Journalist

AJP

-

South Korea's LIG Nex1 pitches air defense systems to Middle Eastern customers SEOUL, January 20 (AJP) - South Korean defense contractor LIG Nex1 is making its first appearance at the Middle East’s largest maritime defense exhibition, stepping up efforts to expand its presence in the region. The company said on Tuesday it is participating in the Doha International Maritime Defense Exhibition & Conference (DIMDEX) 2026, which runs from Jan. 19 to 22 in Doha, Qatar, where it is showcasing integrated air-defense and precision-strike solutions tailored to Middle Eastern customers. Held every two years, DIMDEX is the region’s largest maritime defense exhibition and marks its 10th edition this year. At the event, LIG Nex1 is highlighting its “K-air defense network,” a layered air-defense system designed to counter threats across low- to high-altitude ranges. The system includes the Cheongung-II medium-range, medium-altitude interceptor; the L-SAM long-range, high-altitude interceptor; and the Shingung man-portable air-defense system. The company is also presenting precision-strike and surveillance assets for ground and maritime operations, including the Hyungung anti-tank guided weapon, the 2.75-inch guided rocket Bigung, which has passed U.S. fire control testing, and the Counter-Battery Radar-II for counter-artillery missions. LIG Nex1 said this marks its first participation at DIMDEX. The company has expanded its local presence in the Middle East since August and has intensified region-specific marketing and business development efforts. The company has previously secured export contracts for medium-range surface-to-air guided weapons with key Middle Eastern countries, including the United Arab Emirates, Saudi Arabia and Iraq. 2026-01-20 14:41:09

South Korea's LIG Nex1 pitches air defense systems to Middle Eastern customers SEOUL, January 20 (AJP) - South Korean defense contractor LIG Nex1 is making its first appearance at the Middle East’s largest maritime defense exhibition, stepping up efforts to expand its presence in the region. The company said on Tuesday it is participating in the Doha International Maritime Defense Exhibition & Conference (DIMDEX) 2026, which runs from Jan. 19 to 22 in Doha, Qatar, where it is showcasing integrated air-defense and precision-strike solutions tailored to Middle Eastern customers. Held every two years, DIMDEX is the region’s largest maritime defense exhibition and marks its 10th edition this year. At the event, LIG Nex1 is highlighting its “K-air defense network,” a layered air-defense system designed to counter threats across low- to high-altitude ranges. The system includes the Cheongung-II medium-range, medium-altitude interceptor; the L-SAM long-range, high-altitude interceptor; and the Shingung man-portable air-defense system. The company is also presenting precision-strike and surveillance assets for ground and maritime operations, including the Hyungung anti-tank guided weapon, the 2.75-inch guided rocket Bigung, which has passed U.S. fire control testing, and the Counter-Battery Radar-II for counter-artillery missions. LIG Nex1 said this marks its first participation at DIMDEX. The company has expanded its local presence in the Middle East since August and has intensified region-specific marketing and business development efforts. The company has previously secured export contracts for medium-range surface-to-air guided weapons with key Middle Eastern countries, including the United Arab Emirates, Saudi Arabia and Iraq. 2026-01-20 14:41:09 -

South Korean violinist in wheelchair wins top prize at US competition SEOUL, January 20 (AJP) - Violinist Lim Hyun-jae won the triennial Elmar Oliveira International Violin Competition (EOIVC) in Boca Raton, Florida last weekend. At last Sunday's finals at Lynn University Conservatory of Music, Lim, 28, performed Jean Sibelius' "Violin Concerto in D minor" while seated in a wheelchair and won the top prize among four finalists. She also won two special prizes awarded to the best performers of the EOIVC's commissioned work. Lim received US$30,000 in prize money and an additional $20,000 for special awards, along with the opportunity to perform more than 30 times over the next three years on international stages including Boston and New York, as well as Cremona, Italy. The graduate of the prestigious Curtis Institute of Music in Philadelphia began playing the violin at the age of seven. She returned to Seoul during the coronavirus pandemic while studying in the U.S., but a traffic accident in May 2020 forced her to stop performing for more than four years. After undergoing surgery six times and a lengthy rehabilitation, she returned to the stage in June 2024. Founded in 2017 by American violinist and winner of Moscow's prestigious Tchaikovsky International Competition Elmar Oliveira, the EOIVC aims to help young musicians build independent careers. The competition is held every three years for those aged 18 to 30. 2026-01-20 14:40:26

South Korean violinist in wheelchair wins top prize at US competition SEOUL, January 20 (AJP) - Violinist Lim Hyun-jae won the triennial Elmar Oliveira International Violin Competition (EOIVC) in Boca Raton, Florida last weekend. At last Sunday's finals at Lynn University Conservatory of Music, Lim, 28, performed Jean Sibelius' "Violin Concerto in D minor" while seated in a wheelchair and won the top prize among four finalists. She also won two special prizes awarded to the best performers of the EOIVC's commissioned work. Lim received US$30,000 in prize money and an additional $20,000 for special awards, along with the opportunity to perform more than 30 times over the next three years on international stages including Boston and New York, as well as Cremona, Italy. The graduate of the prestigious Curtis Institute of Music in Philadelphia began playing the violin at the age of seven. She returned to Seoul during the coronavirus pandemic while studying in the U.S., but a traffic accident in May 2020 forced her to stop performing for more than four years. After undergoing surgery six times and a lengthy rehabilitation, she returned to the stage in June 2024. Founded in 2017 by American violinist and winner of Moscow's prestigious Tchaikovsky International Competition Elmar Oliveira, the EOIVC aims to help young musicians build independent careers. The competition is held every three years for those aged 18 to 30. 2026-01-20 14:40:26 -

HD Korea Shipbuilding secures $350 million in new vessel orders SEOUL, January 20 (AJP) - HD Korea Shipbuilding & Offshore, the shipbuilding arm of HD Hyundai, said on Tuesday it has secured orders for crude oil tankers and petrochemical product carriers, extending a strong start to the year. The company said it signed contracts to build two crude oil tankers and two petrochemical product carriers, or PC carriers, with a combined value of 481.6 billion won ($350 million). The vessels will be constructed at HD Hyundai Heavy Industries and delivered in stages by the first half of 2029. With the latest contracts, HD Korea Shipbuilding & Offshore’s year-to-date orders have risen to nine vessels. In value terms, the company has provisionally secured $1.49 billion, equivalent to 6.4 percent of its annual order target of $23.31 billion. The company has so far booked orders for four liquefied natural gas carriers, one liquefied petroleum gas and ammonia carrier, two crude oil tankers and two PC carriers. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-20 14:25:08

HD Korea Shipbuilding secures $350 million in new vessel orders SEOUL, January 20 (AJP) - HD Korea Shipbuilding & Offshore, the shipbuilding arm of HD Hyundai, said on Tuesday it has secured orders for crude oil tankers and petrochemical product carriers, extending a strong start to the year. The company said it signed contracts to build two crude oil tankers and two petrochemical product carriers, or PC carriers, with a combined value of 481.6 billion won ($350 million). The vessels will be constructed at HD Hyundai Heavy Industries and delivered in stages by the first half of 2029. With the latest contracts, HD Korea Shipbuilding & Offshore’s year-to-date orders have risen to nine vessels. In value terms, the company has provisionally secured $1.49 billion, equivalent to 6.4 percent of its annual order target of $23.31 billion. The company has so far booked orders for four liquefied natural gas carriers, one liquefied petroleum gas and ammonia carrier, two crude oil tankers and two PC carriers. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-20 14:25:08 -

Fewer North Korean defectors arrived in Seoul last year SEOUL, January 20 (AJP) - A total of 224 North Korean defectors arrived in South Korea last year, the Ministry of Unification said on Tuesday. The figure is a slight decrease from last year's 236, following a sharp decline during the coronavirus pandemic. Of them, 198 were women and 26 were men, with only a handful having defected directly from North Korea without passing through a third country like China. The cumulative number of North Korean defectors now stands at 34,538, comprising 24,944 women and 9,594 men. Annual arrivals once reached nearly 3,000 but fell sharply after the pandemic, dropping to 229 in 2020, 63 in 2021, and 67 in 2022, before gradually rising to 196 in 2023 and 236 in 2024. A Unification Ministry official said the figure has stood at around 200 since 2023 and is expected to stay at that level as North Korea's border remains closed. 2026-01-20 13:56:56

Fewer North Korean defectors arrived in Seoul last year SEOUL, January 20 (AJP) - A total of 224 North Korean defectors arrived in South Korea last year, the Ministry of Unification said on Tuesday. The figure is a slight decrease from last year's 236, following a sharp decline during the coronavirus pandemic. Of them, 198 were women and 26 were men, with only a handful having defected directly from North Korea without passing through a third country like China. The cumulative number of North Korean defectors now stands at 34,538, comprising 24,944 women and 9,594 men. Annual arrivals once reached nearly 3,000 but fell sharply after the pandemic, dropping to 229 in 2020, 63 in 2021, and 67 in 2022, before gradually rising to 196 in 2023 and 236 in 2024. A Unification Ministry official said the figure has stood at around 200 since 2023 and is expected to stay at that level as North Korea's border remains closed. 2026-01-20 13:56:56 -

South Korea's EV registrations jump 50 percent in 2025, ending two-year slump SEOUL, January 20 (AJP) - New electric-vehicle registrations in South Korea topped 220,000 last year, ending two consecutive years of decline and returning to growth, according to industry data released on Tuesday. In its 2025 report, the Korea Automobile & Mobility Association (KAMA) said new EV registrations rose 50.1 percent from a year earlier to 220,177 units. EV penetration — the share of EVs in new vehicle purchases — reached 13.1 percent, entering double digits for the first time. KAMA attributed the rebound to early disbursement of government subsidies and other policy support, aggressive sales promotions by automakers and an expanded lineup of new models. The recovery was driven in large part by strong demand for Tesla’s Model Y, which sold 50,397 units and accounted for 26.6 percent of the passenger EV market, KAMA said. Domestic automakers Hyundai Motor and Kia helped broaden the market with new models including the EV4, EV5, EV9 GT, PV5 and Ioniq 9. KG Mobility also entered a new segment with South Korea’s first electric pickup, the Musso EV. By automaker, Kia led the market with 60,609 registrations, followed by Tesla with 59,893 and Hyundai Motor with 55,461. Imported EVs continued to gain ground, taking a 42.8 percent market share. The share of domestically produced EVs fell to 57.2 percent, down from 75 percent in 2022. China-made EVs surged 112.4 percent from a year earlier to 74,728 units, emerging as a major force in the market. KAMA cited increased imports of China-produced Teslas and the market entry of brands such as BYD and Polestar. Industry officials said the growing presence of China-made EVs could broaden consumer choice and put downward pressure on prices, but also risks weakening South Korea’s manufacturing base and intensifying supply-chain competition, calling for longer-term policy responses. KAMA said the market’s recovery reflected a combination of policy support and the popularity of specific models rather than broad-based mass adoption or a structural shift in demand. The association called for a more active government role to meet South Korea’s national greenhouse gas reduction target, and to strengthen industry competitiveness. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-20 13:42:29

South Korea's EV registrations jump 50 percent in 2025, ending two-year slump SEOUL, January 20 (AJP) - New electric-vehicle registrations in South Korea topped 220,000 last year, ending two consecutive years of decline and returning to growth, according to industry data released on Tuesday. In its 2025 report, the Korea Automobile & Mobility Association (KAMA) said new EV registrations rose 50.1 percent from a year earlier to 220,177 units. EV penetration — the share of EVs in new vehicle purchases — reached 13.1 percent, entering double digits for the first time. KAMA attributed the rebound to early disbursement of government subsidies and other policy support, aggressive sales promotions by automakers and an expanded lineup of new models. The recovery was driven in large part by strong demand for Tesla’s Model Y, which sold 50,397 units and accounted for 26.6 percent of the passenger EV market, KAMA said. Domestic automakers Hyundai Motor and Kia helped broaden the market with new models including the EV4, EV5, EV9 GT, PV5 and Ioniq 9. KG Mobility also entered a new segment with South Korea’s first electric pickup, the Musso EV. By automaker, Kia led the market with 60,609 registrations, followed by Tesla with 59,893 and Hyundai Motor with 55,461. Imported EVs continued to gain ground, taking a 42.8 percent market share. The share of domestically produced EVs fell to 57.2 percent, down from 75 percent in 2022. China-made EVs surged 112.4 percent from a year earlier to 74,728 units, emerging as a major force in the market. KAMA cited increased imports of China-produced Teslas and the market entry of brands such as BYD and Polestar. Industry officials said the growing presence of China-made EVs could broaden consumer choice and put downward pressure on prices, but also risks weakening South Korea’s manufacturing base and intensifying supply-chain competition, calling for longer-term policy responses. KAMA said the market’s recovery reflected a combination of policy support and the popularity of specific models rather than broad-based mass adoption or a structural shift in demand. The association called for a more active government role to meet South Korea’s national greenhouse gas reduction target, and to strengthen industry competitiveness. * This article, published by Aju Business Daily, was translated by AI and edited by AJP. 2026-01-20 13:42:29 -

Asian markets track Wall Street pullback; KOSPI pauses after 12-day rally SEOUL, January 20 (AJP) — Asian markets moved lower on Tuesday, tracking an overnight retreat on Wall Street, with South Korea’s KOSPI taking a breather after a 12-day uninterrupted rally. As of 11:20 a.m., the benchmark KOSPI was down 0.61 percent at 4,874.83, pulling back after touching an intraday record high of 4,923.53 earlier in the session. The tech-heavy KOSDAQ bucked the trend, rising 0.45 percent to 971.48. Retail investors absorbed selling pressure from institutions and foreigners. Individuals bought a net 646.7 billion won ($438 million), while institutions and foreign investors sold a net 279.4 billion won and 409.4 billion won, respectively. Most large-cap stocks traded lower. Samsung Electronics fell 2.8 percent to 145,000 won, while SK hynix dropped 3 percent to 741,000 won. Samsung Biologics slipped 0.26 percent to 1,916,000 won. In contrast, Samsung Life Insurance rose 3.71 percent to 173,200 won, and LG Energy Solution gained 1.76 percent to 405,500 won. Hyundai Motor briefly topped a market capitalization of 100 trillion won at the open but later edged lower on profit-taking, trading down 0.83 percent at 476,000 won as of 10 a.m. Kia declined 2.12 percent to 165,900 won. Robot-related shares extended gains in early trade. Doosan Robotics jumped 7.06 percent, or 7,600 won, to 115,300 won, while Hyundai Movex advanced 5.15 percent to 36,750 won. Defense and aerospace stocks also traded higher, with Hanwha Aerospace up 0.75 percent at 1.34 million won. Shipbuilding and heavy industry names moved lower, as HD Hyundai Heavy Industries fell 2.78 percent to 630,000 won and Hanwha Ocean declined 1.21 percent to 147,000 won. In the currency market, the won weakened, with the dollar trading at 1,476.80 won, up 2.30 won from the previous session. In Japan, the Nikkei 225 fell 0.76 percent to 53,174.78 after Prime Minister Sanae Takaichi dissolved the lower house and called a snap election. 2026-01-20 11:31:45

Asian markets track Wall Street pullback; KOSPI pauses after 12-day rally SEOUL, January 20 (AJP) — Asian markets moved lower on Tuesday, tracking an overnight retreat on Wall Street, with South Korea’s KOSPI taking a breather after a 12-day uninterrupted rally. As of 11:20 a.m., the benchmark KOSPI was down 0.61 percent at 4,874.83, pulling back after touching an intraday record high of 4,923.53 earlier in the session. The tech-heavy KOSDAQ bucked the trend, rising 0.45 percent to 971.48. Retail investors absorbed selling pressure from institutions and foreigners. Individuals bought a net 646.7 billion won ($438 million), while institutions and foreign investors sold a net 279.4 billion won and 409.4 billion won, respectively. Most large-cap stocks traded lower. Samsung Electronics fell 2.8 percent to 145,000 won, while SK hynix dropped 3 percent to 741,000 won. Samsung Biologics slipped 0.26 percent to 1,916,000 won. In contrast, Samsung Life Insurance rose 3.71 percent to 173,200 won, and LG Energy Solution gained 1.76 percent to 405,500 won. Hyundai Motor briefly topped a market capitalization of 100 trillion won at the open but later edged lower on profit-taking, trading down 0.83 percent at 476,000 won as of 10 a.m. Kia declined 2.12 percent to 165,900 won. Robot-related shares extended gains in early trade. Doosan Robotics jumped 7.06 percent, or 7,600 won, to 115,300 won, while Hyundai Movex advanced 5.15 percent to 36,750 won. Defense and aerospace stocks also traded higher, with Hanwha Aerospace up 0.75 percent at 1.34 million won. Shipbuilding and heavy industry names moved lower, as HD Hyundai Heavy Industries fell 2.78 percent to 630,000 won and Hanwha Ocean declined 1.21 percent to 147,000 won. In the currency market, the won weakened, with the dollar trading at 1,476.80 won, up 2.30 won from the previous session. In Japan, the Nikkei 225 fell 0.76 percent to 53,174.78 after Prime Minister Sanae Takaichi dissolved the lower house and called a snap election. 2026-01-20 11:31:45 -

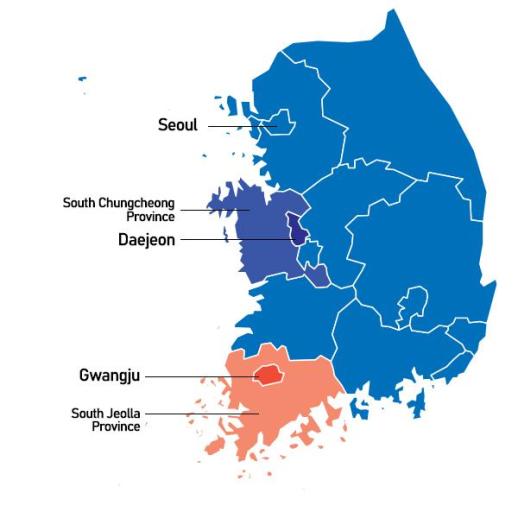

Busan-sized metropolitan hubs envisioned in central and southern western Korea SEOUL, January 20 (AJP) - As Seoul grows ever more crowded, much of the rest of South Korea is quietly emptying out. The imbalance has become one of the country’s defining challenges, straining housing, jobs and infrastructure in the capital while leaving regional cities with shrinking populations, weaker local economies and eroding public services. More than 51 percent of South Korea’s 51.6 million people live in and around Seoul, an area that covers just 12 percent of national land. The concentration is extreme by international standards. Only 7.5 percent of Germany’s population lives around Berlin, 15.9 percent around Rome and 17.4 percent around Madrid. Even in countries known for dominant capitals, the share is far lower: 24.5 percent around Paris, 24.8 percent around London and 34.4 percent around Tokyo. In Korea, this imbalance has reinforced itself as young people leave regional cities for education and work in Seoul, accelerating decline elsewhere. What once fueled growth has now become a structural constraint. South Korea is entering a period of rapid population decline and aging faster than any other major economy. In that context, concentrating people and opportunity in one metropolitan area is no longer efficient. Seoul faces chronic shortages of housing and jobs, while large parts of the country are losing the scale needed to sustain industries, public services and local investment. Policymakers warn that without structural change, the capital will continue to swell even as regional Korea hollows out. Rather than trying to push people out of Seoul, the government is pursuing a different strategy: building regional cities large enough to function as real alternatives. The Lee Jae Myung administration is promoting administrative integration, merging neighboring cities and provinces to create larger metropolitan governments with greater fiscal capacity and policy authority. Prime Minister Kim Min-seok has framed the initiative as a matter of national survival, saying “balanced regional development is not regional favoritism but a survival strategy for a sustainable future.” He added that the government would make the shift from capital-centered growth to region-led growth one of its top policy priorities. The approach is beginning to take shape. In December 2025, Daejeon Metropolitan City and South Chungcheong Province declared their intent to integrate administratively. In January, Gwangju and South Jeolla Province followed, aiming to elect unified leadership in the June local elections. If completed, the new metropolitan governments would have populations of 3.6 million and 3.2 million, respectively — comparable to Busan and Incheon, the country’s second- and third-largest cities. To support the transition, the central government has pledged up to 5 trillion won per year for each integrated region, with total support reaching 20 trillion won over four years. Kim said the government would move quickly to institutionalize support, announcing plans to form a joint task force with relevant ministries to finalize financial and administrative measures and work closely with the National Assembly. A dedicated support committee under the Prime Minister’s Office will also be established to ensure continuity beyond the initial merger phase, officials said. The logic behind the policy is scale. Smaller and shrinking local governments struggle to attract businesses, retain young workers or invest in infrastructure. Larger metropolitan units, officials argue, can pool budgets, coordinate development and create labor markets deep enough to compete with Seoul. The aim is to slow youth migration to the capital, ease pressure on its housing and transport systems, and concentrate remaining growth in a limited number of viable regional hubs as the population shrinks. Experts broadly support the direction but caution that process will determine outcomes. Professor Park Jin-sol of Inha University warned that administrative integration must not be rushed. “If integration proceeds in haste, it may be driven by the central government without sufficient collection of residents’ opinions,” she said, adding that it is more important to ensure resident participation and deliberation than to focus on speed. Past experience underscores the risk. The Cheongju–Cheongwon merger followed more than two decades of consultation and a local referendum and later showed gains in administrative efficiency. By contrast, the Changwon–Masan–Jinhae merger, completed without a referendum, has faced persistent disputes over governance and local marginalization. The difference, Park noted, lay not in policy design but in legitimacy. Lawmakers from both ruling and opposition parties have voiced support for integration while echoing the need for public consent. Democratic Party lawmaker Chae Hyun-il said integration is necessary to strengthen regional competitiveness but stressed that it must “lead to future-oriented development and real improvements in quality of life.” People Power Party lawmaker Koh Dong-jin also backed the policy, emphasizing that “legitimacy must be secured through the collection of residents’ opinions.” At the same time, criticism has emerged over the scale of government funding. Another ruling party lawmaker, Lee Chul-gyu, questioned whether heavy financial incentives risk distorting priorities. “National finances are limited,” he said, arguing that integration should focus on efficiency rather than what he called a “money-driven approach.” Despite debate over funding levels and timing, there is broad agreement across party lines that Seoul’s dominance has become a national constraint rather than a source of strength. As the capital grows ever more crowded and regional Korea continues to hollow out, administrative integration represents a high-stakes attempt to rebalance a shrinking country. 2026-01-20 11:31:08

Busan-sized metropolitan hubs envisioned in central and southern western Korea SEOUL, January 20 (AJP) - As Seoul grows ever more crowded, much of the rest of South Korea is quietly emptying out. The imbalance has become one of the country’s defining challenges, straining housing, jobs and infrastructure in the capital while leaving regional cities with shrinking populations, weaker local economies and eroding public services. More than 51 percent of South Korea’s 51.6 million people live in and around Seoul, an area that covers just 12 percent of national land. The concentration is extreme by international standards. Only 7.5 percent of Germany’s population lives around Berlin, 15.9 percent around Rome and 17.4 percent around Madrid. Even in countries known for dominant capitals, the share is far lower: 24.5 percent around Paris, 24.8 percent around London and 34.4 percent around Tokyo. In Korea, this imbalance has reinforced itself as young people leave regional cities for education and work in Seoul, accelerating decline elsewhere. What once fueled growth has now become a structural constraint. South Korea is entering a period of rapid population decline and aging faster than any other major economy. In that context, concentrating people and opportunity in one metropolitan area is no longer efficient. Seoul faces chronic shortages of housing and jobs, while large parts of the country are losing the scale needed to sustain industries, public services and local investment. Policymakers warn that without structural change, the capital will continue to swell even as regional Korea hollows out. Rather than trying to push people out of Seoul, the government is pursuing a different strategy: building regional cities large enough to function as real alternatives. The Lee Jae Myung administration is promoting administrative integration, merging neighboring cities and provinces to create larger metropolitan governments with greater fiscal capacity and policy authority. Prime Minister Kim Min-seok has framed the initiative as a matter of national survival, saying “balanced regional development is not regional favoritism but a survival strategy for a sustainable future.” He added that the government would make the shift from capital-centered growth to region-led growth one of its top policy priorities. The approach is beginning to take shape. In December 2025, Daejeon Metropolitan City and South Chungcheong Province declared their intent to integrate administratively. In January, Gwangju and South Jeolla Province followed, aiming to elect unified leadership in the June local elections. If completed, the new metropolitan governments would have populations of 3.6 million and 3.2 million, respectively — comparable to Busan and Incheon, the country’s second- and third-largest cities. To support the transition, the central government has pledged up to 5 trillion won per year for each integrated region, with total support reaching 20 trillion won over four years. Kim said the government would move quickly to institutionalize support, announcing plans to form a joint task force with relevant ministries to finalize financial and administrative measures and work closely with the National Assembly. A dedicated support committee under the Prime Minister’s Office will also be established to ensure continuity beyond the initial merger phase, officials said. The logic behind the policy is scale. Smaller and shrinking local governments struggle to attract businesses, retain young workers or invest in infrastructure. Larger metropolitan units, officials argue, can pool budgets, coordinate development and create labor markets deep enough to compete with Seoul. The aim is to slow youth migration to the capital, ease pressure on its housing and transport systems, and concentrate remaining growth in a limited number of viable regional hubs as the population shrinks. Experts broadly support the direction but caution that process will determine outcomes. Professor Park Jin-sol of Inha University warned that administrative integration must not be rushed. “If integration proceeds in haste, it may be driven by the central government without sufficient collection of residents’ opinions,” she said, adding that it is more important to ensure resident participation and deliberation than to focus on speed. Past experience underscores the risk. The Cheongju–Cheongwon merger followed more than two decades of consultation and a local referendum and later showed gains in administrative efficiency. By contrast, the Changwon–Masan–Jinhae merger, completed without a referendum, has faced persistent disputes over governance and local marginalization. The difference, Park noted, lay not in policy design but in legitimacy. Lawmakers from both ruling and opposition parties have voiced support for integration while echoing the need for public consent. Democratic Party lawmaker Chae Hyun-il said integration is necessary to strengthen regional competitiveness but stressed that it must “lead to future-oriented development and real improvements in quality of life.” People Power Party lawmaker Koh Dong-jin also backed the policy, emphasizing that “legitimacy must be secured through the collection of residents’ opinions.” At the same time, criticism has emerged over the scale of government funding. Another ruling party lawmaker, Lee Chul-gyu, questioned whether heavy financial incentives risk distorting priorities. “National finances are limited,” he said, arguing that integration should focus on efficiency rather than what he called a “money-driven approach.” Despite debate over funding levels and timing, there is broad agreement across party lines that Seoul’s dominance has become a national constraint rather than a source of strength. As the capital grows ever more crowded and regional Korea continues to hollow out, administrative integration represents a high-stakes attempt to rebalance a shrinking country. 2026-01-20 11:31:08 -

Blockchain operator Sign estimates 2026 to be turning point for institutional asset tokenization SEOUL, January 20 (AJP) - Sign, a blockchain infrastructure provider, released a market analysis Tuesday projecting that 2026 will serve as a pivotal year for Real World Asset (RWA) tokenization, forecasting a shift from experimental pilots to full-scale institutional integration. The company stated that the digital asset sector is currently undergoing a structural transition. While recent years have focused on technical proof-of-concepts, Sign’s outlook suggests the coming year will see traditional financial institutions begin utilizing blockchain infrastructure for core operations rather than just speculative investment. In its analysis, Sign highlighted industry data projecting the market for tokenized assets could reach 18.9 trillion U.S. dollars by 2033. The firm attributed this growth potential to increasing regulatory clarity in major jurisdictions and a growing demand for on-chain capital efficiency among asset managers. To support this projected influx of institutional activity, Sign announced it intends to expand its proprietary "Sign Chain." The company positions this Layer 1 blockchain as a specialized network designed to handle the rigorous compliance, identity verification, and data privacy requirements of regulated assets—features often lacking in general-purpose public networks. A central component of the company's 2026 roadmap involves government-level partnerships to establish sovereign digital infrastructure. Sign referenced its ongoing collaboration with the National Bank of the Kyrgyz Republic to develop systems for a Central Bank Digital Currency (CBDC) and the "Digital SOM." The company frames this project as a test case for how blockchain can digitize administrative and financial processes at a national level. The report also identified stablecoins as a critical driver for the 2026 outlook. Sign noted that stablecoin settlement volume recently exceeded 46 trillion dollars, interpreting this as evidence that the market is ready for programmable, on-chain currency solutions that can interface seamlessly with traditional banking systems. Addressing the technical barriers to this adoption, Sign stated it is prioritizing "omnichain" connectivity. This approach aims to allow assets to move fluidly between incompatible blockchain networks, removing the technical silos that have previously fragmented liquidity and deterred institutional users. Company executives indicated that Sign plans to roll out additional tokenization services and infrastructure updates in the coming months to align with these anticipated market shifts. 2026-01-20 11:18:36

Blockchain operator Sign estimates 2026 to be turning point for institutional asset tokenization SEOUL, January 20 (AJP) - Sign, a blockchain infrastructure provider, released a market analysis Tuesday projecting that 2026 will serve as a pivotal year for Real World Asset (RWA) tokenization, forecasting a shift from experimental pilots to full-scale institutional integration. The company stated that the digital asset sector is currently undergoing a structural transition. While recent years have focused on technical proof-of-concepts, Sign’s outlook suggests the coming year will see traditional financial institutions begin utilizing blockchain infrastructure for core operations rather than just speculative investment. In its analysis, Sign highlighted industry data projecting the market for tokenized assets could reach 18.9 trillion U.S. dollars by 2033. The firm attributed this growth potential to increasing regulatory clarity in major jurisdictions and a growing demand for on-chain capital efficiency among asset managers. To support this projected influx of institutional activity, Sign announced it intends to expand its proprietary "Sign Chain." The company positions this Layer 1 blockchain as a specialized network designed to handle the rigorous compliance, identity verification, and data privacy requirements of regulated assets—features often lacking in general-purpose public networks. A central component of the company's 2026 roadmap involves government-level partnerships to establish sovereign digital infrastructure. Sign referenced its ongoing collaboration with the National Bank of the Kyrgyz Republic to develop systems for a Central Bank Digital Currency (CBDC) and the "Digital SOM." The company frames this project as a test case for how blockchain can digitize administrative and financial processes at a national level. The report also identified stablecoins as a critical driver for the 2026 outlook. Sign noted that stablecoin settlement volume recently exceeded 46 trillion dollars, interpreting this as evidence that the market is ready for programmable, on-chain currency solutions that can interface seamlessly with traditional banking systems. Addressing the technical barriers to this adoption, Sign stated it is prioritizing "omnichain" connectivity. This approach aims to allow assets to move fluidly between incompatible blockchain networks, removing the technical silos that have previously fragmented liquidity and deterred institutional users. Company executives indicated that Sign plans to roll out additional tokenization services and infrastructure updates in the coming months to align with these anticipated market shifts. 2026-01-20 11:18:36 -

Former PM to face verdict over martial law involvement SEOUL, January 20 (AJP) - Former Prime Minister Han Duck-soo is set to face his first verdict this week over his involvement in former President Yoon Suk Yeol's botched martial law debacle in December 2024. In a nationwide televised trial scheduled for 2 p.m. on Wednesday, the Seoul Central District Court in southern Seoul is set to deliver its ruling on him. Prosecutors sought 15 years in prison at Han's final hearing in November last year, accusing Han of aiding Yoon's Dec. 3 declaration of martial law instead of preventing it, despite his duty to check abuses of presidential power. They also criticized Han for refusing to cooperate with investigators, falsifying documents to cover up the debacle, and committing perjury when he testified during Yoon's impeachment trial in February last year, claiming he had not known in advance about Yoon's late-night bid. 2026-01-20 11:17:13

Former PM to face verdict over martial law involvement SEOUL, January 20 (AJP) - Former Prime Minister Han Duck-soo is set to face his first verdict this week over his involvement in former President Yoon Suk Yeol's botched martial law debacle in December 2024. In a nationwide televised trial scheduled for 2 p.m. on Wednesday, the Seoul Central District Court in southern Seoul is set to deliver its ruling on him. Prosecutors sought 15 years in prison at Han's final hearing in November last year, accusing Han of aiding Yoon's Dec. 3 declaration of martial law instead of preventing it, despite his duty to check abuses of presidential power. They also criticized Han for refusing to cooperate with investigators, falsifying documents to cover up the debacle, and committing perjury when he testified during Yoon's impeachment trial in February last year, claiming he had not known in advance about Yoon's late-night bid. 2026-01-20 11:17:13 -

Former DP lawmaker appears for questioning over alleged bribery SEOUL, January 20 (AJP) - Kang Sun-woo, a former lawmaker of the Democratic Party (DP), appeared for questioning in western Seoul on Tuesday. She is accused of receiving 100 million Korean won (US$68,500) from Seoul city official Kim Kyung in return for the DP's candidate nominations for the 2022 local elections. The money was allegedly delivered to Kang's former aide, identified only by his surname Nam. Her questioning comes nearly a month after an audio recording was abruptly revealed late last month, in which Kang is heard discussing the acceptance of the money with then–DP floor leader Kim Byung-ki, who left the party earlier this week after resigning from his post amid a spate of bribery allegations and other misconduct. Arriving at a police station in Mapo at around 9 a.m., Kang said, "I sincerely apologize for causing public concern," adding, "I will fully cooperate with the investigation." When asked whether she had received the money, she responded that she has "principles" and has "lived a life that adheres to those principles." Police are expected to investigate whether the money was delivered and later returned and, if so, why Kim was later given a single nomination. During earlier investigations, Kim and Nam gave statements that differed slightly from one another. 2026-01-20 10:22:51

Former DP lawmaker appears for questioning over alleged bribery SEOUL, January 20 (AJP) - Kang Sun-woo, a former lawmaker of the Democratic Party (DP), appeared for questioning in western Seoul on Tuesday. She is accused of receiving 100 million Korean won (US$68,500) from Seoul city official Kim Kyung in return for the DP's candidate nominations for the 2022 local elections. The money was allegedly delivered to Kang's former aide, identified only by his surname Nam. Her questioning comes nearly a month after an audio recording was abruptly revealed late last month, in which Kang is heard discussing the acceptance of the money with then–DP floor leader Kim Byung-ki, who left the party earlier this week after resigning from his post amid a spate of bribery allegations and other misconduct. Arriving at a police station in Mapo at around 9 a.m., Kang said, "I sincerely apologize for causing public concern," adding, "I will fully cooperate with the investigation." When asked whether she had received the money, she responded that she has "principles" and has "lived a life that adheres to those principles." Police are expected to investigate whether the money was delivered and later returned and, if so, why Kim was later given a single nomination. During earlier investigations, Kim and Nam gave statements that differed slightly from one another. 2026-01-20 10:22:51