SEOUL, October 14 (AJP) - Despite lingering doubts over the durability and scope of the so-called AI-fueled chip supercycle, Samsung Electronics’ record-setting earnings guidance for the third quarter has set a new benchmark for the ongoing semiconductor boom.

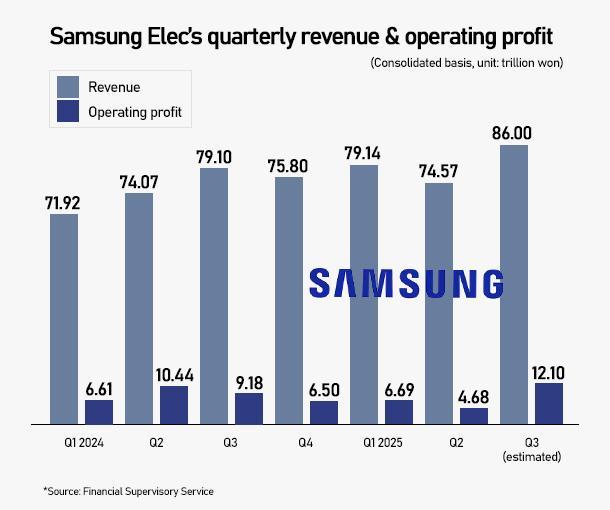

The South Korean tech giant on Tuesday projected an operating profit of 12.1 trillion won ($9.1 billion) for the July–September period, more than doubling from the previous quarter and marking the strongest quarterly performance since the second quarter of 2022.

Revenue also hit a new quarterly high of 86 trillion won, up 15.3 percent on quarter and 8.7 percent on year.

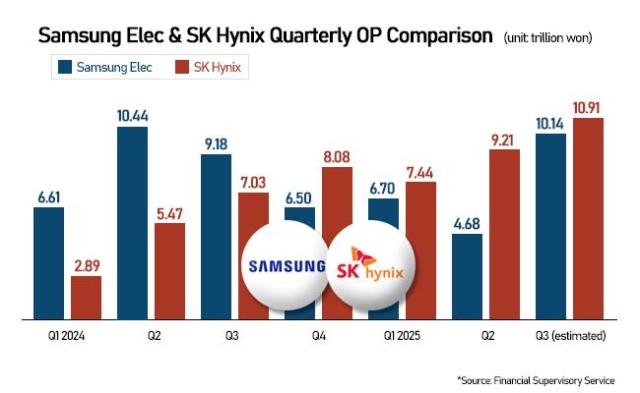

The stellar rebound comes after Samsung, for the first time in memory chip history, temporarily ceded its No. 1 position to local rival SK hynix earlier this year amid delays in its transition to high-bandwidth memory (HBM), critical to powering AI chips.

Although the company’s contract with AI leader Nvidia has stalled, Samsung has secured new orders from Advanced Micro Devices (AMD) and Tesla, signaling progress in its next-generation AI chip portfolio.

While the firm does not release divisional breakdowns in preliminary guidance, industry watchers estimate that the Device Solutions (DS) division — responsible for semiconductors — earned between 5 trillion and 6 trillion won, up sharply from 400 billion won in the second quarter.

Investor sentiment remains upbeat that the strong run will extend well into next year. Kim Dong-won, analyst at KB Securities, forecast Samsung’s 2025 operating profit at 53.5 trillion won, the highest since 2018, driven by rising DRAM profitability and higher foundry utilization rates.

The optimism is underpinned by firming memory prices. According to DRAMeXchange, the average fixed transaction price for PC DRAM (DDR4 8Gb 1Gx8) in September was $6.30, up 10.5 percent from August and surpassing the $6 mark for the first time since January 2019. The rebound reflects supply cuts in generic DRAM as chipmakers focus on high-performance server memory.

The strength extends across the industry. Micron Technology, the U.S.-based DRAM producer, posted an operating profit of $2.2 billion on $9.3 billion in revenue for its latest fiscal quarter. Analysts say memory makers such as Samsung, SK hynix, and Micron are next in line to benefit from the AI-driven surge that has already lifted TSMC and Nvidia.

SK hynix, a frontrunner in HBM and AI memory, is expected to post a record 11.6 trillion won in third-quarter operating profit, according to Son In-jun of Heungkuk Securities, citing sustained DRAM and NAND shipments.

TrendForce and other research firms forecast that average DRAM contract prices will continue to strengthen into the fourth quarter and next year, supported by resilient AI server demand and tight supply conditions.

Samsung shares closed 1.8 percent lower at 91,600 won on Tuesday after hitting an intraday high of 96,000 won, as investors took profits following the earnings announcement.

Copyright ⓒ Aju Press All rights reserved.