SEOUL, June 16 (AJP) - As global electricity demand rises at an unprecedented pace — fueled by the growth of artificial intelligence, data centers, and high-performance computing — nuclear power is experiencing a resurgence.

At the center of this renewed interest are small modular reactors, or SMRs, a next-generation nuclear technology that is gaining traction across the globe. South Korea, long a major player in nuclear energy, is now moving decisively to claim a stake in this emerging market.

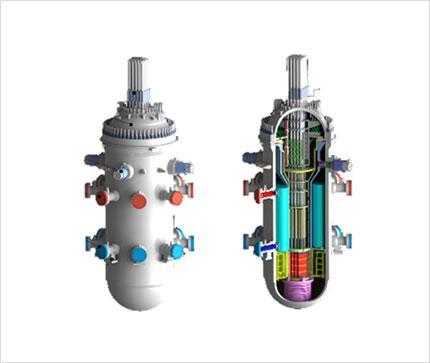

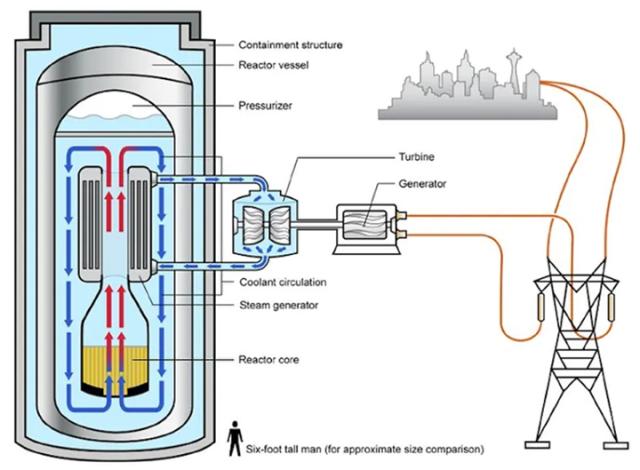

Unlike traditional gigawatt-scale nuclear power plants, SMRs are designed to be compact, factory-fabricated, and easier to install. Typically generating 300 megawatts or less, these modular reactors require less land, offer greater construction flexibility, and are engineered with passive safety features that mitigate the risks of accidents — even in the event of a power outage.

These attributes have positioned SMRs as promising solutions for regions with limited grid infrastructure or geographic constraints, including remote islands, military installations, and offshore facilities. They are also seen as a way to modernize national grids without the lengthy timelines and high capital costs associated with conventional nuclear projects.

The United States, United Kingdom, Canada, China, and Russia are already jostling for leadership in the SMR sector.

South Korea, for its part, is ramping up its policy and industrial efforts in earnest. On June 12, the National Assembly passed the Special Act on Promoting the Development and Support of SMR Technology, creating the country’s first dedicated legal framework for the advancement and deployment of SMRs.

The legislation marks a turning point for Korea’s nuclear sector, which has often faced criticism for regulatory inertia despite its engineering prowess. While implementation details remain pending, industry experts say the new framework provides long-overdue clarity for stakeholders across the public and private sectors.

Even before the law’s passage, Korean firms had begun investing in SMR partnerships abroad. Korea Hydro & Nuclear Power (KHNP), Doosan Enerbility, and SK Inc. are collaborating to localize components for U.S.-based NuScale’s SMR technology.

The Korea Atomic Energy Research Institute has also developed its own 100-megawatt-class SMR design, known as SMART (System-integrated Modular Advanced Reactor), aimed at dual-use applications such as electricity generation and desalination. While not yet deployed domestically, the SMART reactor has drawn interest from countries including Saudi Arabia and remains Korea’s most advanced indigenous platform.

Beyond the nuclear sector, a growing number of Korean companies in steel, materials, and power systems are aligning with SMR development, suggesting the beginnings of a national industrial ecosystem.

One of the most pressing obstacles facing SMR deployment is access to High-Assay Low-Enriched Uranium (HALEU), a specialized fuel enriched up to 19.75 percent U-235. While HALEU offers advantages such as longer operational cycles and higher power density, it also poses significant regulatory and geopolitical challenges due to its proximity to weapons-grade enrichment levels.

At present, the only commercial supplier of HALEU is Centrus Energy in the United States. Although Russia has production capabilities, sanctions and strained diplomatic relations preclude cooperation. South Korea currently lacks domestic HALEU enrichment facilities and is exploring partnerships with the United States, France, and Canada to secure future supply.

Some SMR designs require only a single HALEU load for over a decade of operation, but such fuel remains tightly controlled under international nonproliferation agreements. Developing a reliable and transparent HALEU supply chain is now considered a strategic imperative for countries investing in next-generation nuclear infrastructure.

South Korea’s embrace of SMRs comes amid broader efforts to redefine energy security in a post-carbon world.

The country aims to secure demonstration sites by 2026 and begin construction of its first SMR unit by 2027. However, details regarding project locations and concrete fuel acquisition plans have yet to be made public.

Copyright ⓒ Aju Press All rights reserved.