SEOUL, October 13 (AJP) - South Korean authorities issued a strong verbal warning – and possibly followed up by won-propping action - on Monday, after the U.S. dollar hovered above the psychologically important 1,430-won mark amid stalled tariff negotiations with Washington and renewed trade tensions between the United States and China.

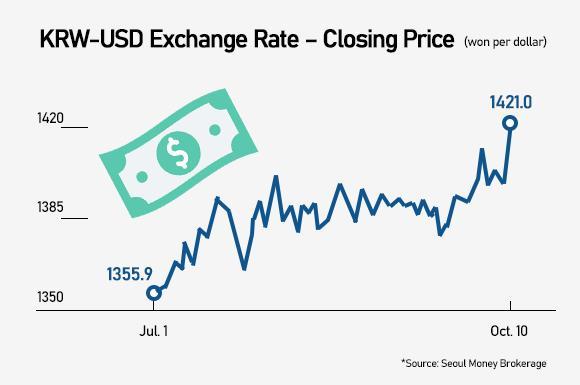

The won opened at 1,430.0 per dollar, up 9.0 won from the previous session, briefly touching 1,434.0 before stabilizing in the mid-1,420s. It was the weakest level since May 2, when it hit 1,440.0. The currency, down nearly 3 percent so far this month, later recovered to 1,426.1 following government intervention.

In a joint statement, the Ministry of Economy and Finance and the Bank of Korea warned against “potential herd behavior,” adding, “The foreign-exchange authorities are closely monitoring the market with heightened vigilance, as volatility in the won has increased due to recent domestic and global factors.”

The dollar remains firm, with the U.S. Dollar Index at 99.018. Persistent uncertainty over the U.S. government shutdown since Oct. 1 and heightened trade-war fears have fueled risk aversion. Beijing’s move to tighten rare-earth exports prompted U.S. President Donald Trump to threaten a 100 percent tariff on Chinese imports starting Nov. 1.

Trump later struck a softer tone on Truth Social, writing, “Don’t worry about China. Everything will be fine,” while noting that President Xi Jinping was facing a “bad moment” but did not want a recession.

Korean markets reacted nervously. The KOSPI fell more than 1 percent to the 3,500 range as foreign investors offloaded shares. The won-yen exchange rate rose to 940.31 per 100 yen, up 10.67 won from the previous close of 929.64, while the yen-dollar rate weakened 0.6 percent to 151.931 yen.

“Trump’s criticism of China’s export controls and his tariff threats could spark sharp declines in Asian markets and currencies,” said Min Kyung-won, economist at Woori Bank. “Although foreign selling and local buying may temporarily support prices, prolonged uncertainty over trade negotiations will likely weigh on sentiment.”

Copyright ⓒ Aju Press All rights reserved.