Journalist

AJP

-

ROK army special forces conduct winter survival training SEOUL, January 23 (AJP) - The ROK Army Special Warfare Command announced on Jan. 22 that it has been conducting winter survival training at training grounds in the Hwangbyeongsan area of Daegwallyeong, Gangwon Province, from January through February. The training runs for 11 nights and 12 days for each unit. 2026-01-23 16:06:02

ROK army special forces conduct winter survival training SEOUL, January 23 (AJP) - The ROK Army Special Warfare Command announced on Jan. 22 that it has been conducting winter survival training at training grounds in the Hwangbyeongsan area of Daegwallyeong, Gangwon Province, from January through February. The training runs for 11 nights and 12 days for each unit. 2026-01-23 16:06:02 -

Samsung Electro-Mechanics posts record revenue on AI, auto electronics demand SEOUL, January 23 (AJP) - South Korea's Samsung Electro-Mechanics said Friday growth in artificial intelligence and automotive electronics helped it post the highest annual revenue in its history last year. In a regulatory filing, the company reported consolidated revenue of 11.3 trillion won ($7.7 billion) and operating profit of 913.3 billion won. Revenue rose 10 percent from a year earlier to a record high, while operating profit climbed 24 percent. Fourth-quarter revenue increased 16 percent from a year earlier to 2.9 trillion won, while operating profit more than doubled, rising 108 percent to 239.5 billion won, the company said. Samsung Electro-Mechanics expects continued expansion in AI infrastructure investment and the autonomous driving market this year. A company official said the firm plans to strengthen competitiveness in high-value products, including AI and automotive electronics, while building a mid- to long-term growth base through new businesses such as glass substrates and components for humanoid robots. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 15:48:59

Samsung Electro-Mechanics posts record revenue on AI, auto electronics demand SEOUL, January 23 (AJP) - South Korea's Samsung Electro-Mechanics said Friday growth in artificial intelligence and automotive electronics helped it post the highest annual revenue in its history last year. In a regulatory filing, the company reported consolidated revenue of 11.3 trillion won ($7.7 billion) and operating profit of 913.3 billion won. Revenue rose 10 percent from a year earlier to a record high, while operating profit climbed 24 percent. Fourth-quarter revenue increased 16 percent from a year earlier to 2.9 trillion won, while operating profit more than doubled, rising 108 percent to 239.5 billion won, the company said. Samsung Electro-Mechanics expects continued expansion in AI infrastructure investment and the autonomous driving market this year. A company official said the firm plans to strengthen competitiveness in high-value products, including AI and automotive electronics, while building a mid- to long-term growth base through new businesses such as glass substrates and components for humanoid robots. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 15:48:59 -

Overseas stock buying drives record FX trading in South Korea in 2025 SEOUL, January 23 (AJP) - South Korean banks recorded a sharp rise in foreign exchange trading last year, with average daily volumes hitting a record high as overseas securities investment by residents surged and foreign investors stepped up purchases of South Korean assets. According to a Bank of Korea report released on Friday, average daily foreign exchange trading at domestic banks — including spot and derivatives transactions — totaled $80.71 billion in 2025, up 17 percent from $68.96 billion a year earlier. It marked the highest level since the data series was revised in 2008. The said the increase reflected the continued impact of extended foreign exchange trading hours, as well as a sharp rise in transactions linked to cross-border securities investment by both South Koreans and foreign investors. On a balance-of-payments basis, South Korean residents' overseas securities investment rose 79.2 percent year on year, from $72.2 billion in 2024 to $129.4 billion in the January–November period of last year. Over the same period, foreign investors’ purchases of South Korean securities jumped 129.1 percent, from $22 billion to $50.4 billion. By institution, foreign exchange trading by domestic banks increased 21.2 percent to an average of $37.54 billion per day, while trading by branches of foreign banks rose 13.6 percent to $43.17 billion. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 15:32:18

Overseas stock buying drives record FX trading in South Korea in 2025 SEOUL, January 23 (AJP) - South Korean banks recorded a sharp rise in foreign exchange trading last year, with average daily volumes hitting a record high as overseas securities investment by residents surged and foreign investors stepped up purchases of South Korean assets. According to a Bank of Korea report released on Friday, average daily foreign exchange trading at domestic banks — including spot and derivatives transactions — totaled $80.71 billion in 2025, up 17 percent from $68.96 billion a year earlier. It marked the highest level since the data series was revised in 2008. The said the increase reflected the continued impact of extended foreign exchange trading hours, as well as a sharp rise in transactions linked to cross-border securities investment by both South Koreans and foreign investors. On a balance-of-payments basis, South Korean residents' overseas securities investment rose 79.2 percent year on year, from $72.2 billion in 2024 to $129.4 billion in the January–November period of last year. Over the same period, foreign investors’ purchases of South Korean securities jumped 129.1 percent, from $22 billion to $50.4 billion. By institution, foreign exchange trading by domestic banks increased 21.2 percent to an average of $37.54 billion per day, while trading by branches of foreign banks rose 13.6 percent to $43.17 billion. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 15:32:18 -

German embassies in Seoul and Tokyo to host amateur League of Legends tournament SEOUL, January 23 (AJP) - The Embassy of Germany in Seoul and the Embassy of Germany in Tokyo have announced a joint esports tournament, ".DE (Diplomacy Meets Esports)," scheduled to culminate in Tokyo this March. The event will gather amateur League of Legends teams from South Korea, Japan, and Germany to compete in a tri-nation format intended to blend competitive gaming with cultural diplomacy. The initiative follows recent major esports events in the host nations, with South Korea hosting the League of Legends World Championship in 2023 and Germany hosting the event in 2024. While South Korea is established as a global powerhouse in the title, producing prominent professional players such as Faker and Showmaker, the tournament organizers noted that gaming infrastructure and player bases in Germany and Japan have seen significant professionalization and growth in recent years. The competition is open to selected amateur gamers. Online regional qualifiers are scheduled for February 7 in South Korea and February 11 in Japan. Registration for these qualifiers runs from January 15 to January 30, with the official rulebook set for release on January 21. An official Discord server will function as the central hub for tournament updates and coordination. The winning teams from the South Korean and Japanese qualifiers will advance to the offline final in Tokyo on March 1. They will be joined by a specially invited team from Germany. The Embassies stated that the project aims to recognize esports as a central component of modern youth culture and to facilitate exchange between digitally native audiences in the three countries. Winners of the regional qualifiers will receive support for travel and accommodation to attend the final in Tokyo. Participation requires parental consent for minors, defined as individuals under 19 in South Korea as of January 30, and under 18 in Japan. The offline final on March 1 will be broadcast live via YouTube and Twitch. 2026-01-23 15:12:57

German embassies in Seoul and Tokyo to host amateur League of Legends tournament SEOUL, January 23 (AJP) - The Embassy of Germany in Seoul and the Embassy of Germany in Tokyo have announced a joint esports tournament, ".DE (Diplomacy Meets Esports)," scheduled to culminate in Tokyo this March. The event will gather amateur League of Legends teams from South Korea, Japan, and Germany to compete in a tri-nation format intended to blend competitive gaming with cultural diplomacy. The initiative follows recent major esports events in the host nations, with South Korea hosting the League of Legends World Championship in 2023 and Germany hosting the event in 2024. While South Korea is established as a global powerhouse in the title, producing prominent professional players such as Faker and Showmaker, the tournament organizers noted that gaming infrastructure and player bases in Germany and Japan have seen significant professionalization and growth in recent years. The competition is open to selected amateur gamers. Online regional qualifiers are scheduled for February 7 in South Korea and February 11 in Japan. Registration for these qualifiers runs from January 15 to January 30, with the official rulebook set for release on January 21. An official Discord server will function as the central hub for tournament updates and coordination. The winning teams from the South Korean and Japanese qualifiers will advance to the offline final in Tokyo on March 1. They will be joined by a specially invited team from Germany. The Embassies stated that the project aims to recognize esports as a central component of modern youth culture and to facilitate exchange between digitally native audiences in the three countries. Winners of the regional qualifiers will receive support for travel and accommodation to attend the final in Tokyo. Participation requires parental consent for minors, defined as individuals under 19 in South Korea as of January 30, and under 18 in Japan. The offline final on March 1 will be broadcast live via YouTube and Twitch. 2026-01-23 15:12:57 -

PM tells US lawmakers Coupang probe 'not discriminatory' SEOUL, January 23 (AJP) - Prime Minister Kim Min-seok, who is currently in Washington, D.C., told U.S. lawmakers that South Korea is not discriminating against e-commerce giant Coupang in its investigation into a massive data leak late last year. His remarks came on Thursday as Kim began his five-day trip to the U.S., starting with a luncheon meeting with several U.S. House members including Young Kim, Ami Bera, Dave Min, Joe Wilson, John Moolenaar, Marilyn Strickland, Michael Baumgartner, Ryan Mackenzie and Young Kim. When asked whether the South Korean government is on a "politically motivated witch hunt" against Coupang in its investigation into the data breach, an issue raised by two U.S. investors, Kim denied any such "discrimination" against the company, adding that he believes that the country's relationship with the U.S. has been built on "sufficient trust" not to worry about such issues. Kim was also quoted as saying, "South Korea does not think immigration raid involving South Korean workers in Georgia was a discrimination case resulting from the fact they were South Korean." He added, "Likewise, no discriminatory actions were taken against Coupang simply because it is a U.S.-listed company." In the meeting, Kim also expressed hope that his visit would "accelerate" the implementation of follow-up measures in tariff-related agreements between the two countries, urging the U.S. lawmakers to continue playing an important role in strengthening the bilateral alliance. Their discussions also included a bill, led by Rep. Young Kim, that would allow up to 15,000 professional work visas for South Koreans and is currently pending in the House. After wrapping up the meeting, Kim visited the Korean War Veterans Memorial to lay flowers later in the day and attended an event to meet with young people and talk about Korean culture. 2026-01-23 14:51:22

PM tells US lawmakers Coupang probe 'not discriminatory' SEOUL, January 23 (AJP) - Prime Minister Kim Min-seok, who is currently in Washington, D.C., told U.S. lawmakers that South Korea is not discriminating against e-commerce giant Coupang in its investigation into a massive data leak late last year. His remarks came on Thursday as Kim began his five-day trip to the U.S., starting with a luncheon meeting with several U.S. House members including Young Kim, Ami Bera, Dave Min, Joe Wilson, John Moolenaar, Marilyn Strickland, Michael Baumgartner, Ryan Mackenzie and Young Kim. When asked whether the South Korean government is on a "politically motivated witch hunt" against Coupang in its investigation into the data breach, an issue raised by two U.S. investors, Kim denied any such "discrimination" against the company, adding that he believes that the country's relationship with the U.S. has been built on "sufficient trust" not to worry about such issues. Kim was also quoted as saying, "South Korea does not think immigration raid involving South Korean workers in Georgia was a discrimination case resulting from the fact they were South Korean." He added, "Likewise, no discriminatory actions were taken against Coupang simply because it is a U.S.-listed company." In the meeting, Kim also expressed hope that his visit would "accelerate" the implementation of follow-up measures in tariff-related agreements between the two countries, urging the U.S. lawmakers to continue playing an important role in strengthening the bilateral alliance. Their discussions also included a bill, led by Rep. Young Kim, that would allow up to 15,000 professional work visas for South Koreans and is currently pending in the House. After wrapping up the meeting, Kim visited the Korean War Veterans Memorial to lay flowers later in the day and attended an event to meet with young people and talk about Korean culture. 2026-01-23 14:51:22 -

Lotte Card raises $300 million overseas via asset-backed securities SEOUL, January 23 (AJP) - South Korea’s Lotte Card said on Friday it has secured about 4.42 trillion won ($300 million) in overseas funding through the issuance of asset-backed securities. The credit card company, part of the Lotte Group conglomerate, said the funding was raised by issuing asset-backed securities (ABS) backed by credit card sales receivables. Societe Generale participated as an investor, and the securities have an average maturity of three years. Lotte Card said the issuance was structured as a social bond, with all proceeds to be used to provide financial services to low-income customers. Since 2021, the company has raised a cumulative 23.1 trillion won in overseas funding through five rounds of issuance, it added. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 14:26:25

Lotte Card raises $300 million overseas via asset-backed securities SEOUL, January 23 (AJP) - South Korea’s Lotte Card said on Friday it has secured about 4.42 trillion won ($300 million) in overseas funding through the issuance of asset-backed securities. The credit card company, part of the Lotte Group conglomerate, said the funding was raised by issuing asset-backed securities (ABS) backed by credit card sales receivables. Societe Generale participated as an investor, and the securities have an average maturity of three years. Lotte Card said the issuance was structured as a social bond, with all proceeds to be used to provide financial services to low-income customers. Since 2021, the company has raised a cumulative 23.1 trillion won in overseas funding through five rounds of issuance, it added. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 14:26:25 -

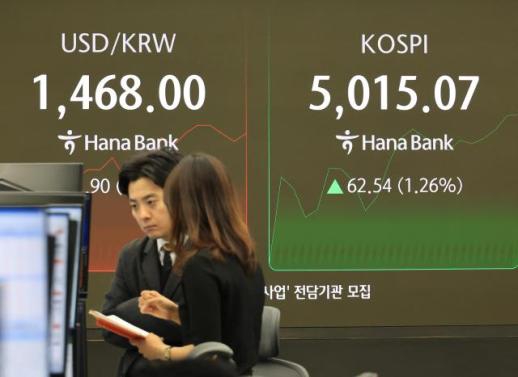

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48 -

Homeplus confirms closures of additional stores amid liquidity strain SEOUL, January 23 (AJP) - South Korea’s retail chain Homeplus has confirmed the closure of additional stores as the company undergoes court-led rehabilitation, raising fresh concerns about its financial condition. Industry sources said on Friday that Homeplus informed staff in an internal notice the previous day of plans to shut its Jamsil store in Seoul and its Sungui store in Incheon. A Homeplus official said the timing of the closures has yet to be set, adding that both outlets are leased locations affected by lease expirations and ongoing operating losses. Homeplus has said its cash flow has continued to deteriorate since entering rehabilitation proceedings. In August last year, the company announced plans to close 15 loss-making leased stores after failing to secure rent reductions, though it later suspended the move on the condition that transaction terms would be eased. The latest closures add to a growing list of store shutdowns. Homeplus recently said it would halt operations at seven locations around the country. In December, it closed five stores. A further five stores are also scheduled to close on Jan. 31. Under a rehabilitation plan submitted to the court, Homeplus plans to shut 41 loss-making stores over the next six years. Concerns among employees have also grown after wages for January were not paid due to the company’s cash shortage. Homeplus has applied for an emergency debtor-in-possession loan of 300 billion won ($205 million), with 100 billion won each expected from private equity owner MBK Partners, its largest creditor Meritz, and state-run Korea Development Bank. MBK has indicated it will participate in the financing, but it remains unclear whether the remaining funds will be secured. “If the emergency operating loan is provided, we will use it as a catalyst for rehabilitation to overcome the liquidity crisis and carry out our structural reform plan without disruption to improve business viability,” Homeplus said in a statement. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 13:57:42

Homeplus confirms closures of additional stores amid liquidity strain SEOUL, January 23 (AJP) - South Korea’s retail chain Homeplus has confirmed the closure of additional stores as the company undergoes court-led rehabilitation, raising fresh concerns about its financial condition. Industry sources said on Friday that Homeplus informed staff in an internal notice the previous day of plans to shut its Jamsil store in Seoul and its Sungui store in Incheon. A Homeplus official said the timing of the closures has yet to be set, adding that both outlets are leased locations affected by lease expirations and ongoing operating losses. Homeplus has said its cash flow has continued to deteriorate since entering rehabilitation proceedings. In August last year, the company announced plans to close 15 loss-making leased stores after failing to secure rent reductions, though it later suspended the move on the condition that transaction terms would be eased. The latest closures add to a growing list of store shutdowns. Homeplus recently said it would halt operations at seven locations around the country. In December, it closed five stores. A further five stores are also scheduled to close on Jan. 31. Under a rehabilitation plan submitted to the court, Homeplus plans to shut 41 loss-making stores over the next six years. Concerns among employees have also grown after wages for January were not paid due to the company’s cash shortage. Homeplus has applied for an emergency debtor-in-possession loan of 300 billion won ($205 million), with 100 billion won each expected from private equity owner MBK Partners, its largest creditor Meritz, and state-run Korea Development Bank. MBK has indicated it will participate in the financing, but it remains unclear whether the remaining funds will be secured. “If the emergency operating loan is provided, we will use it as a catalyst for rehabilitation to overcome the liquidity crisis and carry out our structural reform plan without disruption to improve business viability,” Homeplus said in a statement. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 13:57:42 -

Over 70 South Koreans sent home after online scam crackdown in Cambodia SEOUL, January 23 (AJP) - Some 73 South Koreans detained in Cambodia over alleged involvement in online scams and other crimes were forcibly returned home from the Southeast Asian country on Friday. A chartered Korean Air flight carrying them arrived at Incheon International Airport at around 9:40 a.m., after departing Phnom Penh the previous day. The suspects are set to face investigations here. They are accused of swindling a total of 486.7 billion won (US$331.5 million) from 869 South Korean victims and were nabbed by South Korea's task force in collaboration with Cambodian authorities, after the brutal torture and killing of a South Korean college student in Cambodia was belatedly reveled last summer. Investigators reportedly targeted several organized scam rings to arrest a score of suspects, including a couple who used deepfake technology to swindle about 12 billion won from 104 South Koreans and tried to evade arrest by altering their appearance through plastic surgery. 2026-01-23 13:41:37

Over 70 South Koreans sent home after online scam crackdown in Cambodia SEOUL, January 23 (AJP) - Some 73 South Koreans detained in Cambodia over alleged involvement in online scams and other crimes were forcibly returned home from the Southeast Asian country on Friday. A chartered Korean Air flight carrying them arrived at Incheon International Airport at around 9:40 a.m., after departing Phnom Penh the previous day. The suspects are set to face investigations here. They are accused of swindling a total of 486.7 billion won (US$331.5 million) from 869 South Korean victims and were nabbed by South Korea's task force in collaboration with Cambodian authorities, after the brutal torture and killing of a South Korean college student in Cambodia was belatedly reveled last summer. Investigators reportedly targeted several organized scam rings to arrest a score of suspects, including a couple who used deepfake technology to swindle about 12 billion won from 104 South Koreans and tried to evade arrest by altering their appearance through plastic surgery. 2026-01-23 13:41:37 -

Doosan Bobcat walks away from bid to acquire Germany's Wacker Neuson SEOUL, January 23 (AJP) -Doosan Bobcat is walking away from around $3 billion acquisition talks with German construction equipment maker Wacker Neuson SE, formally ending negotiations that would have marked one of the South Korean company’s largest overseas deals. In a regulatory filing on Friday, the KOSPI-trading Doosan Bobcat said it had reviewed the potential acquisition but decided not to proceed, without disclosing further details. Shares were up 1.3 percent at 60,800 won as of 1:00 p.m. in Seoul. “After reviewing the acquisition of Wacker Neuson, we have decided not to move forward,” the company said. Wacker Neuson separately confirmed that discussions would not continue. In a disclosure released late Thursday under the European Union’s Market Abuse Regulation, the Munich-based company said talks with Doosan Bobcat regarding the acquisition of a majority stake and a possible public takeover offer had been terminated. “The Wacker Neuson Group remains focused on executing its Strategy 2030, pursuing sustainable growth,” the company said. The decision brings to a close roughly a year of negotiations between the two compact construction equipment makers. Wacker Neuson last month said it was in “advanced discussions” with Doosan Bobcat over the sale of about 63 percent of its shares by major shareholders, followed by an all-cash public takeover offer for remaining shares. Investment banking sources said the deal fell through largely over valuation, with the proposed purchase price seen as too high amid a global slowdown in construction equipment demand. Analysts had estimated the total transaction value at more than 5 trillion won ($3.4 billion), which would have made it Doosan Bobcat’s largest acquisition since it bought the Bobcat brand in 2007. Wacker Neuson is the market leader in Europe’s compact construction equipment segment, while Doosan Bobcat dominates North America. The acquisition had been widely viewed as a strategic move to accelerate Doosan Bobcat’s expansion in Europe and diversify its geographic revenue base. Both companies have been facing softer market conditions. Doosan Bobcat reported declining sales in both North America and Europe in 2025, while Wacker Neuson has also posted revenue declines across its major regions, reflecting high borrowing costs and weaker construction activity. Doosan Bobcat said it would continue to explore strategic opportunities to strengthen its global presence, but stressed that any move would be guided by financial discipline. 2026-01-23 13:04:38

Doosan Bobcat walks away from bid to acquire Germany's Wacker Neuson SEOUL, January 23 (AJP) -Doosan Bobcat is walking away from around $3 billion acquisition talks with German construction equipment maker Wacker Neuson SE, formally ending negotiations that would have marked one of the South Korean company’s largest overseas deals. In a regulatory filing on Friday, the KOSPI-trading Doosan Bobcat said it had reviewed the potential acquisition but decided not to proceed, without disclosing further details. Shares were up 1.3 percent at 60,800 won as of 1:00 p.m. in Seoul. “After reviewing the acquisition of Wacker Neuson, we have decided not to move forward,” the company said. Wacker Neuson separately confirmed that discussions would not continue. In a disclosure released late Thursday under the European Union’s Market Abuse Regulation, the Munich-based company said talks with Doosan Bobcat regarding the acquisition of a majority stake and a possible public takeover offer had been terminated. “The Wacker Neuson Group remains focused on executing its Strategy 2030, pursuing sustainable growth,” the company said. The decision brings to a close roughly a year of negotiations between the two compact construction equipment makers. Wacker Neuson last month said it was in “advanced discussions” with Doosan Bobcat over the sale of about 63 percent of its shares by major shareholders, followed by an all-cash public takeover offer for remaining shares. Investment banking sources said the deal fell through largely over valuation, with the proposed purchase price seen as too high amid a global slowdown in construction equipment demand. Analysts had estimated the total transaction value at more than 5 trillion won ($3.4 billion), which would have made it Doosan Bobcat’s largest acquisition since it bought the Bobcat brand in 2007. Wacker Neuson is the market leader in Europe’s compact construction equipment segment, while Doosan Bobcat dominates North America. The acquisition had been widely viewed as a strategic move to accelerate Doosan Bobcat’s expansion in Europe and diversify its geographic revenue base. Both companies have been facing softer market conditions. Doosan Bobcat reported declining sales in both North America and Europe in 2025, while Wacker Neuson has also posted revenue declines across its major regions, reflecting high borrowing costs and weaker construction activity. Doosan Bobcat said it would continue to explore strategic opportunities to strengthen its global presence, but stressed that any move would be guided by financial discipline. 2026-01-23 13:04:38