Editor's Note: This article is the 26th installment in our series on Asia's top 100 companies, exploring the strategies, challenges, and innovations driving the region's most influential corporations.

SEOUL, July 10 (AJP) - Spanning sectors from steel and software to salt and automobiles, the Tata Group of India stands as Asia’s most enduring industrial empire.

With operations in more than 100 countries and a global workforce exceeding one million, the conglomerate posted $165 billion in revenue in fiscal 2024. Its 29 publicly listed companies boasted a combined market capitalization of $403 billion as of August in 2024.

To many, Tata is more than a business. It is a byword for Indian enterprise and a case study in how legacy, ethics, and innovation can form the bedrock of global expansion.

At its heart is a model of corporate stewardship that has shaped Indian capitalism and influenced business practices around the world.

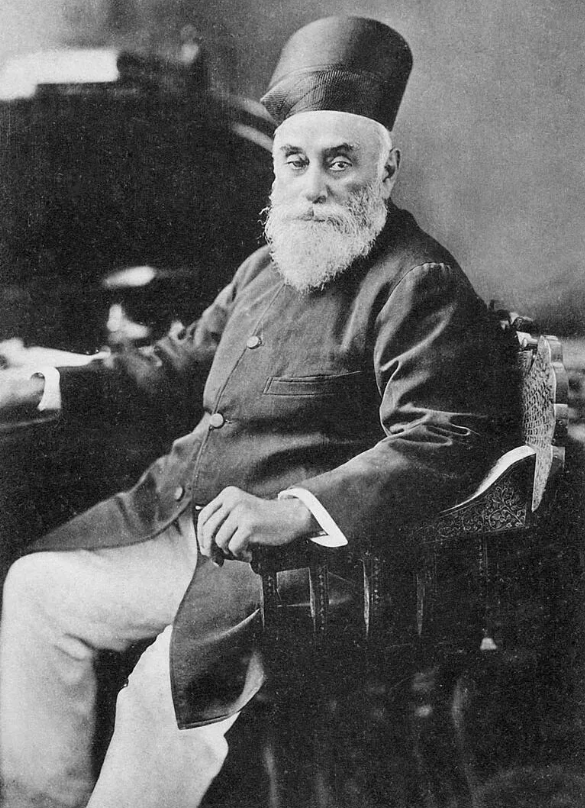

The group traces its origins to 1868, when Jamsetji Nusserwanji Tata — a visionary Parsi industrialist — founded a modest trading firm with an outsized ambition: to help build a modern, self-reliant India.

From establishing the Empress Mills in Nagpur to opening the Taj Mahal Hotel in Mumbai — India’s first hotel with electricity — Jamsetji laid the foundations for what would become one of the world's most diversified conglomerates.

But his legacy is not only industrial. Jamsetji championed a radical business philosophy for his time that industry should serve society. He seeded institutions such as the Indian Institute of Science and invested in hydroelectric power projects, embedding public good into private enterprise.

That ethos — prioritizing employee welfare, education, and infrastructure over pure profit — remains core to Tata’s identity, setting it apart in an era dominated by shareholder-first capitalism.

Tata’s expansion unfolded through a series of calculated bets on India’s industrial future.

Tata Steel was launched in 1907 as the nation’s first major steel plant. Tata Motors, founded in 1945, began with locomotives and evolved into a key player in commercial and passenger vehicles. In 1968, Tata Consultancy Services (TCS) was formed — now Asia’s largest IT firm, generating $30 billion in revenue and employing over 600,000 consultants worldwide.

Its global footprint grew dramatically in the 2000s with a series of bold acquisitions. In 2000, the group acquired Tetley Tea, marking its foray into international consumer markets. The $12 billion purchase of Corus Steel in 2007 vaulted Tata Steel into the global top tier, and the $2.3 billion acquisition of Jaguar Land Rover in 2008 transformed Tata Motors into an automotive powerhouse. TCS today leads the group in valuation, with a market cap exceeding $150 billion, followed by Tata Motors and Titan Company.

Despite its vast scale — more than 30 companies spanning 10 sectors — Tata operates on a decentralized model. Each firm has its own board, granting operational autonomy while adhering to shared principles of governance and ethical conduct.

At the center sits Tata Sons, the group’s principal holding company.

Nearly two-thirds of its equity is held by philanthropic trusts established by the Tata family. The largest, the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust, direct a significant portion of the group’s profits to charitable, educational, and scientific causes — a structure virtually unique among global business conglomerates.

Since assuming the chairmanship in 2017, Natarajan Chandrasekaran has accelerated internal consolidation and long-term capital allocation.

His tenure has seen the merger of seven metal subsidiaries with Tata Steel and the creation of Tata Consumer Products through strategic reorganization. The group plans to deploy over 80 percent of its capital expenditures in India over the next five years, including Tata Power’s $10 billion push into renewables and $5 billion earmarked for gigafactories.

Still, Tata faces the complexities of an evolving global economy — climate pressures, technological disruption, and geopolitical volatility among them. Yet its strengths lie in its unmatched diversification, deep-rooted brand equity, and 157-year legacy of integrity.

As the group charts its next chapter, balancing innovation with social purpose, it appears poised to maintain its place as one of Asia’s most resilient and principled industrial dynasties — an empire not only built to last, but built to lead.

Copyright ⓒ Aju Press All rights reserved.