SEOUL, October 21 (AJP) - Samsung Electronics is equipping half of its upcoming Galaxy S26 lineup with its upgraded in-house processor, the Exynos 2600, to counter rising expectations for Apple’s AI-powered iPhone 17 series and to showcase renewed confidence in its AI chipset design and manufacturing capabilities.

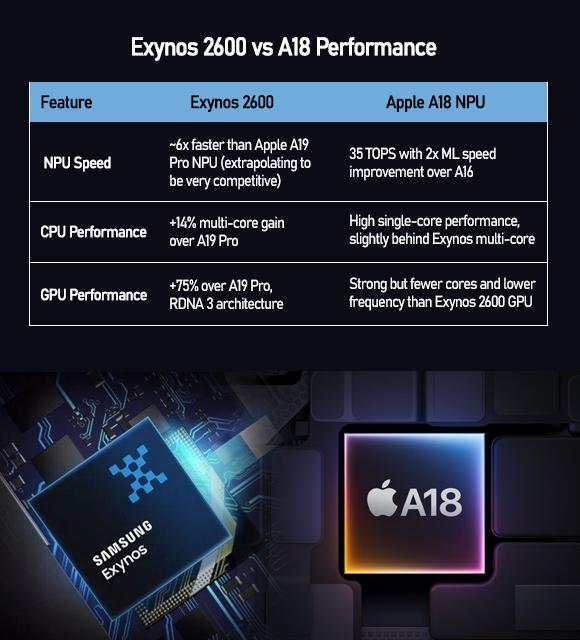

The tech giant said the new Exynos delivers more than six times the neural processing power of Apple’s latest A-series chip. The move marks the first time in four years that Samsung is mounting its own application processor on its flagship Galaxy S series, a sign of confidence in both hardware design and software integration.

The decision comes as Apple’s tight hardware-software ecosystem and expanding AI investments have lifted its shares to record highs this year.

Samsung has long split its premium phones between its Exynos and Qualcomm Snapdragon processors by region. However, earlier overheating and performance issues led the company to exclude Exynos from its Ultra models after 2021. Under the new strategy, Galaxy S26 units sold in Korea and Europe will use the latest Exynos chip, while models shipped to the United States, Japan, and other markets will continue to rely on Snapdragon.

The reinstatement reflects Samsung’s confidence in resolving the long-standing issues surrounding its application processor — the “brain” of a smartphone — while also improving profitability. The company spent nearly 10 billion dollars on external AP purchases last year, and analysts note that bringing production back in-house could strengthen margins and ecosystem control.

Daishin Securities analyst Ryu Hyung-geun said the Exynos 2600, designed for the Galaxy S26, is Samsung’s first 2-nanometer mobile processor and has shown stronger early-stage performance than its 3-nanometer predecessor.

“If the performance was really a problem, Samsung would have no reason to choose it,” countered Kim Yongdae, professor of electrical engineering at KAIST.

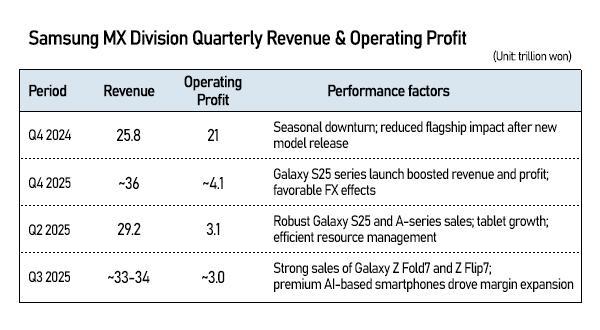

Samsung’s mobile division, known as MX, reported revenue of 29.2 trillion won and operating profit of 3.1 trillion won in the second quarter of 2025, down from 36 trillion won and 4.1 trillion won in the previous quarter, which had been boosted by Galaxy S25 sales. Third-quarter revenue is projected at around 33 to 34 trillion won, with profit near 3 trillion won, supported by solid demand for the Galaxy Z Fold7, Z Flip7, and higher-end AI-enabled smartphones.

Samsung commanded about 19.7 percent of the global top-tier smartphone market in the second quarter, shipping 58 million units — up 7.9 percent from a year earlier — while Apple accounted for roughly 15.7 percent with 46.4 million iPhones, a 1.5 percent increase. In the third quarter, Samsung retained a narrow lead with a 19 percent market share versus Apple’s 18 percent.

Sales of Samsung’s flagship devices also improved. The Galaxy S25 series sold about 22.7 million units in the first six months after launch, up 12 percent from 20.8 million for the Galaxy S24 during the same period a year earlier. Domestic sales in Korea surpassed 3 million units, two months faster than the S24.

Consumers largely await in suspicion.

“The Exynos has always been seen as weaker than Snapdragon, and now they’re putting it even in the Ultra model — that makes no sense,” said Kevin Park, a 33-year-old Galaxy user in Seoul.

Built with Samsung’s latest nanometer process, the Exynos 2600 integrates a next-generation neural processing unit for running language models, live translation, and image generation directly on-device without a network connection. Apple is expected to introduce similar AI capabilities through its A18 chip in the iPhone 17 lineup next year.

Analysts say on-device AI has become a key differentiator in the smartphone industry, as privacy concerns and cloud costs drive companies to process more data locally. Still, they caution that Samsung must prove its ability to manage heat, battery efficiency, and performance parity with Snapdragon-based models to avoid a repeat of past criticism in Europe and Asia.

Globally, tech companies are pursuing chip sovereignty to guard against supply disruptions. Apple designs its A- and M-series chips, Google uses its Tensor processors, and Huawei has revived its Kirin lineup despite U.S. sanctions. Governments in South Korea, China, and the United States are all promoting semiconductor self-reliance, reinforcing the trend.

Samsung has yet to disclose shipment targets for Exynos-powered Galaxy S26 devices. Suppliers say production will begin in November, with an official launch expected in early 2025. Whether the shift boosts profitability or revives old controversies will depend on how consumers judge its AI capabilities against Apple’s next-generation iPhones.

Copyright ⓒ Aju Press All rights reserved.