SEOUL, September 25 (AJP) - South Korea's state-run sea carrier HMM is betting big on clean fuel, digitalized fleet management, and business diversification as it navigates a turbulent freight cycle and an uncertain privatization push.

On Sept. 12, HMM signed a 10-year transportation contract with Brazil's mining giant Vale worth 430 billion won ($310 million), its second major deal with the company this year. The agreement, running from 2026 to 2036, will deploy five vessels to ship iron ore, building on a 636 billion won deal inked in May.

The back-to-back contracts highlight HMM's pivot beyond everyday container shipping toward bulk cargo, a strategy that has cushioned volatility in freight markets while making the company more attractive as an acquisition target.

Shipping tailwinds, market headwinds

South Korea's shipbuilding industry is bracing for an earlier-than-expected super cycle, driven by record orders for LNG carriers and floating production facilities. The government's proposed Korea-U.S. shipbuilding partnership, dubbed the "Make American Shipbuilding Great Again (MASGA)" initiative, is further boosting sentiment.

But freight oversupply clouds the outlook.

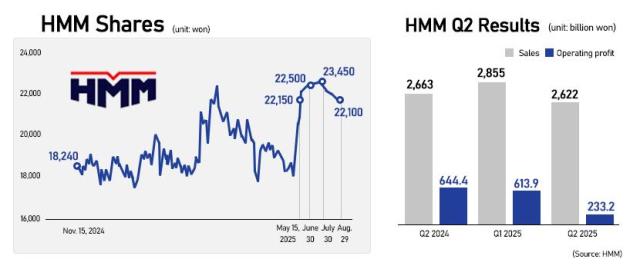

"Shipping fares had a brief spike in May after tariff suspensions between the U.S. and China, but rates are now trending downward," said Choi Ji-yun, analyst at Yuanta Securities Korea. "With backlogs now covering more than 30 percent of the global container fleet, supply is overwhelming demand. Freight rates will remain under pressure, and HMM cannot avoid the impact."

Despite market headwinds, HMM is pressing ahead with its modernization program. The company is scheduled to take delivery of seven methanol-powered 9,000-TEU container ships between late 2025 and mid-2026.

"Since 2020, all newly built vessels have been designed as smart ships," an HMM spokesperson said. "Roughly 10,000 sensors on each ship transmit real-time data to our integrated operations center, enabling safe voyage planning and big-data analysis for fuel and route optimization."

Existing ships are also being retrofitted with digital systems as part of a broader push for efficiency and carbon reduction.

HMM has pledged to achieve net-zero emissions by 2045 — five years ahead of the global maritime industry's 2050 goal. In September 2024, it announced a 14.4 trillion won ($10.4 billion) investment plan through 2030, with 60 percent earmarked for green initiatives such as alternative fuels and electrification.

The company is exploring ammonia and hydrogen as next-generation fuel sources. It is also expanding its bulk fleet, with 13 new carriers entering service in stages — including seven car and truck carriers, four multipurpose ships, and two MR tankers. Strategic acquisitions of second-hand vessels are also under review.

From state rescue to national champion

Founded in 1976 as Asia Merchant Marine, the company began with just three crude carriers before rebranding as Hyundai Merchant Marine in 1983. After rapid expansion, HMM was hit hard by the global financial crisis and eventually fell under state control in 2016 when the Korea Development Bank (KDB) became the largest shareholder.

In 2017, HMM absorbed assets from bankrupt rival Hanjin Shipping, cementing its position as Korea's flagship carrier. It rebranded as HMM in 2020.

Ownership, however, remains unsettled. A 2023 privatization bid collapsed after food-to-shipping conglomerate Harim Group withdrew. Once HMM completes its 2.2 trillion won stock buyback this month, state shareholders KDB and the Korea Ocean Business Corporation will hold just over 30 percent, opening the door to a new auction.

"HMM's growing pivot toward bulk shipping aligns naturally with POSCO's raw material needs," said Jang Woon-jae, professor of maritime transportation science at Mokpo National University. "But private shareholders must recognize that HMM's large vessels are obliged to operate even when demand is weak — volatility is built into the business."

As HMM pushes toward a green future while its ownership remains up for grabs, the company finds itself straddling two identities: a vital national strategic asset and a prize in Korea's evolving industrial landscape.

Copyright ⓒ Aju Press All rights reserved.