese manufacturers flooding the market with legacy DRAM chips, potentially pressuring prices later this year. Hanwha Group also stood out. Hanwha Ocean climbed 5.8 percent on news of a new LNG carrier contract, while Hanwha Systems jumped 10.93 percent amid reports it will supply advanced electronic displays for Boeing’s F-15 fighter jets. The tech-heavy KOSDAQ rose 1.55 percent to 915.27, buoyed by renewed biotech momentum. Rznomics, an RNA-editing specialist, hit its daily 30 percent limit to close at 117,000 won on its second day of trading. Index heavyweight Alteogen gained 3.94 percent. In Tokyo, the Nikkei 225 advanced 1.03 percent to 49,507.21, as markets welcomed Governor Kazuo Ueda’s resolve to normalize monetary policy amid steady domestic inflation. Toyota rose 1.81 percent to 3,424 yen ($21.9), while Honda gained 0.91 percent despite lingering recall concerns. Japanese chip-equipment makers tracked gains in U.S. peers, with Ibiden surging 4.44 percent and Tokyo Electron climbing 2.94 percent. Taiwan’s TAIEX added 0.83 percent, led by a 2.55 percent jump in Foxconn, which ended at 221.5 Taiwan dollars ($7). TSMC was flat at 1,430 Taiwan dollars, while MediaTek slipped 0.7 percent to 1,410 Taiwan dollars amid worries over intensifying competition in legacy chips. Mainland Chinese markets edged higher, with the Shanghai Composite up 0.36 percent and the Shenzhen Component rising 0.66 percent. Hong Kong’s Hang Seng Index was up 0.73 percent in late trade. 2025-12-19 17:24:51

Asian markets rally as BOJ ends policy uncertainty SEOUL, December 19 (AJP) - Asian equities closed higher on Friday as investors welcomed signs of cooling U.S. inflation and the Bank of Japan’s long-anticipated interest rate hike, which helped clear a major policy overhang across the region. The BOJ’s move allowed markets to look past fears of a disorderly yen carry-trade unwind — at least for now — lifting benchmark indices across Asia. In Seoul, the KOSPI rose 0.65 percent to close at 4,020.55, reclaiming the 4,000 level. Institutional investors led the advance, snapping up a net 858.3 billion won ($580 million) in shares, more than offsetting combined selling by foreign and retail investors. The Korean won, however, remained fragile, ending the session at 1,479.3 per dollar, down 2.8 won as of 3:45 p.m., despite a brief intraday rebound. The BOJ raised its short-term policy rate from 0.5 percent to 0.75 percent — the highest level in 30 years — supporting the yen and exerting residual pressure on the won. A temporary suspension of South Korea’s foreign-exchange stability levy, aimed at encouraging FX inflows including dollars, has yet to show a meaningful impact. Bond yields in Seoul edged higher, with the 10-year government bond yield rising three basis points to 3.342 percent. Stocks within the Hyundai Motor Group saw sharp rotation. Hyundai AutoEver surged 18.45 percent to 305,000 won, fueled by investor optimism that the group will accelerate its push into robotics and software-defined vehicles (SDVs). Hyundai Motor gained 2.12 percent, while Hyundai Mobis rose 4.12 percent. Semiconductor heavyweights lagged the broader market. Samsung Electronics fell 1.21 percent to 106,300 won, and SK hynix declined 0.91 percent, as sentiment was weighed down by concerns over a looming supply glut from Chinese manufacturers flooding the market with legacy DRAM chips, potentially pressuring prices later this year. Hanwha Group also stood out. Hanwha Ocean climbed 5.8 percent on news of a new LNG carrier contract, while Hanwha Systems jumped 10.93 percent amid reports it will supply advanced electronic displays for Boeing’s F-15 fighter jets. The tech-heavy KOSDAQ rose 1.55 percent to 915.27, buoyed by renewed biotech momentum. Rznomics, an RNA-editing specialist, hit its daily 30 percent limit to close at 117,000 won on its second day of trading. Index heavyweight Alteogen gained 3.94 percent. In Tokyo, the Nikkei 225 advanced 1.03 percent to 49,507.21, as markets welcomed Governor Kazuo Ueda’s resolve to normalize monetary policy amid steady domestic inflation. Toyota rose 1.81 percent to 3,424 yen ($21.9), while Honda gained 0.91 percent despite lingering recall concerns. Japanese chip-equipment makers tracked gains in U.S. peers, with Ibiden surging 4.44 percent and Tokyo Electron climbing 2.94 percent. Taiwan’s TAIEX added 0.83 percent, led by a 2.55 percent jump in Foxconn, which ended at 221.5 Taiwan dollars ($7). TSMC was flat at 1,430 Taiwan dollars, while MediaTek slipped 0.7 percent to 1,410 Taiwan dollars amid worries over intensifying competition in legacy chips. Mainland Chinese markets edged higher, with the Shanghai Composite up 0.36 percent and the Shenzhen Component rising 0.66 percent. Hong Kong’s Hang Seng Index was up 0.73 percent in late trade. 2025-12-19 17:24:51 -

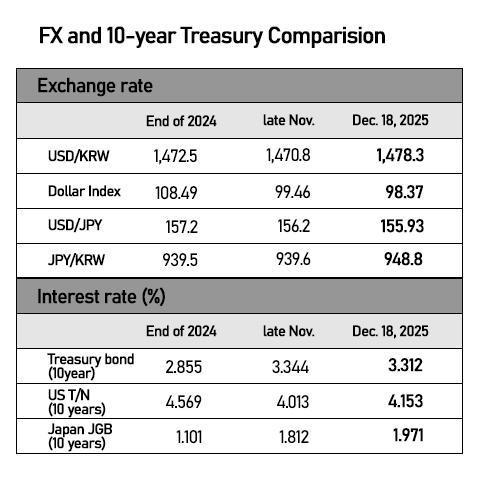

Korean markets price in Japan's rate hike to 30-year high, yen carry risk weighs SEOUL, December 19 (AJP) - Japan’s widely expected rate hike to 0.75 percent — the highest level in 30 years — delivered a mild upset to Korean markets, pressuring bond prices and the currency while lifting equities as investors positioned for a stronger yen environment. Although still low by global standards — compared with Korea’s 2.50 percent policy rate and the U.S. federal funds rate midpoint of about 3.6 percent — the Bank of Japan’s signal of further tightening to combat stubborn inflation near 3 percent marks a turning point for an economy long accustomed to deflation. For global investors, it also introduces an unfamiliar landscape in which Japanese yields are converging toward international levels. The benchmark 10-year Japanese government bond yield broke above 2.00 percent for the first time in 19 years following the decision. Korea’s 10-year government bond closed Friday at 3.342 percent, while the U.S. 10-year Treasury yielded 4.139 percent in early session. Equities advanced in Seoul, with the KOSPI ending Friday 0.65 percent up at 4,020.55 and the tech-heavy KOSDAQ gaining 1.55 percent to 915.27. The dollar rose 2.50 won to 1,479.00 won. “Given the sharp weakening of the yen, a December rate hike was widely expected, with BOJ officials openly discussing the possibility,” said Cho Yong-gu, an economist at Shinyoung Securities. Long positions in yen futures also reflected that market bet, and Korean bond and foreign-exchange markets were relieved that the period of uncertainty had ended, he added. Unlike the BOJ’s surprise first rate hike in August last year, Friday’s move — the second following a January increase — was largely anticipated. Still, Korean financial markets remain exposed to the potential unwinding of the yen carry trade, a strategy that quietly underpinned post-pandemic, liquidity-driven asset inflation. The trade involved borrowing in near-zero-cost yen to invest in higher-yielding assets abroad while Japan kept rates below or near zero even as other central banks tightened policy to curb inflation. That dynamic can reverse abruptly, with destabilizing consequences for emerging markets. According to Cho, the dollar is currently trading around 155 to 156 yen, and a move beyond 160 yen could trigger a rapid unwinding of carry trades — as seen in August last year when the dollar-yen pair briefly surged to 162. Korea, where the won has hovered near the 1,480-per-dollar level throughout December, is particularly sensitive to any sudden foreign capital outflows. The currency is already trading at levels associated with past crises. According to the Bank for International Settlements, Korea’s real effective exchange rate (REER) index fell to 87.05 at the end of November (2020=100), down 2.02 points from a month earlier. That marks the lowest level since April 2009, in the aftermath of the global financial crisis, and comes close to levels seen following the Asian financial crisis in November 1998. The REER measures a currency’s purchasing power against those of major trading partners. Korea ranked 63rd out of 64 countries in November, second only to Japan, whose REER stood at 69.4. The won has weakened steadily this year, slipping from the low-90s earlier in 2025 into the 80s by October. With the exchange rate lingering around the 1,480 range this month, analysts warn the REER could fall further. A weaker real exchange rate also raises the cost of essential imports such as wheat and gasoline, intensifying the burden on households. The Bank of Korea said the import price index rose 2.6 percent month on month in November, extending gains for a fifth consecutive month and marking the sharpest increase since April last year. Nor does currency weakness necessarily benefit exporters. The Korea Institute for Industrial Economics and Trade estimates that a 10 percent decline in the REER reduces large companies’ operating profit margins by 0.29 percentage points, reflecting Korea’s heavy reliance on imported raw materials and intermediate goods. As the won weakens, manufacturers must pay more dollars for inputs before re-exporting finished products. According to BOK on Friday, the producer price index rose 0.3 percent month on month and 1.9 percent year on year in November, with coal and fuel prices jumping 5 percent and memory chip prices rising in double digits, driven by higher import costs linked to the weak won. 2025-12-19 14:38:25

Korean markets price in Japan's rate hike to 30-year high, yen carry risk weighs SEOUL, December 19 (AJP) - Japan’s widely expected rate hike to 0.75 percent — the highest level in 30 years — delivered a mild upset to Korean markets, pressuring bond prices and the currency while lifting equities as investors positioned for a stronger yen environment. Although still low by global standards — compared with Korea’s 2.50 percent policy rate and the U.S. federal funds rate midpoint of about 3.6 percent — the Bank of Japan’s signal of further tightening to combat stubborn inflation near 3 percent marks a turning point for an economy long accustomed to deflation. For global investors, it also introduces an unfamiliar landscape in which Japanese yields are converging toward international levels. The benchmark 10-year Japanese government bond yield broke above 2.00 percent for the first time in 19 years following the decision. Korea’s 10-year government bond closed Friday at 3.342 percent, while the U.S. 10-year Treasury yielded 4.139 percent in early session. Equities advanced in Seoul, with the KOSPI ending Friday 0.65 percent up at 4,020.55 and the tech-heavy KOSDAQ gaining 1.55 percent to 915.27. The dollar rose 2.50 won to 1,479.00 won. “Given the sharp weakening of the yen, a December rate hike was widely expected, with BOJ officials openly discussing the possibility,” said Cho Yong-gu, an economist at Shinyoung Securities. Long positions in yen futures also reflected that market bet, and Korean bond and foreign-exchange markets were relieved that the period of uncertainty had ended, he added. Unlike the BOJ’s surprise first rate hike in August last year, Friday’s move — the second following a January increase — was largely anticipated. Still, Korean financial markets remain exposed to the potential unwinding of the yen carry trade, a strategy that quietly underpinned post-pandemic, liquidity-driven asset inflation. The trade involved borrowing in near-zero-cost yen to invest in higher-yielding assets abroad while Japan kept rates below or near zero even as other central banks tightened policy to curb inflation. That dynamic can reverse abruptly, with destabilizing consequences for emerging markets. According to Cho, the dollar is currently trading around 155 to 156 yen, and a move beyond 160 yen could trigger a rapid unwinding of carry trades — as seen in August last year when the dollar-yen pair briefly surged to 162. Korea, where the won has hovered near the 1,480-per-dollar level throughout December, is particularly sensitive to any sudden foreign capital outflows. The currency is already trading at levels associated with past crises. According to the Bank for International Settlements, Korea’s real effective exchange rate (REER) index fell to 87.05 at the end of November (2020=100), down 2.02 points from a month earlier. That marks the lowest level since April 2009, in the aftermath of the global financial crisis, and comes close to levels seen following the Asian financial crisis in November 1998. The REER measures a currency’s purchasing power against those of major trading partners. Korea ranked 63rd out of 64 countries in November, second only to Japan, whose REER stood at 69.4. The won has weakened steadily this year, slipping from the low-90s earlier in 2025 into the 80s by October. With the exchange rate lingering around the 1,480 range this month, analysts warn the REER could fall further. A weaker real exchange rate also raises the cost of essential imports such as wheat and gasoline, intensifying the burden on households. The Bank of Korea said the import price index rose 2.6 percent month on month in November, extending gains for a fifth consecutive month and marking the sharpest increase since April last year. Nor does currency weakness necessarily benefit exporters. The Korea Institute for Industrial Economics and Trade estimates that a 10 percent decline in the REER reduces large companies’ operating profit margins by 0.29 percentage points, reflecting Korea’s heavy reliance on imported raw materials and intermediate goods. As the won weakens, manufacturers must pay more dollars for inputs before re-exporting finished products. According to BOK on Friday, the producer price index rose 0.3 percent month on month and 1.9 percent year on year in November, with coal and fuel prices jumping 5 percent and memory chip prices rising in double digits, driven by higher import costs linked to the weak won. 2025-12-19 14:38:25 -

Asian markets in modest gains Friday ahead of BOJ rate decision SEOUL, December 19 (AJP) - Asian equity markets were moderately up early Friday as they await the rate decision from the Bank of Japan. In South Korea, the KOSPI was trading 0.4 percent up at 4,011 as of 10:30 a.m., retracing some of its earlier gains after rebounding 1 percent to track overnight Wall Street rise. Institutional investors led the buying with net purchases of 94 billion won, while retail investors added 33.8 billion won ($23 million). Conversely, foreign investors remained net sellers, offloading 117 billion won. The Korean won traded at 1,478.6 per dollar, down 2.1 won from the previous session. Concerns over potential volatility is looming in the morning session on the best on a rate hike in Japan. Leading stocks showed a marked divergence. Samsung Electronics fell 0.9 percent to 106,600 won amid concerns over increasing competition from Chinese DRAM producers. However, SK hynix gained 1.5 percent to 560,000 won, as its strategic focus on high-bandwidth memory (HBM) and cutting-edge chips continued to draw investor interest. The secondary battery sector remained under pressure. LG Energy Solution dropped 2.7 percent to 368,000 won, and Samsung SDI shed 1.8 percent to 272,000 won. SK Innovation, the parent of SK On, was also trading 1.35 percent lower at 103,400 won. The Hyundai Motor Group saw mixed results. Hyundai Motor and Kia fell 0.9 percent and 1.5 percent respectively, while Hyundai AutoEver, viewed as a key player in the group's transition to Software-Defined Vehicles (SDV), jumped 2.5 percent to 264,000 won. In the shipbuilding sector, Hanwha Ocean surged 4.7 percent to 108,500 won after announcing a 2.6 trillion won contract to build seven LNG carriers before the market open. The junior KOSDAQ was up 0.5 percent at 906. New listing Rznomics, an RNA-editing drug developer, hit its daily limit, trading at 117,000 won—a 30 percent jump from its IPO price. Satellite solution startup Nara Space Technology extended its rally, climbing 20.7 percent to 37,650 won in its second day of trading. In Tokyo, the Nikkei 225 rose 0.9 percent to 49,430, tracking overnight gains in the U.S. market. Toyota spearheaded the advance, gaining 1.8 percent to 3,425 yen ($22). Honda, however, remained flat at 1,544 yen due to ongoing supply chain issues and recall concerns in the U.S. Japanese semiconductor shares tracked their U.S. peers higher. Ibiden gained 3 percent, Tokyo Electron rose 2.8 percent, and Advantest was up 1.5 percent. Taiwan’s TAIEX advanced 1.3 percent to 27,820, with TSMC leading the charge, up 1.75 percent to 1,455 Taiwan dollars ($46.1). Mainland China markets remained largely flat as investors moved into a wait-and-watch mode ahead of the BOJ decision. The Shanghai Composite was little changed at 3,878, while the Hang Seng Index and Shenzhen Component edged up 0.2 percent and 0.3 percent respectively. 2025-12-19 11:18:04

Asian markets in modest gains Friday ahead of BOJ rate decision SEOUL, December 19 (AJP) - Asian equity markets were moderately up early Friday as they await the rate decision from the Bank of Japan. In South Korea, the KOSPI was trading 0.4 percent up at 4,011 as of 10:30 a.m., retracing some of its earlier gains after rebounding 1 percent to track overnight Wall Street rise. Institutional investors led the buying with net purchases of 94 billion won, while retail investors added 33.8 billion won ($23 million). Conversely, foreign investors remained net sellers, offloading 117 billion won. The Korean won traded at 1,478.6 per dollar, down 2.1 won from the previous session. Concerns over potential volatility is looming in the morning session on the best on a rate hike in Japan. Leading stocks showed a marked divergence. Samsung Electronics fell 0.9 percent to 106,600 won amid concerns over increasing competition from Chinese DRAM producers. However, SK hynix gained 1.5 percent to 560,000 won, as its strategic focus on high-bandwidth memory (HBM) and cutting-edge chips continued to draw investor interest. The secondary battery sector remained under pressure. LG Energy Solution dropped 2.7 percent to 368,000 won, and Samsung SDI shed 1.8 percent to 272,000 won. SK Innovation, the parent of SK On, was also trading 1.35 percent lower at 103,400 won. The Hyundai Motor Group saw mixed results. Hyundai Motor and Kia fell 0.9 percent and 1.5 percent respectively, while Hyundai AutoEver, viewed as a key player in the group's transition to Software-Defined Vehicles (SDV), jumped 2.5 percent to 264,000 won. In the shipbuilding sector, Hanwha Ocean surged 4.7 percent to 108,500 won after announcing a 2.6 trillion won contract to build seven LNG carriers before the market open. The junior KOSDAQ was up 0.5 percent at 906. New listing Rznomics, an RNA-editing drug developer, hit its daily limit, trading at 117,000 won—a 30 percent jump from its IPO price. Satellite solution startup Nara Space Technology extended its rally, climbing 20.7 percent to 37,650 won in its second day of trading. In Tokyo, the Nikkei 225 rose 0.9 percent to 49,430, tracking overnight gains in the U.S. market. Toyota spearheaded the advance, gaining 1.8 percent to 3,425 yen ($22). Honda, however, remained flat at 1,544 yen due to ongoing supply chain issues and recall concerns in the U.S. Japanese semiconductor shares tracked their U.S. peers higher. Ibiden gained 3 percent, Tokyo Electron rose 2.8 percent, and Advantest was up 1.5 percent. Taiwan’s TAIEX advanced 1.3 percent to 27,820, with TSMC leading the charge, up 1.75 percent to 1,455 Taiwan dollars ($46.1). Mainland China markets remained largely flat as investors moved into a wait-and-watch mode ahead of the BOJ decision. The Shanghai Composite was little changed at 3,878, while the Hang Seng Index and Shenzhen Component edged up 0.2 percent and 0.3 percent respectively. 2025-12-19 11:18:04 -

Korea's producer prices accelerate as fuel and chip cost jump SEOUL, December 19 (AJP) -South Korea’s producer prices accelerated in November despite easing international commodity prices, driven by a weaker won and a spike in semiconductor production costs. The producer price index (PPI) rose 0.3 percent from the previous month to 121.31 in November (2020 = 100), extending gains since September, the Bank of Korea said. From a year earlier, the index increased 1.9 percent, accelerating from a 1.6 percent rise in October. By category, prices of agricultural products fell 2.3 percent, while livestock products declined 2.6 percent, pulling the broader agriculture, forestry and fisheries group down 2.1 percent on the month. Lettuce prices plunged 42.7 percent, while beef prices fell 4.6 percent and pork prices dropped 4.1 percent. Prices of manufactured products climbed 0.8 percent from the previous month, led by coal and petroleum products, which jumped 5 percent — the largest increase since September 2023. Production prices for computers, electronic and optical equipment rose 2.3 percent, reflecting sharp increases in semiconductor costs. Prices of DRAM surged 15.5 percent on the month and 67.9 percent from a year earlier, while flash memory prices rose 23.4 percent on the month and 58.2 percent on the year. The increase reflects the broad impact of the won’s weakness on imported inputs and fuel costs, combined with rapid strengthening in memory prices amid tight supply conditions. The trend is expected to ripple through end products, including electronic devices and automobiles, both of which rely heavily on memory components. The domestic supply price index for November, which includes imports, rose 0.7 percent from the previous month. Intermediate goods prices climbed 1.1 percent and final goods rose 0.2 percent, offsetting a 0.5 percent decline in raw material prices. The total output price index for November, which includes exports as well as domestic shipments, increased 1.1 percent from the previous month, as manufactured products rose 1.9 percent and services edged up 0.1 percent. A weaker won against the U.S. dollar raises domestic production costs by making imported raw materials and intermediate goods more expensive, indirectly pushing up producer prices, the central bank said. The timing and extent of pass-through to producer prices can vary depending on business conditions, supply and demand, and government price-stabilization measures, it added. So far in December, Dubai crude prices have fallen 3.1 percent from the previous month, while the dollar-won exchange rate has risen 0.9 percent. In a separate report released Wednesday, the Bank of Korea warned that inflation could rise above this year’s estimated 2.1 percent level if the exchange rate remains near 1,500 won per dollar, given the two-to-four-week lag in the pass-through to consumer prices. It added the oversupply and soft international fuel prices will likely offset the inflationary pressure from the won's weakness. 2025-12-19 09:09:57

Korea's producer prices accelerate as fuel and chip cost jump SEOUL, December 19 (AJP) -South Korea’s producer prices accelerated in November despite easing international commodity prices, driven by a weaker won and a spike in semiconductor production costs. The producer price index (PPI) rose 0.3 percent from the previous month to 121.31 in November (2020 = 100), extending gains since September, the Bank of Korea said. From a year earlier, the index increased 1.9 percent, accelerating from a 1.6 percent rise in October. By category, prices of agricultural products fell 2.3 percent, while livestock products declined 2.6 percent, pulling the broader agriculture, forestry and fisheries group down 2.1 percent on the month. Lettuce prices plunged 42.7 percent, while beef prices fell 4.6 percent and pork prices dropped 4.1 percent. Prices of manufactured products climbed 0.8 percent from the previous month, led by coal and petroleum products, which jumped 5 percent — the largest increase since September 2023. Production prices for computers, electronic and optical equipment rose 2.3 percent, reflecting sharp increases in semiconductor costs. Prices of DRAM surged 15.5 percent on the month and 67.9 percent from a year earlier, while flash memory prices rose 23.4 percent on the month and 58.2 percent on the year. The increase reflects the broad impact of the won’s weakness on imported inputs and fuel costs, combined with rapid strengthening in memory prices amid tight supply conditions. The trend is expected to ripple through end products, including electronic devices and automobiles, both of which rely heavily on memory components. The domestic supply price index for November, which includes imports, rose 0.7 percent from the previous month. Intermediate goods prices climbed 1.1 percent and final goods rose 0.2 percent, offsetting a 0.5 percent decline in raw material prices. The total output price index for November, which includes exports as well as domestic shipments, increased 1.1 percent from the previous month, as manufactured products rose 1.9 percent and services edged up 0.1 percent. A weaker won against the U.S. dollar raises domestic production costs by making imported raw materials and intermediate goods more expensive, indirectly pushing up producer prices, the central bank said. The timing and extent of pass-through to producer prices can vary depending on business conditions, supply and demand, and government price-stabilization measures, it added. So far in December, Dubai crude prices have fallen 3.1 percent from the previous month, while the dollar-won exchange rate has risen 0.9 percent. In a separate report released Wednesday, the Bank of Korea warned that inflation could rise above this year’s estimated 2.1 percent level if the exchange rate remains near 1,500 won per dollar, given the two-to-four-week lag in the pass-through to consumer prices. It added the oversupply and soft international fuel prices will likely offset the inflationary pressure from the won's weakness. 2025-12-19 09:09:57 -

Hyundai Motor still at the starting line as Tesla races toward autonomous finish SEOUL, December 18 (AJP) - Tesla’s shares surged to a record high last Tuesday on CEO Elon Musk’s renewed push toward fully autonomous robotaxis — a breakthrough that drew cool look at Hyundai Motor’s lag in self-driving technology. Tesla has been testing its robotaxi service in Austin, Texas since early this year. What began as supervised trials has moved further, with Musk signaling over the weekend that vehicles are now operating without a driver in the seat, reinforcing investor confidence that Tesla is nearing true autonomy. The reaction in South Korea was notably different. Hyundai Motor shares slid 6 percent over the week to close Thursday at 282,500 won ($193.3), even as the benchmark KOSPI gained 1.4 percent on the day. Hyundai AutoEver, the group’s software and autonomous-driving arm, fell 3.37 percent to 272,500 won, extending losses after a sharp sell-off earlier in the week. Autonomous driving — or the perceived lack of progress in it — is increasingly cited by investors as a structural drag on Hyundai’s valuation. While Hyundai Motor shares have risen 33.6 percent this year, the gain is still less than half of the broader market’s advance. Hyundai’s autonomous-driving subsidiary 42dot has been testing self-driving buses in downtown Seoul, but the technology embedded in Hyundai and Kia production vehicles remains largely limited to basic driver-assistance functions such as acceleration, braking and lane-keeping. By global benchmarks, Hyundai has yet to reach the midpoint of the autonomy race. Tesla, by contrast, demonstrated a fully autonomous 296-mile drive from Seoul to Busan in November without human intervention, though the journey was supervised. General Motors has also showcased its “Super Cruise” system on new Cadillac electric vehicles, a technology often compared to Tesla’s Full Self-Driving. Both systems are generally classified as Level 2+ autonomy — legally requiring driver supervision but capable of lane changes, speed control and destination-based navigation. Hyundai has said it aims to deploy Level 3 autonomous driving technology, which handles all driving tasks until the system requests human intervention, by 2027. Leadership reshuffle adds uncertainty Confidence in that timeline has been dented by recent leadership changes. On December 3, Song Chang-hyun, founder and CEO of 42dot and head of Hyundai’s Advanced Vehicle Platform division, resigned. He was followed by Yang Hee-won, president overseeing research and development at both Hyundai and Kia. Yang’s role was filled by Manfred Harrer, a former Apple executive involved in the now-defunct Apple Car project. Following the reshuffle, Hyundai Motor Group Chairman Chung Euisun said the group would “prioritize stability over speed” in autonomous-driving development — a remark widely interpreted as an acknowledgment of setbacks in Hyundai’s transition toward software-defined vehicles. Strategic bet on LiDAR under pressure Beyond leadership churn, Hyundai faces a strategic dilemma rooted in its reliance on LiDAR technology, just as industry momentum pivots away from it. On December 16, U.S.-based LiDAR supplier Luminar Technologies filed for bankruptcy protection following contract cancellations and weakening demand, shortly after Tesla confirmed successful robotaxi tests using only cameras and satellite data. Industry consensus is increasingly shifting toward end-to-end deep learning models that emulate human decision-making rather than rule-based systems, paired with satellite-based data instead of costly LiDAR sensors. Chinese automakers are moving quickly in the same direction. Xpeng recently launched the P7+, the world’s second electric vehicle after Tesla to achieve autonomous driving using cameras alone. Geely affiliate Geespace plans to deploy 72 low-earth orbit satellites by year-end to support high-precision driving data collection. 42dot presses on, but questions linger Despite the shifting landscape, 42dot continues to project confidence. This week, it unveiled Ateria AI, a camera-based end-to-end autonomous-driving system. The announcement follows Hyundai Motor Group’s plan to build an AI factory equipped with 50,000 next-generation Nvidia Blackwell chips to accelerate so-called “Physical AI” initiatives across the group. Still, uncertainty surrounds 42dot’s standing within Hyundai. In Thursday's sweeping year-end reshuffle that replaced more than 200 executives, no successor was named for Song — a signal some analysts interpret as a possible downgrade in strategic priority. “The core reason Hyundai trades at a chronic discount is the fragmentation of its software capabilities across affiliates such as 42dot, Hyundai Mobis, Hyundai AutoEver and Boston Dynamics,” said Choi Tae-young, an analyst at DS Investment & Securities. Analysts argue Hyundai must replicate the model it used to centralize its hydrogen business under the HTWO brand and establish a single command structure for AI and autonomous driving. “Buying 50,000 GPUs or adopting Nvidia’s Drive platform is the easy part,” said Lee Hyun-wook, a researcher at IBK Securities. “The real challenge is empowering one lead entity to standardize data and fundamentally change how the organization works.” The pressure is also mounting on Motional, Hyundai’s joint venture with U.S.-based Aptiv, which has yet to deliver a commercial robotaxi despite aggressive talent recruitment from rivals such as Amazon-backed Zoox. 2025-12-18 17:00:17

Hyundai Motor still at the starting line as Tesla races toward autonomous finish SEOUL, December 18 (AJP) - Tesla’s shares surged to a record high last Tuesday on CEO Elon Musk’s renewed push toward fully autonomous robotaxis — a breakthrough that drew cool look at Hyundai Motor’s lag in self-driving technology. Tesla has been testing its robotaxi service in Austin, Texas since early this year. What began as supervised trials has moved further, with Musk signaling over the weekend that vehicles are now operating without a driver in the seat, reinforcing investor confidence that Tesla is nearing true autonomy. The reaction in South Korea was notably different. Hyundai Motor shares slid 6 percent over the week to close Thursday at 282,500 won ($193.3), even as the benchmark KOSPI gained 1.4 percent on the day. Hyundai AutoEver, the group’s software and autonomous-driving arm, fell 3.37 percent to 272,500 won, extending losses after a sharp sell-off earlier in the week. Autonomous driving — or the perceived lack of progress in it — is increasingly cited by investors as a structural drag on Hyundai’s valuation. While Hyundai Motor shares have risen 33.6 percent this year, the gain is still less than half of the broader market’s advance. Hyundai’s autonomous-driving subsidiary 42dot has been testing self-driving buses in downtown Seoul, but the technology embedded in Hyundai and Kia production vehicles remains largely limited to basic driver-assistance functions such as acceleration, braking and lane-keeping. By global benchmarks, Hyundai has yet to reach the midpoint of the autonomy race. Tesla, by contrast, demonstrated a fully autonomous 296-mile drive from Seoul to Busan in November without human intervention, though the journey was supervised. General Motors has also showcased its “Super Cruise” system on new Cadillac electric vehicles, a technology often compared to Tesla’s Full Self-Driving. Both systems are generally classified as Level 2+ autonomy — legally requiring driver supervision but capable of lane changes, speed control and destination-based navigation. Hyundai has said it aims to deploy Level 3 autonomous driving technology, which handles all driving tasks until the system requests human intervention, by 2027. Leadership reshuffle adds uncertainty Confidence in that timeline has been dented by recent leadership changes. On December 3, Song Chang-hyun, founder and CEO of 42dot and head of Hyundai’s Advanced Vehicle Platform division, resigned. He was followed by Yang Hee-won, president overseeing research and development at both Hyundai and Kia. Yang’s role was filled by Manfred Harrer, a former Apple executive involved in the now-defunct Apple Car project. Following the reshuffle, Hyundai Motor Group Chairman Chung Euisun said the group would “prioritize stability over speed” in autonomous-driving development — a remark widely interpreted as an acknowledgment of setbacks in Hyundai’s transition toward software-defined vehicles. Strategic bet on LiDAR under pressure Beyond leadership churn, Hyundai faces a strategic dilemma rooted in its reliance on LiDAR technology, just as industry momentum pivots away from it. On December 16, U.S.-based LiDAR supplier Luminar Technologies filed for bankruptcy protection following contract cancellations and weakening demand, shortly after Tesla confirmed successful robotaxi tests using only cameras and satellite data. Industry consensus is increasingly shifting toward end-to-end deep learning models that emulate human decision-making rather than rule-based systems, paired with satellite-based data instead of costly LiDAR sensors. Chinese automakers are moving quickly in the same direction. Xpeng recently launched the P7+, the world’s second electric vehicle after Tesla to achieve autonomous driving using cameras alone. Geely affiliate Geespace plans to deploy 72 low-earth orbit satellites by year-end to support high-precision driving data collection. 42dot presses on, but questions linger Despite the shifting landscape, 42dot continues to project confidence. This week, it unveiled Ateria AI, a camera-based end-to-end autonomous-driving system. The announcement follows Hyundai Motor Group’s plan to build an AI factory equipped with 50,000 next-generation Nvidia Blackwell chips to accelerate so-called “Physical AI” initiatives across the group. Still, uncertainty surrounds 42dot’s standing within Hyundai. In Thursday's sweeping year-end reshuffle that replaced more than 200 executives, no successor was named for Song — a signal some analysts interpret as a possible downgrade in strategic priority. “The core reason Hyundai trades at a chronic discount is the fragmentation of its software capabilities across affiliates such as 42dot, Hyundai Mobis, Hyundai AutoEver and Boston Dynamics,” said Choi Tae-young, an analyst at DS Investment & Securities. Analysts argue Hyundai must replicate the model it used to centralize its hydrogen business under the HTWO brand and establish a single command structure for AI and autonomous driving. “Buying 50,000 GPUs or adopting Nvidia’s Drive platform is the easy part,” said Lee Hyun-wook, a researcher at IBK Securities. “The real challenge is empowering one lead entity to standardize data and fundamentally change how the organization works.” The pressure is also mounting on Motional, Hyundai’s joint venture with U.S.-based Aptiv, which has yet to deliver a commercial robotaxi despite aggressive talent recruitment from rivals such as Amazon-backed Zoox. 2025-12-18 17:00:17