SEOUL, October 20 (AJP) - South Korea’s central bank, like most of its Asian peers, is expected to hold fire on interest rates this week, preserving policy ammunition amid mounting uncertainties from U.S. tariff and trade policies.

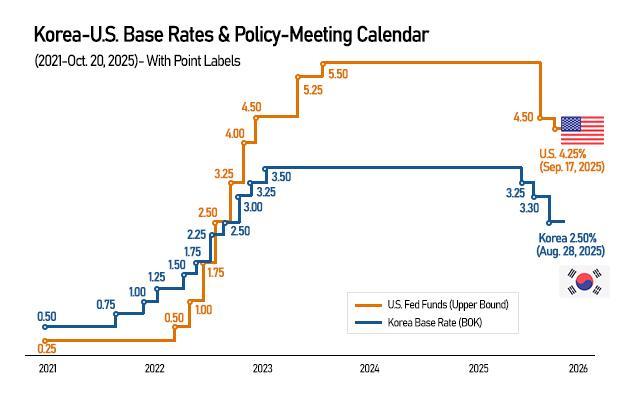

At Thursday’s Monetary Policy Board meeting, the Bank of Korea (BOK) is widely forecast to keep its benchmark rate unchanged at 2.50 percent, maintaining its cautious stance since the last cut in August. The decision comes as inflation shows signs of easing, but risks in the foreign exchange and housing markets remain elevated.

Last week, the government unveiled sweeping measures to cool soaring home prices in Seoul, designating the entire capital area as a restricted zone to tighten property transactions and mortgage lending. Under the new rules, buyers will be required to obtain government approval for certain deals and will face tougher loan-to-value limits.

In Korea, curbing housing inflation and household debt growth has become as critical as maintaining overall price stability. Lowering borrowing costs too soon, analysts warn, could send mixed signals while fiscal authorities pursue hawkish action to rein in speculative real-estate demand.

Governor Rhee Chang-yong has also signaled caution, indicating that the BOK will not rush into another easing cycle to revive growth at the expense of financial stability.

The continued weakness of the Korean won further complicates the outlook. The currency has fallen around 2 percent in recent weeks, briefly breaching the 1,430 mark against the U.S. dollar amid renewed U.S.-China trade tensions. A rate cut at a time when the U.S. Federal Reserve remains on hold could spur additional capital outflows and intensify pressure on the won.

Market observers expect the BOK to wait until its final meeting in November before considering another rate adjustment, pending confirmation of a slowdown in third-quarter GDP.

Elsewhere in Asia, the People's Bank of China kept its key lending rates unchanged for a fifth consecutive month, while the Bank of Japan, facing both currency volatility and political uncertainty, is also likely to stay on hold at its Oct. 29-30 policy meeting despite domestic inflation signals.

Copyright ⓒ Aju Press All rights reserved.