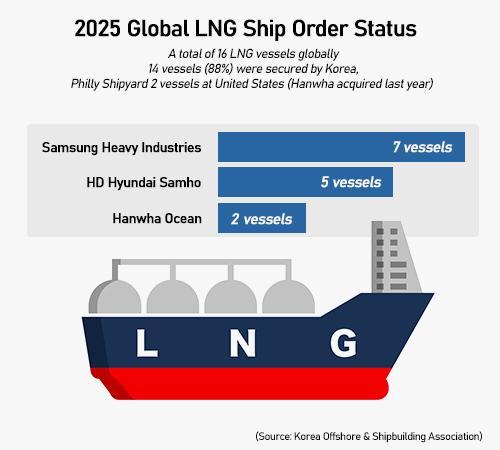

SEOUL, October 01 (AJP) - Korean shipbuilders have dominated the global orderbook for liquefied natural gas (LNG) carriers this year, securing 14 out of 16 new orders and leaving none for Chinese rivals despite an overall market slowdown.

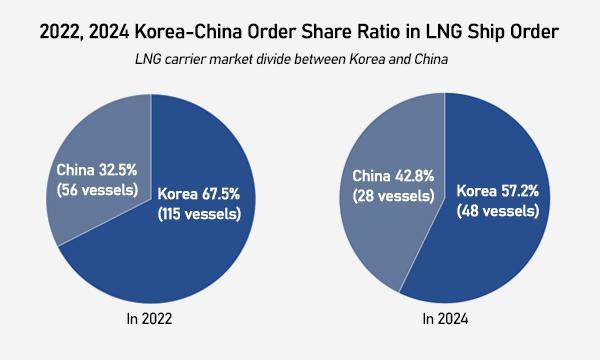

The global LNG market has long been split between Korea and China, with Korea’s lead appearing at risk until last year. But Korean yards have pulled ahead again in 2025, buoyed by shifts in demand and trade policies.

China’s slowdown is partly explained by new U.S. protectionist fees and weaker orders from Qatar, a major client for Chinese builders.

Beginning October 14, the U.S. Trade Representative will impose a $50-per-net-tonnage fee on Chinese-built, -operated, or -flagged vessels docking in U.S. ports.

Safety concerns have also weighed on Chinese yards. In 2023, the CESI Qingdao, an LNG carrier built by Hudong-Zhonghua Shipbuilding, suffered a generator failure at an Australian terminal, disrupting operations.

The broader shipbuilding market contracted in the first half, with global order volume falling 55 percent year-on-year. Orders for LNG carriers plunged 83 percent to 1.05 million compensated gross tonnage (CGT).

But momentum has shifted in the second half, with major energy companies preparing fresh investments. Australian producer Woodside Energy is in talks with shipyards on 16 to 20 LNG carriers, while U.S. firm Sempra has approved a $14 billion LNG project that could generate up to 20 carrier orders.

Korean shipbuilders are already seeing results. Hanwha Ocean announced a $251 million order from a North American shipowner this week and forecast stronger earnings for the rest of the year.

“Hanwha Ocean is positioned to substantially build up its capacity to construct LNG carriers in the United States by securing unparalleled technology and supply dominance,” said Oh Jun-ho, an analyst at Stunning Value Research, predicting the company could achieve 1 trillion won ($710 million) in operating profit this year.

Samsung Heavy Industries also struck an optimistic tone, noting that “LNG carrier orders will remain robust as the Trump administration resumes export approvals for non-FTA countries and new final investment decisions accelerate.”

Copyright ⓒ Aju Press All rights reserved.