Journalist

AJP

-

Lotte Card raises $300 million overseas via asset-backed securities SEOUL, January 23 (AJP) - South Korea’s Lotte Card said on Friday it has secured about 4.42 trillion won ($300 million) in overseas funding through the issuance of asset-backed securities. The credit card company, part of the Lotte Group conglomerate, said the funding was raised by issuing asset-backed securities (ABS) backed by credit card sales receivables. Societe Generale participated as an investor, and the securities have an average maturity of three years. Lotte Card said the issuance was structured as a social bond, with all proceeds to be used to provide financial services to low-income customers. Since 2021, the company has raised a cumulative 23.1 trillion won in overseas funding through five rounds of issuance, it added. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 14:26:25

Lotte Card raises $300 million overseas via asset-backed securities SEOUL, January 23 (AJP) - South Korea’s Lotte Card said on Friday it has secured about 4.42 trillion won ($300 million) in overseas funding through the issuance of asset-backed securities. The credit card company, part of the Lotte Group conglomerate, said the funding was raised by issuing asset-backed securities (ABS) backed by credit card sales receivables. Societe Generale participated as an investor, and the securities have an average maturity of three years. Lotte Card said the issuance was structured as a social bond, with all proceeds to be used to provide financial services to low-income customers. Since 2021, the company has raised a cumulative 23.1 trillion won in overseas funding through five rounds of issuance, it added. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 14:26:25 -

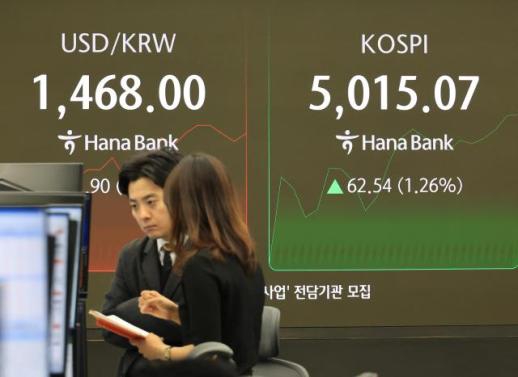

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48

FX looms as Korea's top financial risk: BOK survey SEOUL, Jan 23 (AJP) - The Korean won has stabilized and edged higher against the U.S. dollar following explicit verbal intervention by authorities, but foreign exchange volatility remains the biggest financial risk facing South Korea, according to a new Bank of Korea (BOK) survey. Nearly seven in 10 financial experts flagged the exchange rate as a key source of risk, underscoring persistent unease despite recent market calm. According to the BOK survey of 75 professionals from international investment banks, research institutes and academia released Friday, 66.7 percent cited foreign exchange fluctuations as one of the top five risks to the economy, while 26.7 percent identified it as the single most significant threat. The won’s prolonged weakness against the dollar — still hovering near levels seen during past crisis periods — has overtaken household debt, a longstanding concern, which was cited by 16 percent of respondents in the latest survey. Other major risk factors included elevated housing prices in the Seoul metropolitan area and sluggish domestic economic growth. Despite the heightened focus on the exchange rate, economists did not see an imminent financial crisis. The perceived probability of a financial shock occurring within one year declined to 12.0 percent last year from 15.4 percent in 2024. Medium-term risk perceptions also eased, with the estimated probability over a one- to three-year horizon falling sharply from 34.6 percent to 24.0 percent. Confidence in the resilience of Korea’s financial system showed a corresponding improvement. The share of respondents rating their confidence as “high” or above rose to 54.7 percent last year, up from 50.0 percent in 2024. “Respondents called for enhanced risk management against both domestic and external uncertainties, alongside stronger policy credibility and predictability,” the BOK said in a statement. To bolster financial stability, experts urged authorities to stabilize foreign exchange and asset markets through closer monitoring and “clear and transparent communication.” The report also emphasized the need for a consistent policy mix to manage household debt and institutional efforts to address structural vulnerabilities across borrower segments, including the “orderly restructuring” of marginal firms. The BOK said it plans to use the survey results to guide its analysis and monitoring of financial system vulnerabilities throughout the year. As of 2 p.m. Friday, the won was trading at 1,468.10 per dollar, down 3.1 won from the previous session. 2026-01-23 13:58:48 -

Homeplus confirms closures of additional stores amid liquidity strain SEOUL, January 23 (AJP) - South Korea’s retail chain Homeplus has confirmed the closure of additional stores as the company undergoes court-led rehabilitation, raising fresh concerns about its financial condition. Industry sources said on Friday that Homeplus informed staff in an internal notice the previous day of plans to shut its Jamsil store in Seoul and its Sungui store in Incheon. A Homeplus official said the timing of the closures has yet to be set, adding that both outlets are leased locations affected by lease expirations and ongoing operating losses. Homeplus has said its cash flow has continued to deteriorate since entering rehabilitation proceedings. In August last year, the company announced plans to close 15 loss-making leased stores after failing to secure rent reductions, though it later suspended the move on the condition that transaction terms would be eased. The latest closures add to a growing list of store shutdowns. Homeplus recently said it would halt operations at seven locations around the country. In December, it closed five stores. A further five stores are also scheduled to close on Jan. 31. Under a rehabilitation plan submitted to the court, Homeplus plans to shut 41 loss-making stores over the next six years. Concerns among employees have also grown after wages for January were not paid due to the company’s cash shortage. Homeplus has applied for an emergency debtor-in-possession loan of 300 billion won ($205 million), with 100 billion won each expected from private equity owner MBK Partners, its largest creditor Meritz, and state-run Korea Development Bank. MBK has indicated it will participate in the financing, but it remains unclear whether the remaining funds will be secured. “If the emergency operating loan is provided, we will use it as a catalyst for rehabilitation to overcome the liquidity crisis and carry out our structural reform plan without disruption to improve business viability,” Homeplus said in a statement. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 13:57:42

Homeplus confirms closures of additional stores amid liquidity strain SEOUL, January 23 (AJP) - South Korea’s retail chain Homeplus has confirmed the closure of additional stores as the company undergoes court-led rehabilitation, raising fresh concerns about its financial condition. Industry sources said on Friday that Homeplus informed staff in an internal notice the previous day of plans to shut its Jamsil store in Seoul and its Sungui store in Incheon. A Homeplus official said the timing of the closures has yet to be set, adding that both outlets are leased locations affected by lease expirations and ongoing operating losses. Homeplus has said its cash flow has continued to deteriorate since entering rehabilitation proceedings. In August last year, the company announced plans to close 15 loss-making leased stores after failing to secure rent reductions, though it later suspended the move on the condition that transaction terms would be eased. The latest closures add to a growing list of store shutdowns. Homeplus recently said it would halt operations at seven locations around the country. In December, it closed five stores. A further five stores are also scheduled to close on Jan. 31. Under a rehabilitation plan submitted to the court, Homeplus plans to shut 41 loss-making stores over the next six years. Concerns among employees have also grown after wages for January were not paid due to the company’s cash shortage. Homeplus has applied for an emergency debtor-in-possession loan of 300 billion won ($205 million), with 100 billion won each expected from private equity owner MBK Partners, its largest creditor Meritz, and state-run Korea Development Bank. MBK has indicated it will participate in the financing, but it remains unclear whether the remaining funds will be secured. “If the emergency operating loan is provided, we will use it as a catalyst for rehabilitation to overcome the liquidity crisis and carry out our structural reform plan without disruption to improve business viability,” Homeplus said in a statement. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-23 13:57:42 -

Over 70 South Koreans sent home after online scam crackdown in Cambodia SEOUL, January 23 (AJP) - Some 73 South Koreans detained in Cambodia over alleged involvement in online scams and other crimes were forcibly returned home from the Southeast Asian country on Friday. A chartered Korean Air flight carrying them arrived at Incheon International Airport at around 9:40 a.m., after departing Phnom Penh the previous day. The suspects are set to face investigations here. They are accused of swindling a total of 486.7 billion won (US$331.5 million) from 869 South Korean victims and were nabbed by South Korea's task force in collaboration with Cambodian authorities, after the brutal torture and killing of a South Korean college student in Cambodia was belatedly reveled last summer. Investigators reportedly targeted several organized scam rings to arrest a score of suspects, including a couple who used deepfake technology to swindle about 12 billion won from 104 South Koreans and tried to evade arrest by altering their appearance through plastic surgery. 2026-01-23 13:41:37

Over 70 South Koreans sent home after online scam crackdown in Cambodia SEOUL, January 23 (AJP) - Some 73 South Koreans detained in Cambodia over alleged involvement in online scams and other crimes were forcibly returned home from the Southeast Asian country on Friday. A chartered Korean Air flight carrying them arrived at Incheon International Airport at around 9:40 a.m., after departing Phnom Penh the previous day. The suspects are set to face investigations here. They are accused of swindling a total of 486.7 billion won (US$331.5 million) from 869 South Korean victims and were nabbed by South Korea's task force in collaboration with Cambodian authorities, after the brutal torture and killing of a South Korean college student in Cambodia was belatedly reveled last summer. Investigators reportedly targeted several organized scam rings to arrest a score of suspects, including a couple who used deepfake technology to swindle about 12 billion won from 104 South Koreans and tried to evade arrest by altering their appearance through plastic surgery. 2026-01-23 13:41:37 -

Doosan Bobcat walks away from bid to acquire Germany's Wacker Neuson SEOUL, January 23 (AJP) -Doosan Bobcat is walking away from around $3 billion acquisition talks with German construction equipment maker Wacker Neuson SE, formally ending negotiations that would have marked one of the South Korean company’s largest overseas deals. In a regulatory filing on Friday, the KOSPI-trading Doosan Bobcat said it had reviewed the potential acquisition but decided not to proceed, without disclosing further details. Shares were up 1.3 percent at 60,800 won as of 1:00 p.m. in Seoul. “After reviewing the acquisition of Wacker Neuson, we have decided not to move forward,” the company said. Wacker Neuson separately confirmed that discussions would not continue. In a disclosure released late Thursday under the European Union’s Market Abuse Regulation, the Munich-based company said talks with Doosan Bobcat regarding the acquisition of a majority stake and a possible public takeover offer had been terminated. “The Wacker Neuson Group remains focused on executing its Strategy 2030, pursuing sustainable growth,” the company said. The decision brings to a close roughly a year of negotiations between the two compact construction equipment makers. Wacker Neuson last month said it was in “advanced discussions” with Doosan Bobcat over the sale of about 63 percent of its shares by major shareholders, followed by an all-cash public takeover offer for remaining shares. Investment banking sources said the deal fell through largely over valuation, with the proposed purchase price seen as too high amid a global slowdown in construction equipment demand. Analysts had estimated the total transaction value at more than 5 trillion won ($3.4 billion), which would have made it Doosan Bobcat’s largest acquisition since it bought the Bobcat brand in 2007. Wacker Neuson is the market leader in Europe’s compact construction equipment segment, while Doosan Bobcat dominates North America. The acquisition had been widely viewed as a strategic move to accelerate Doosan Bobcat’s expansion in Europe and diversify its geographic revenue base. Both companies have been facing softer market conditions. Doosan Bobcat reported declining sales in both North America and Europe in 2025, while Wacker Neuson has also posted revenue declines across its major regions, reflecting high borrowing costs and weaker construction activity. Doosan Bobcat said it would continue to explore strategic opportunities to strengthen its global presence, but stressed that any move would be guided by financial discipline. 2026-01-23 13:04:38

Doosan Bobcat walks away from bid to acquire Germany's Wacker Neuson SEOUL, January 23 (AJP) -Doosan Bobcat is walking away from around $3 billion acquisition talks with German construction equipment maker Wacker Neuson SE, formally ending negotiations that would have marked one of the South Korean company’s largest overseas deals. In a regulatory filing on Friday, the KOSPI-trading Doosan Bobcat said it had reviewed the potential acquisition but decided not to proceed, without disclosing further details. Shares were up 1.3 percent at 60,800 won as of 1:00 p.m. in Seoul. “After reviewing the acquisition of Wacker Neuson, we have decided not to move forward,” the company said. Wacker Neuson separately confirmed that discussions would not continue. In a disclosure released late Thursday under the European Union’s Market Abuse Regulation, the Munich-based company said talks with Doosan Bobcat regarding the acquisition of a majority stake and a possible public takeover offer had been terminated. “The Wacker Neuson Group remains focused on executing its Strategy 2030, pursuing sustainable growth,” the company said. The decision brings to a close roughly a year of negotiations between the two compact construction equipment makers. Wacker Neuson last month said it was in “advanced discussions” with Doosan Bobcat over the sale of about 63 percent of its shares by major shareholders, followed by an all-cash public takeover offer for remaining shares. Investment banking sources said the deal fell through largely over valuation, with the proposed purchase price seen as too high amid a global slowdown in construction equipment demand. Analysts had estimated the total transaction value at more than 5 trillion won ($3.4 billion), which would have made it Doosan Bobcat’s largest acquisition since it bought the Bobcat brand in 2007. Wacker Neuson is the market leader in Europe’s compact construction equipment segment, while Doosan Bobcat dominates North America. The acquisition had been widely viewed as a strategic move to accelerate Doosan Bobcat’s expansion in Europe and diversify its geographic revenue base. Both companies have been facing softer market conditions. Doosan Bobcat reported declining sales in both North America and Europe in 2025, while Wacker Neuson has also posted revenue declines across its major regions, reflecting high borrowing costs and weaker construction activity. Doosan Bobcat said it would continue to explore strategic opportunities to strengthen its global presence, but stressed that any move would be guided by financial discipline. 2026-01-23 13:04:38 -

BTS' Jin thanks fans after receiving Golden Disc upbit popularity award SEOUL, January 23 (AJP) - BTS member Jin thanked fans on Thursday after receiving his plaque for the "Upbit Male Popularity Award" at the 40th Golden Disc Awards, sharing a message on Weverse, a global superfan platform operated by HYBE that enables direct communication between artists and fans. “The precious award that ARMY gave us. It’s been delivered to me now. Thank you. I’ll cherish it,” Jin wrote, expressing appreciation for his fan's support. The Golden Disc Awards select winners based primarily on annual album sales and digital streaming performance, combined with evaluations by industry experts. Jin has continued to receive strong listener response with “Don’t Say You Love Me,” the title track of his second mini album Echo, as well as “Running Wild,” “I’ll Be There,” and “Super Tuna.” Meanwhile, BTS announced on Weverse that the group will return on March 20 with its fifth full-length album ARIRANG, a 14-track release that reflects the group’s Korean roots and shared emotional identity. 2026-01-23 11:14:35

BTS' Jin thanks fans after receiving Golden Disc upbit popularity award SEOUL, January 23 (AJP) - BTS member Jin thanked fans on Thursday after receiving his plaque for the "Upbit Male Popularity Award" at the 40th Golden Disc Awards, sharing a message on Weverse, a global superfan platform operated by HYBE that enables direct communication between artists and fans. “The precious award that ARMY gave us. It’s been delivered to me now. Thank you. I’ll cherish it,” Jin wrote, expressing appreciation for his fan's support. The Golden Disc Awards select winners based primarily on annual album sales and digital streaming performance, combined with evaluations by industry experts. Jin has continued to receive strong listener response with “Don’t Say You Love Me,” the title track of his second mini album Echo, as well as “Running Wild,” “I’ll Be There,” and “Super Tuna.” Meanwhile, BTS announced on Weverse that the group will return on March 20 with its fifth full-length album ARIRANG, a 14-track release that reflects the group’s Korean roots and shared emotional identity. 2026-01-23 11:14:35 -

Kookmin University launches international design award emphasizing educator-student collaboration SEOUL, January 23 (AJP) - Kookmin University announced the launch of the "DBEW AWARD 2026," an international design competition organized in partnership with the Association for Industrial Design (ADI). The award aims to highlight the educational process and collaboration between students and instructors rather than focusing solely on finished design products. The award distinguishes itself from traditional design competitions by evaluating the mentorship and cooperative efforts that lead to creative outcomes. It is the first global design award to explicitly assess and recognize the leadership and mentoring capabilities of educators alongside student work. The initiative seeks to establish a new standard in design education by fostering convergence across technology, humanities, and design. "In the era of artificial intelligence, the role of education in fostering human thinking and collaboration becomes increasingly important," said Jeong Seung-ryul, president of Kookmin University. "We hope the DBEW AWARD will establish itself as a global platform where design educators and students from around the world can design the future together." The competition is open to undergraduate and graduate students, as well as new designers who have graduated within the last two years. Participants must form a team consisting of a student (or students) and an educator acting as a mentor. Submitted works must have been created within the past two years. Categories include Space and Architectural Design, Product and Fashion Design, and Visual, Communication, and Service Design, which encompasses AI, digital media, and branding. A multidisciplinary panel of jurors from the fields of design, architecture, and curation will evaluate entries. The jury includes Paola Antonelli, senior curator at the Museum of Modern Art (MoMA); John Thackara, a leading voice in sustainability; industrial designer Stefano Giovannoni; architect Daniel Libeskind; Korean architect Cho Byoung-soo; and Lou Yongqi, president of Shanghai University of Engineering Science. "The core of the DBEW AWARD is the attitude of embracing fresh ideas through a cooperation model between students and professors," said juror Cho Byoung-soo. "The point of contemplating how to interact and present new visions, rather than dividing East and West dichotomously, differentiates this from other awards." Evaluation criteria cover six areas: originality, innovation, thematic relevance, aesthetic completeness, sustainability and social responsibility, and expressiveness. "While many design awards exist, prizes focusing on the joint creation of educators and students are very rare," said Lou Yongqi. "By bringing the value of human collaboration and education to the forefront in the age of artificial intelligence, the DBEW AWARD will present a new direction." Choi Kyung-ran, a professor at Kookmin University and the chairperson of the DBEW Award steering committee, explained that the award evaluates the entire sequence where the creative process of education leads to an outcome. She noted that global opinion leaders joined the jury because they aligned with the importance of the award's theme, which seeks sustainable design transcending East and West. The submission deadline is March 15, 2026, with final results scheduled for announcement on March 25. The total prize pool is 25,000 US dollars. An awards ceremony and forum will take place on April 21, 2026, at the ADI Design Museum in Milan during Milan Design Week. A subsequent exhibition is planned for October 2026 at the Dongdaemun Design Plaza (DDP) during Seoul Design Week. 2026-01-23 11:09:28

Kookmin University launches international design award emphasizing educator-student collaboration SEOUL, January 23 (AJP) - Kookmin University announced the launch of the "DBEW AWARD 2026," an international design competition organized in partnership with the Association for Industrial Design (ADI). The award aims to highlight the educational process and collaboration between students and instructors rather than focusing solely on finished design products. The award distinguishes itself from traditional design competitions by evaluating the mentorship and cooperative efforts that lead to creative outcomes. It is the first global design award to explicitly assess and recognize the leadership and mentoring capabilities of educators alongside student work. The initiative seeks to establish a new standard in design education by fostering convergence across technology, humanities, and design. "In the era of artificial intelligence, the role of education in fostering human thinking and collaboration becomes increasingly important," said Jeong Seung-ryul, president of Kookmin University. "We hope the DBEW AWARD will establish itself as a global platform where design educators and students from around the world can design the future together." The competition is open to undergraduate and graduate students, as well as new designers who have graduated within the last two years. Participants must form a team consisting of a student (or students) and an educator acting as a mentor. Submitted works must have been created within the past two years. Categories include Space and Architectural Design, Product and Fashion Design, and Visual, Communication, and Service Design, which encompasses AI, digital media, and branding. A multidisciplinary panel of jurors from the fields of design, architecture, and curation will evaluate entries. The jury includes Paola Antonelli, senior curator at the Museum of Modern Art (MoMA); John Thackara, a leading voice in sustainability; industrial designer Stefano Giovannoni; architect Daniel Libeskind; Korean architect Cho Byoung-soo; and Lou Yongqi, president of Shanghai University of Engineering Science. "The core of the DBEW AWARD is the attitude of embracing fresh ideas through a cooperation model between students and professors," said juror Cho Byoung-soo. "The point of contemplating how to interact and present new visions, rather than dividing East and West dichotomously, differentiates this from other awards." Evaluation criteria cover six areas: originality, innovation, thematic relevance, aesthetic completeness, sustainability and social responsibility, and expressiveness. "While many design awards exist, prizes focusing on the joint creation of educators and students are very rare," said Lou Yongqi. "By bringing the value of human collaboration and education to the forefront in the age of artificial intelligence, the DBEW AWARD will present a new direction." Choi Kyung-ran, a professor at Kookmin University and the chairperson of the DBEW Award steering committee, explained that the award evaluates the entire sequence where the creative process of education leads to an outcome. She noted that global opinion leaders joined the jury because they aligned with the importance of the award's theme, which seeks sustainable design transcending East and West. The submission deadline is March 15, 2026, with final results scheduled for announcement on March 25. The total prize pool is 25,000 US dollars. An awards ceremony and forum will take place on April 21, 2026, at the ADI Design Museum in Milan during Milan Design Week. A subsequent exhibition is planned for October 2026 at the Dongdaemun Design Plaza (DDP) during Seoul Design Week. 2026-01-23 11:09:28 -

Singer-turned-actor Cha Eun-woo under scrutiny for alleged tax evasion SEOUL, January 23 (AJP) - Actor Cha Eun-woo, a member of K-pop boy band ASTRO, has come under scrutiny after allegations of tax evasion surfaced this week. The National Tax Service (NTS) has reportedly launched an audit into his alleged failure to properly declare taxable income, according to multiple sources. The audit began early last year, several months before he enlisted in the military to fulfill his mandatory service in July. The NTS believes that the actor evaded taxes worth 20 billion Korean won (US$13.6 million) by diverting taxable earnings through a company established by his mother, which reportedly had little to no actual business activity. "Cha will fully cooperate with the probe through his lawyer and tax accountant to ensure that all necessary procedures are completed promptly," his management agency Fantagio said in a press release. Cha is said to be awaiting a reassessment of the probe after filing an objection with the NTS. Cha, who has been serving in the army's brass band, is expected to be discharged in January next year. The multi-talented star has won over numerous ardent fans across Asia since his debut in the showbiz industry in 2016, thanks to his good looks as well as his successful transition from K-pop idol to sought-after actor. 2026-01-23 11:01:54

Singer-turned-actor Cha Eun-woo under scrutiny for alleged tax evasion SEOUL, January 23 (AJP) - Actor Cha Eun-woo, a member of K-pop boy band ASTRO, has come under scrutiny after allegations of tax evasion surfaced this week. The National Tax Service (NTS) has reportedly launched an audit into his alleged failure to properly declare taxable income, according to multiple sources. The audit began early last year, several months before he enlisted in the military to fulfill his mandatory service in July. The NTS believes that the actor evaded taxes worth 20 billion Korean won (US$13.6 million) by diverting taxable earnings through a company established by his mother, which reportedly had little to no actual business activity. "Cha will fully cooperate with the probe through his lawyer and tax accountant to ensure that all necessary procedures are completed promptly," his management agency Fantagio said in a press release. Cha is said to be awaiting a reassessment of the probe after filing an objection with the NTS. Cha, who has been serving in the army's brass band, is expected to be discharged in January next year. The multi-talented star has won over numerous ardent fans across Asia since his debut in the showbiz industry in 2016, thanks to his good looks as well as his successful transition from K-pop idol to sought-after actor. 2026-01-23 11:01:54 -

Dispute deepens as US investors seek probe into 'discriminatory' actions against Coupang SEOUL, January 23 (AJP) - The dispute between Coupang and South Korean regulators appears to have turned into a potential diplomatic issue after the e-commerce giant's U.S. investors urged the Trump administration to investigate Seoul over alleged unfair trade practices. Greenoaks Capital and Altimeter Capital, the two largest shareholders of the New York-listed company, filed a petition on Thursday, requesting the Office of the U.S. Trade Representative (USTR) launch an investigation under Section 301 of the Trade Act of 1974. Simultaneously, the two submitted a Notice of Intent to initiate arbitration against the South Korean government under the investor-state dispute settlement (ISDS) provisions of the Korea-United States Free Trade Agreement (KORUS FTA). The dual filings are seen as a bold move in the investors' strategy. By citing Section 301, a powerful trade tool that allows a U.S. president to impose retaliatory tariffs, the shareholders are seeking to leverage U.S. President Donald Trump's "America First" mantra to pressure Seoul. The USTR must decide within 45 days whether to launch a formal investigation. In a joint petition, the investors alleged that the South Korean government is engaging in "discriminatory and expropriatory" actions against Coupang following a data breach detected in November last year. Greenoaks and Altimeter argued that the aggressive regulatory probes, which include threats to suspend the company's business license, are politically motivated attacks intended to dismantle a successful American firm. "A multi-year pattern of selective government enforcement and escalating regulatory pressure singling out Coupang, marked by extraordinary investigations, audits, and on-site inspections that appear to far exceed the regulatory scrutiny imposed on domestic Korean and Chinese competitors," the joint petition stated. Greenoaks and Altimeter added that the South Korean government's actions against Coupang appear intended to "target, disable, and destroy an innovative American competitor," urging the USTR to consider retaliatory duties on South Korean exports if the alleged harassment continues. The investors also claim that by targeting Coupang, the South Korean government is inadvertently aiding Chinese e-commerce platforms compete for market share in the country, citing remarks by South Korean President Lee Jae-myung and Fair Trade Commission Chairman Joo Byung-ki as evidence of hostility toward the U.S.-backed company. South Korean officials have moved quickly to reject these claims, insisting the investigation is a legitimate response to a security breach that exposed the personal data of nearly 34 million citizens. Prime Minister Kim Min-seok, currently visiting the United States, personally addressed the controversy during a lunch with U.S. lawmakers in Washington, D.C., on Friday. "There is absolutely no discrimination against Coupang," Kim told the legislators. "The trust between South Korea and the U.S. is deep enough that there is no need to worry about discriminatory treatment." Kim drew a parallel to the "Georgia incident" involving Korean workers in the U.S., noting that Seoul did not view that event as national discrimination. He explained that the government is not taking measures against Coupang simply because it is an American company, seeking to draw a line under suspicions raised by the U.S. tech sector. This follows earlier diplomatic efforts by Trade Minister Yeo Han-koo, who reportedly met with U.S. Trade Representative Jamieson Greer in Washington last week to clarify Seoul's position. The diplomatic maneuvering comes amid intense domestic scrutiny of Coupang. Public sentiment has plunged following a series of parliamentary hearings in which interim CEO Harold Rogers was criticized for his "audacious" behavior. Rogers, who reportedly refused to use official interpretation services or provide contact information during questioning, fled the country on January 13 just before a travel ban could be imposed. Fueling public anger is further controversy over the company's compensation plan for the data breach. Distributed starting January 15, the package offers 50,000 won ($35) in purchase vouchers, but consumers have criticized the offer as a "marketing tactic." Users note that the vouchers are largely limited to Coupang's luxury and travel subsidiaries rather than its core delivery service. The South Korean government has formed a joint task force involving the Ministry of Justice and the Ministry of Trade, Industry and Energy to prepare for the potential arbitration and the USTR's decision on the petition. 2026-01-23 10:32:41

Dispute deepens as US investors seek probe into 'discriminatory' actions against Coupang SEOUL, January 23 (AJP) - The dispute between Coupang and South Korean regulators appears to have turned into a potential diplomatic issue after the e-commerce giant's U.S. investors urged the Trump administration to investigate Seoul over alleged unfair trade practices. Greenoaks Capital and Altimeter Capital, the two largest shareholders of the New York-listed company, filed a petition on Thursday, requesting the Office of the U.S. Trade Representative (USTR) launch an investigation under Section 301 of the Trade Act of 1974. Simultaneously, the two submitted a Notice of Intent to initiate arbitration against the South Korean government under the investor-state dispute settlement (ISDS) provisions of the Korea-United States Free Trade Agreement (KORUS FTA). The dual filings are seen as a bold move in the investors' strategy. By citing Section 301, a powerful trade tool that allows a U.S. president to impose retaliatory tariffs, the shareholders are seeking to leverage U.S. President Donald Trump's "America First" mantra to pressure Seoul. The USTR must decide within 45 days whether to launch a formal investigation. In a joint petition, the investors alleged that the South Korean government is engaging in "discriminatory and expropriatory" actions against Coupang following a data breach detected in November last year. Greenoaks and Altimeter argued that the aggressive regulatory probes, which include threats to suspend the company's business license, are politically motivated attacks intended to dismantle a successful American firm. "A multi-year pattern of selective government enforcement and escalating regulatory pressure singling out Coupang, marked by extraordinary investigations, audits, and on-site inspections that appear to far exceed the regulatory scrutiny imposed on domestic Korean and Chinese competitors," the joint petition stated. Greenoaks and Altimeter added that the South Korean government's actions against Coupang appear intended to "target, disable, and destroy an innovative American competitor," urging the USTR to consider retaliatory duties on South Korean exports if the alleged harassment continues. The investors also claim that by targeting Coupang, the South Korean government is inadvertently aiding Chinese e-commerce platforms compete for market share in the country, citing remarks by South Korean President Lee Jae-myung and Fair Trade Commission Chairman Joo Byung-ki as evidence of hostility toward the U.S.-backed company. South Korean officials have moved quickly to reject these claims, insisting the investigation is a legitimate response to a security breach that exposed the personal data of nearly 34 million citizens. Prime Minister Kim Min-seok, currently visiting the United States, personally addressed the controversy during a lunch with U.S. lawmakers in Washington, D.C., on Friday. "There is absolutely no discrimination against Coupang," Kim told the legislators. "The trust between South Korea and the U.S. is deep enough that there is no need to worry about discriminatory treatment." Kim drew a parallel to the "Georgia incident" involving Korean workers in the U.S., noting that Seoul did not view that event as national discrimination. He explained that the government is not taking measures against Coupang simply because it is an American company, seeking to draw a line under suspicions raised by the U.S. tech sector. This follows earlier diplomatic efforts by Trade Minister Yeo Han-koo, who reportedly met with U.S. Trade Representative Jamieson Greer in Washington last week to clarify Seoul's position. The diplomatic maneuvering comes amid intense domestic scrutiny of Coupang. Public sentiment has plunged following a series of parliamentary hearings in which interim CEO Harold Rogers was criticized for his "audacious" behavior. Rogers, who reportedly refused to use official interpretation services or provide contact information during questioning, fled the country on January 13 just before a travel ban could be imposed. Fueling public anger is further controversy over the company's compensation plan for the data breach. Distributed starting January 15, the package offers 50,000 won ($35) in purchase vouchers, but consumers have criticized the offer as a "marketing tactic." Users note that the vouchers are largely limited to Coupang's luxury and travel subsidiaries rather than its core delivery service. The South Korean government has formed a joint task force involving the Ministry of Justice and the Ministry of Trade, Industry and Energy to prepare for the potential arbitration and the USTR's decision on the petition. 2026-01-23 10:32:41 -

Asia stocks edge higher; KOSPI back above 5,000 SEOUL, January 23 (AJP) – Asian equities opened higher on Friday, with South Korean stocks leading gains as easing global trade tensions lifted investor sentiment. South Korea’s benchmark KOSPI climbed back above the 5,000 mark in early trading. As of 9:48 a.m. local time, the index was up 1.17 percent at 5,010.28. The tech-heavy KOSDAQ rose 0.82 percent to 978.26. Institutional investors were net buyers of 191.0 billion won ($94 million), while individual investors and foreigners sold a net 138.1 billion won and 81.8 billion won, respectively. Among heavyweight stocks, Samsung Electronics rose 2.1 percent to 155,500 won. SK hynix slipped 0.4 percent to 752,000 won, while LG Energy Solution fell 0.48 percent to 415,000 won. Samsung Life Insurance gained 2.68 percent to 183,600 won, and Samsung Biologics advanced 1.07 percent to 1,797,000 won. Automakers traded mixed. Hyundai Motor rose 0.76 percent to 533,000 won, extending recent gains, while Kia fell 0.3 percent to 164,100 won. Defense and aerospace shares declined, with Hanwha Aerospace down 1.01 percent at 1,276,000 won. Shipbuilders outperformed, supported by expectations of improved earnings and new orders this year. HD Hyundai Heavy Industries gained 2.45 percent to 628,000 won, while Hanwha Ocean jumped 4.5 percent to 143,900 won. Construction and redevelopment-related stocks also drew attention as major builders positioned for a new wave of urban renewal projects. With multiple contractor selections scheduled in key redevelopment districts such as Seongsu and Apgujeong, competition among builders has intensified. Daewoo Engineering & Construction surged 11.07 percent in early trade, after entering the bidding race with its premium “Summit” brand. In the foreign exchange market, the South Korean won weakened, with the dollar trading at 1,468.7 won, up 3.70 won from the previous session. Elsewhere in Asia, Japanese shares were higher, with the Nikkei 225 Index gaining 0.17 percent to 53,782.57. 2026-01-23 10:32:17

Asia stocks edge higher; KOSPI back above 5,000 SEOUL, January 23 (AJP) – Asian equities opened higher on Friday, with South Korean stocks leading gains as easing global trade tensions lifted investor sentiment. South Korea’s benchmark KOSPI climbed back above the 5,000 mark in early trading. As of 9:48 a.m. local time, the index was up 1.17 percent at 5,010.28. The tech-heavy KOSDAQ rose 0.82 percent to 978.26. Institutional investors were net buyers of 191.0 billion won ($94 million), while individual investors and foreigners sold a net 138.1 billion won and 81.8 billion won, respectively. Among heavyweight stocks, Samsung Electronics rose 2.1 percent to 155,500 won. SK hynix slipped 0.4 percent to 752,000 won, while LG Energy Solution fell 0.48 percent to 415,000 won. Samsung Life Insurance gained 2.68 percent to 183,600 won, and Samsung Biologics advanced 1.07 percent to 1,797,000 won. Automakers traded mixed. Hyundai Motor rose 0.76 percent to 533,000 won, extending recent gains, while Kia fell 0.3 percent to 164,100 won. Defense and aerospace shares declined, with Hanwha Aerospace down 1.01 percent at 1,276,000 won. Shipbuilders outperformed, supported by expectations of improved earnings and new orders this year. HD Hyundai Heavy Industries gained 2.45 percent to 628,000 won, while Hanwha Ocean jumped 4.5 percent to 143,900 won. Construction and redevelopment-related stocks also drew attention as major builders positioned for a new wave of urban renewal projects. With multiple contractor selections scheduled in key redevelopment districts such as Seongsu and Apgujeong, competition among builders has intensified. Daewoo Engineering & Construction surged 11.07 percent in early trade, after entering the bidding race with its premium “Summit” brand. In the foreign exchange market, the South Korean won weakened, with the dollar trading at 1,468.7 won, up 3.70 won from the previous session. Elsewhere in Asia, Japanese shares were higher, with the Nikkei 225 Index gaining 0.17 percent to 53,782.57. 2026-01-23 10:32:17