The Songdo, Korea-based pharmaceutical giant said on Friday 99.9 percent of voting shares backed the spin-off proposal at an extraordinary general meeting in Incheon, attended by about 93 percent of eligible votes represented by 1,286 shareholders. The 20-minute session passed the single agenda item with near-unanimous support, paving the way for a Nov. 1 separation that will establish Samsung Epis Holdings as a holding company for the biosimilar business.

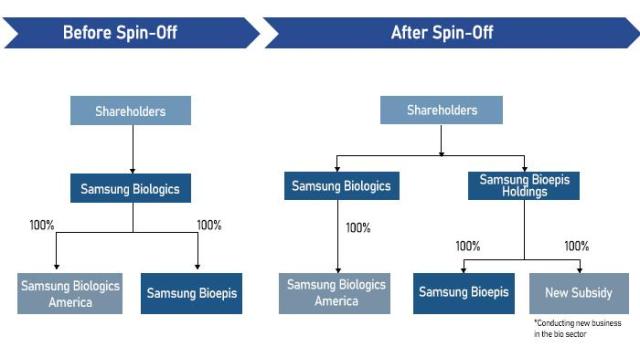

Under the plan, the new holding company will absorb Samsung Biologics' entire stake in Samsung Bioepis, while the parent company will continue as the surviving entity dedicated exclusively to contract development and manufacturing (CDMO) operations. Both firms are scheduled to begin separate trading on the Korea Exchange on Nov. 24 after a brief suspension period.

According to the spin-off ratio, shareholders will receive 0.3496087 shares of Samsung Epis Holdings for each Samsung Biologics share held—roughly one new share for every three existing shares. Ownership percentages will remain unchanged based on absolute share issuance.

The restructuring resolves a long-standing conflict within Samsung Biologics' hybrid business model. CDMO operations require clients to transfer proprietary processes and technologies, creating potential conflicts of interest when the same company also develops competing biosimilar products. With Plant 5 beginning operations in April, the separation removes a key barrier to securing new contracts from multinational pharmaceutical firms cautious about intellectual property exposure.

"This spin-off is a positive decision. Given CDMO's business characteristics of receiving process and technology transfers from clients, pursuing new drug development in parallel could raise technology leakage concerns and restrict new orders," said Jung Yi-soo, analyst at IBK Securities. "With conflict-of-interest concerns resolved through the business separation, prospects are positive for expanding new CDMO orders."

Jung added that the split could unlock significant valuation upside, noting that Samsung Bioepis operates with around 20 percent operating margins, compared to 30–40 percent for Samsung Biologics. "Through the split, independent valuation of high margins becomes possible, raising expectations for considerable upside in Samsung Biologics' corporate value," he said.

Investor confidence has already reflected optimism over the breakup, with Samsung Biologics' stock gaining 20 percent this year on restructuring expectations.

The move comes nine years after Samsung Biologics' IPO, launched under the ambition to replicate Samsung's global dominance in semiconductors in the bio sector. Founded in 2011, the company broke ground on Plant 1 that year, secured FDA approvals by 2015, opened an R&D center in San Francisco by 2020, and achieved full operations at Plant 5 this year, lifting total production capacity to 784,000 liters.

Meanwhile, Samsung Epis Holdings will focus on expanding Samsung Bioepis' biosimilar portfolio and future growth areas such as biotechnology platforms through new subsidiaries. The biosimilar arm aims to secure more than 20 product lines while strengthening research and development capabilities.

"This spin-off will provide an opportunity for both CDMO and biosimilar businesses to be transparently valued for their unique worth in capital markets through individual listings," said John Rim, CEO of Samsung Biologics. "Each company will do its utmost to further strengthen core business expertise and competitiveness, leading to enhanced shareholder value."

Samsung Biologics is slated to announce third-quarter results on Oct. 28. Analysts expect record earnings of 1.55 trillion won in revenue and operating profit of 505.2 billion won, supported by full-scale operations at Plants 4 and 5 and large contract wins earlier this year.

Copyright ⓒ Aju Press All rights reserved.

![[K-Bio] Korean pharma firms post record earnings despite US trade uncertainty](https://image.ajunews.com/content/image/2025/08/04/20250804110245656891_278_163.jpg)