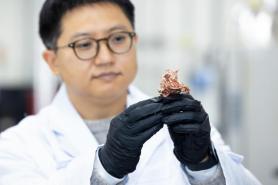

[Courtesy of SK nexilis]

Through a new guidance released on March 31, the U.S. Department of the Treasury said that cathode and anode plates for electric vehicle (EV) batteries are classified as battery components. To receive subsidies for manufacturing EVs on U.S. soil, carmakers must use car parts and components, especially large-capacity batteries, which are made in factories located in America.

However, while the Department of the Treasury classified anode plated and cathode plates as battery components, the treasury classified copper foils, which are the key active materials used in the production of EV batteries, as "constituent materials". Unlike battery components, battery materials including copper foils can be produced in South Korea and sent to the U.S. for assembly. Seoul signed a Free Trade Agreement (FTA) with Washington in 2007.

Currently, South Korean battery makers produce anode and cathode plates in the U.S. while copper foil companies have manufacturing bases at home. They would not have to change their production lines to receive subsidies from the U.S. government for EV batteries assembled on American soil.

Also, the guideline states that subsidies will be provided when key mineral materials produced in countries that did not sign FTA with the U.S., like Indonesia and Argentina, were processed in South Korea and used in the production of EV batteries in the U.S.

South Korean companies -- SK nexilis, the copper foil-making wing of South Korea's polyester film and chemical material manufacturer SKC, and Lotte Energy Materials, an elec-foil maker formerly known as Ilsin Materials -- are the top companies in the global copper foil market. SK nexilis had the largest market share of 22 percent in 2021.

SK nexilis currently has an annual production capacity of 520,000 tons per year while Lotte Energy Materials will have an annual capacity of about 225,000 tons by 2027. Other South Korean material companies such as Korea Zinc and Solus Advanced Materials have joined the copper foil race. Korea Zinc plans to beef up its annual capacity to up to 120,000 tons by 2027 while Solus will build two copper factories in Europe and Canada with annual capacities of 100,000 tons and 17,000 tons, respectively.

Copyright ⓒ Aju Press All rights reserved.