SEOUL, September 30 (AJP) - South Korea’s internet giant Naver and Dunamu, operator of Upbit—the world’s fourth-largest crypto exchange—are waging a war of nerves ahead of their $14 billion strategic tie-up through a stock swap, as they seek the blessing of their respective shareholders.

Naver Financial, the fintech arm of the country’s dominant internet platform, has agreed on a share-for-share merger with Dunamu, which would bring the crypto powerhouse firmly under the Naver family

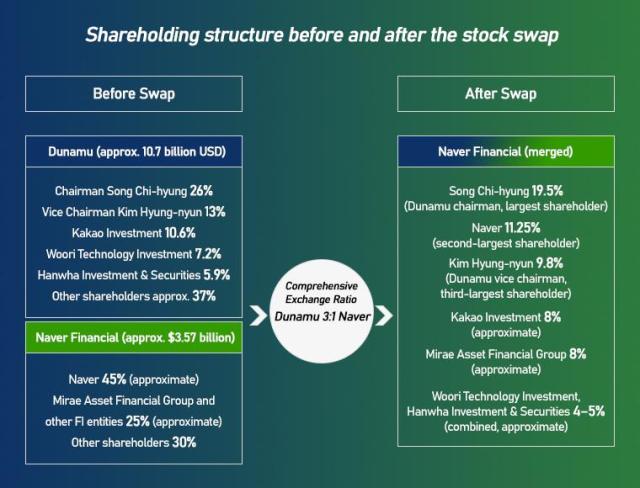

The challenge lies in valuation. Dunamu, which trades at over 400,000 won apiece in the over-the-counter market, commands a market value of about 15 trillion won ($11 billion)—roughly three times that of Naver Financial, valued at 5 trillion won.

Under the proposed terms, one Dunamu share would be swapped for about three newly issued Naver Financial shares. While that may look attractive on paper, many Dunamu shareholders remain unconvinced that multiple lower-valued shares fairly compensate for a single high-priced one.

Adding to the intrigue, Dunamu shares have been hitting fresh highs amid speculation of a Nasdaq listing—momentum that could give investors second thoughts about locking themselves into the deal.

Dunamu’s largest shareholder, Chairman Song Chi-hyung, who holds around 26%, is expected to emerge as the biggest shareholder of Naver Financial under the new structure. That would effectively give him control over both Dunamu and its broader digital asset business within the Naver ecosystem.

On the flip side, existing stakes held by Naver Corp. and financial investor Mirae Asset Financial Group could face dilution. Mirae Asset has reportedly ruled out further capital injections, while other investors, including Kakao Investment and Hanwha Investment & Securities, are still weighing their options. Hanwha said Tuesday it was reviewing the potential impact but had not reached a decision.

For Dunamu, the merger amounts to choosing Naver as its gateway to the mainstream financial system. Through Naver’s big-tech platform, Dunamu could strengthen its position in future financial arenas such as virtual assets, payments, and stablecoins, while securing ties with traditional banking infrastructure.

If completed, the share swap would establish a chain of ownership running from Naver to Chairman Song, then to Naver Financial, Dunamu, and finally Upbit. The arrangement would allow Dunamu to access financial operations and payment infrastructure without the need to acquire a bank outright.

The tie-up is also seen as a stepping stone for Dunamu’s long-anticipated Nasdaq IPO, with analysts expecting it to follow Naver’s example of listing Webtoon in the U.S.

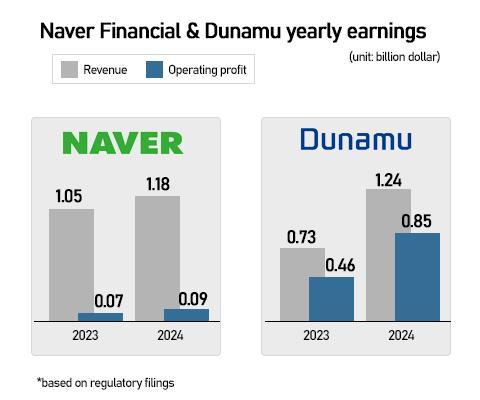

“The collaboration secures long-term growth drivers,” said Lee Jee-eun, an analyst at Daishin Securities, who kept a “Buy” rating on Naver with a target price of 330,000 won ($236). She noted that consolidating Dunamu’s financials could boost Naver’s net profit and enterprise value.

Longer term, she added, capturing the won-denominated stablecoin market early could allow the merged entity to generate steady income from stablecoin deposits and collateralized lending services.

Copyright ⓒ Aju Press All rights reserved.