"We have no confirmed plans to pursue a Nasdaq listing for Naver Financial at this time," CEO Choi Soo-yeon said Thursday at a press briefing at Naver's headquarters in Seongnam.

"Even if we consider going public in the future, we will prioritize enhancing shareholder value and contributing to the development of capital markets."

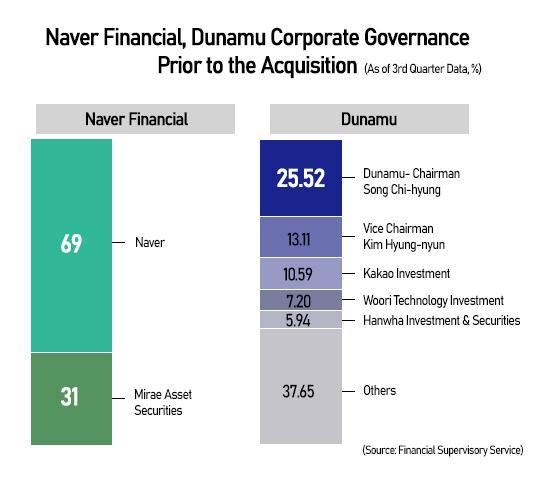

Her remarks came a day after the board approved a stock-swap deal giving Naver Financial full ownership of Dunamu. Under the terms, each Dunamu share will be exchanged for 2.54 shares of Naver Financial, valuing Dunamu at roughly 15 trillion won and Naver Financial at about 5 trillion won. The transaction—about $14 billion in implied value—faces extensive regulatory scrutiny.

The Financial Supervisory Service will review whether the merger could infringe shareholder rights or create financial-stability risks by combining mobile payments with cryptocurrency services. The Fair Trade Commission is expected to assess whether integrating Naver's vast user-data network with Dunamu's crypto-trading data could create undue market power.

If the merger is cleared and the combined unit seeks an IPO, listing venue will be a pivotal decision. A Nasdaq debut is considered plausible: Naver already trades on the KOSPI, and leaving Dunamu shareholders with non-voting, unlisted shares would likely trigger opposition. Naver also has recent U.S. market experience through last year's listing of Webtoon Entertainment.

"A Nasdaq listing would significantly boost Naver Financial's credibility and open doors to global institutional investors," said Hwang Suk-jin, professor at Dongguk University's Graduate School of International Affairs and Information Security. "The timing may not be now, but the opportunity remains open."

Mirae Asset Securities, previously the second-largest shareholder of Naver Financial with a 30 percent stake, declined to comment on potential IPO plans but welcomed the merger decision. Dunamu said it had no information to share regarding listing intentions.

The merger news was tempered Thursday when Dunamu disclosed that about 54 billion won in Solana-based assets had been transferred to an undesignated wallet early that morning, prompting Upbit to suspend all crypto deposits and withdrawals. The company said it would cover any losses with its own assets and stressed that customer funds would not be affected.

Copyright ⓒ Aju Press All rights reserved.