SEOUL, October 28 (AJP) - Hanwha Ocean’s red-hot rally lost steam Tuesday after the Korea Exchange (KRX) warned of overheating in the shipbuilder’s stock, which has surged more than 20 percent this month on anticipation of blockbuster quarterly earnings.

Shares of Hanwha Ocean fell about 5 percent to 132,300 won ($92.16) by midday after the KRX designated the stock as an “issue of investment caution,” citing excessive volatility in price and trading volume. The stock recently drew the second-largest margin loan balance on the market after SK hynix.

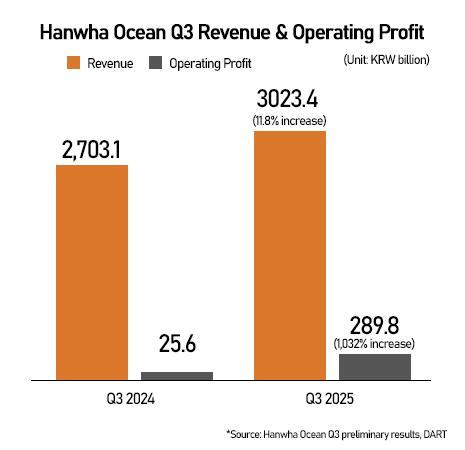

On Monday, Hanwha Ocean reported 289.8 billion won in operating profit for the July–September period — more than 11 times the 25.6 billion won earned a year earlier. Revenue rose 11.8 percent on year to 3.02 trillion won.

The turnaround was largely driven by a surge in commercial-ship deliveries, which accounted for 2.46 trillion won, or 82 percent of total revenue, with the segment’s operating margin staying strong at 12.5 percent. High-value vessels, particularly liquefied natural gas (LNG) carriers, were cited as the main growth driver.

“LNG carriers are expected to represent about 60 percent of our total revenue this year,” a company official said. “As related projects continue to be recognized, we expect to sustain solid profitability.”

Further upside may come from the defense sector. Hanwha Ocean and HD Hyundai Heavy Industries have formed the “Team Korea” consortium to bid for Canada’s Patrol Submarine Project (CPSP), competing against Germany’s ThyssenKrupp Marine Systems (TKMS).

The deal, if won, could open access to a market worth an estimated 60 trillion won. On Oct. 22, Hanwha Ocean launched the 3,600-ton diesel-electric submarine Jang Yeong-sil, underscoring its expanding naval shipbuilding capabilities.

The company also plans to submit a letter of intent for Poland’s Orka submarine program, which calls for the construction of three vessels valued at around 8 trillion won, potentially deepening its foothold in Europe’s defense market.

Meanwhile, Hanwha Philly Shipyard — the company’s U.S. unit acquired last December and central to the Korea–U.S. “Make American Shipbuilding Great Again” initiative — remains in a turnaround phase. It posted third-quarter revenue of 172 billion won but an operating loss of 39 billion won. Still, the yard’s backlog of 4.3 trillion won suggests a return to profitability once key contracts are delivered.

Analysts expect Hanwha Ocean to maintain solid earnings momentum through steady LNG-carrier demand and new defense opportunities. According to Yuanta Securities Korea analyst Kim Yong-min, LNG-carrier revenue is projected to rise about 2 percent in the first quarter of 2026, while “a major event in the defense segment could further boost the stock.” Kim added that container-ship sales may dip temporarily but rebound by the third quarter of 2026, with revenue from very large crude oil carriers (VLCCs) increasing roughly 8 percent.

Copyright ⓒ Aju Press All rights reserved.