SEOUL, October 17 (AJP) - South Korea is fast becoming the test kitchen for Western food giants eyeing Asia. Chipotle, one of America’s leading fast-casual chains, has chosen Seoul to gauge Asian palates for its Mexican flavors, while California-based In-N-Out Burger has returned with a second pop-up event — underscoring how Western brands increasingly view Korean “Zenners” as the first benchmark to crack the regional market.

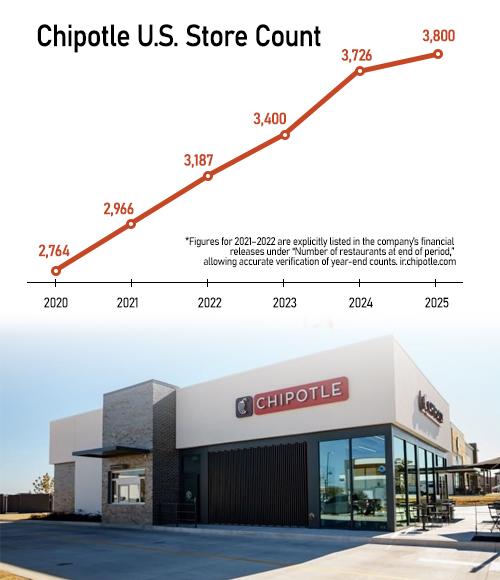

Chipotle last month partnered with Korea’s SPC Group to open its first restaurants in South Korea and Singapore in 2026, marking its first Asian venture in a decade. The U.S. burrito chain, which operates more than 3,800 locations worldwide, posted $3.06 billion in second-quarter 2025 revenue, up 3 percent on year, following double-digit growth through 2024.

“I’ve been waiting 13 years for Chipotle to come to Korea. Now I can finally taste the same burrito bowls I had in the U.S.,” said Jennifer, a 30-year-old Seoul resident who frequented the chain while living in California.

Whether the enthusiasm can last is another question. Korean consumers are notoriously demanding and adventurous, often flying overseas purely for new dining experiences.

Five Guys debuted in Seoul’s Garosu-gil in June 2023 with much fanfare, selling 30,000 burgers in its first week, but its importer Hanwha Galleria is now reportedly reviewing its partnership amid slowing sales. Shake Shack Korea, which topped global sales in 2017 after its Gangnam launch a year earlier, has also lost luster as boutique local burger brands won over customers with greater customization and freshness.

That demanding market has long fascinated In-N-Out, whose pop-ups spark feverish anticipation. Its latest event on Wednesday in Seoul’s Cheongdam district — the second after 2019 — drew hours-long lines.

“I tried to get an Animal-Style burger at the 2019 pop-up but couldn’t — it sold out after I waited two hours. This time I came three hours early,” said James Kim, 32.

Still, both the chain and its local partners remain cautious about sustaining that buzz.

Timing, experts say, is crucial.

“When Taco Bell entered Korea in 2010 and 2014, the timing wasn’t right — Korean consumers had little exposure to Mexican food. But now their tastes have broadened, so Chipotle might fare differently,” said You Hyun Alex Suh of the Consumer Trend Analysis Center.

Success will hinge on how fast newcomers adapt to local preferences — sometimes at the cost of brand identity.

A Cinnabon Korea spokesperson said the chain drastically reduced sugar content to suit local tastes. “We had to tone down the sweetness significantly because most Koreans don’t like overly sweet desserts,” the spokesperson said.

The shifting landscape mirrors a wider change across Asia’s food scene, where Korean consumers are seen as early adopters setting trends for neighboring markets while insisting on customization, quality, and health consciousness.

“How well Chipotle manages to balance authenticity with adaptation will determine whether it thrives here — or ends up like others who couldn’t,” said Suh.

Copyright ⓒ Aju Press All rights reserved.