SEOUL, October 16 (AJP) - Chinese tourists are returning to South Korea in full force under the one-year visa waiver for group travelers, but their spending behavior has changed dramatically. Rather than binge shopping at duty-free stores, visitors are now showing a preference for budget-friendly and value-driven purchases.

The post-pandemic shift reflects growing familiarity among Chinese consumers with Korean brands and retail platforms. Instead of traditional package-tour splurges, travelers are opting for self-directed shopping experiences centered on price and authenticity.

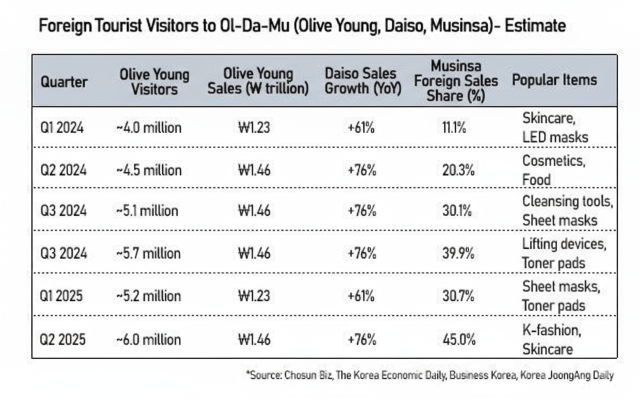

Curated local franchises such as Olive Young, Daiso, and Musinsa — collectively dubbed “Ol-Da-Mu” — have become must-visit stops for young Chinese tourists seeking Korean beauty, fashion, and household goods.

Duty-free retailers, once reliant on high-volume Chinese spending, are now adapting quickly. Shinsegae Duty Free has expanded its premium beauty-device lineup at its Myeong-dong flagship store, launching a pop-up for MediCube’s Age-R Booster Pro — currently the best-selling beauty gadget among departing travelers.

“Tourists from China, the U.S., Vietnam and other countries visit our booth,” a Shinsegae official said. “As interest in beauty devices grows globally, visitors in Myeong-dong are showing strong curiosity.”

Foreign sales at Shinsegae’s Myeong-dong store rose about 25 percent during the Chuseok holiday period (Oct. 1–8), with younger Chinese travelers driving much of the growth. The company plans to expand premium device offerings to capture this evolving demand.

Nationwide, the beauty-device segment is booming. MediCube’s sales jumped 102 percent between the second half of 2024 and the first half of 2025, according to Shinsegae.

“Nowadays, the devices are so good that I’ve stopped going to dermatology clinics altogether,” said 32-year-old Seoul resident Yea-ji Park. “The high-frequency treatments I used to get can now be done freely at home.”

“Korean beauty brands have built strong trust,” added Lee Ye-eun, a beauty show host. “While many devices are expensive, users see them as cost-effective compared with clinical treatments. People don’t spend on unknown brands — only trusted names with proven results.”

According to the Korea Tourism Organization, about 2.52 million Chinese tourists visited Korea in the first half of 2025, up 13.8 percent from a year earlier. The reinstatement of China’s visa-free entry program on September 26 is expected to further accelerate arrivals in the coming months.

Copyright ⓒ Aju Press All rights reserved.