SEOUL, September 08 (AJP) - Korean companies building some of the largest industrial facilities in the United States are bracing for construction delays that could stretch up to two years, after stepped-up immigration enforcement exposed widespread reliance on short-term business visas for technical staff.

Industry data compiled in the aftermath of last week’s raid on a Hyundai–LG Energy Solution battery plant in Georgia show that 22 projects worth about 145 trillion won, or more than $100 billion, are potentially at risk. At least six plants scheduled to begin operations this year now face staffing shortages severe enough to force comprehensive revisions to their timelines.

The Georgia battery plant is the most immediate casualty.

LG Energy Solution recently postponed the facility’s startup from the second half of 2025 to at least early 2026, after construction ground to a halt. The $4.4 billion venture, intended to supply 30 gigawatt hours of battery cells annually, is critical to Hyundai and Kia’s electric vehicle production schedules.

Surveys conducted by industry groups revealed that about 90 percent of Korean engineers and technicians dispatched to U.S. sites had been working under visa waiver programs or short-term B-1 business visas — categories never intended for long-term technical operations.

In response, Samsung Electronics has ordered employees to limit visa waiver trips to two weeks or secure expatriate visas for longer stays, while Hyundai canceled all planned U.S. business travel.

The disruption has triggered an urgent government response in Seoul.

Park Jong-won, deputy assistant minister for trade at the Ministry of Trade, Industry and Energy, said after a hastily convened meeting with major investors that the government would coordinate closely with the Foreign Ministry to craft a solution.

“This cannot be a one-time meeting,” Park said. “We will continue communicating with companies operating locally to find solutions.”

The visa bottleneck extends well beyond Georgia. Projects at risk include Samsung’s $17 billion semiconductor fabrication plant in Texas, LG Chem’s cathode materials facility in Tennessee, Samsung SDI’s joint battery plant with Stellantis in Indiana, SK On’s battery complexes with Ford, and Hanwha Q Cells’ solar hub.

Together, they represent critical elements of Washington’s supply chain strategy under the Inflation Reduction Act.

But securing proper work authorization is no quick fix. L-1 intracompany transfer visas or E-2 investor visas often take one to two years to process, and the oversubscribed H-1B program — capped at 85,000 annually — would require congressional intervention to expand.

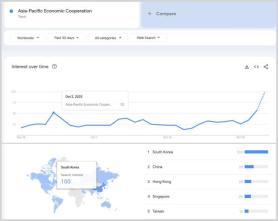

Seoul has been lobbying for a Korea-specific visa category similar to programs available to Australia and Singapore, though legislative timelines remain uncertain.

In the meantime, companies face hard choices: overhaul staffing to rely more heavily on local hires, accelerate automation to reduce technical labor needs, or absorb costly delays.

The stakes are especially high for the semiconductor and battery sectors, linchpins of U.S. industrial policy and vulnerable points in global supply chains if new facilities fail to come online as planned.

Copyright ⓒ Aju Press All rights reserved.