SEOUL, October 29 (AJP) - Shares of South Korean electrical-equipment makers, particularly transformer manufacturers, climbed sharply on Wednesday after a consortium led by Korea Electric Power Corporation (KEPCO) was named the preferred bidder for a major wind power project in Saudi Arabia — a decision that investors saw as a boost for Korean exports in the energy-infrastructure sector.

Saudi Arabia’s Ministry of Energy announced Tuesday that the KEPCO consortium had been selected to develop the Dawadmi Wind Independent Power Producer (IPP) project in Riyadh Province, about 250 kilometers west of the capital. The project, estimated at 9 billion Saudi riyals ($2.4 billion), will generate up to 1,500 megawatts, or 1.5 gigawatts — roughly equivalent to the output of a nuclear reactor. It marks the first time a South Korean consortium has secured a gigawatt-class power generation contract in Saudi Arabia.

The massive scale of the project is expected to drive strong demand for high-voltage transformers, a key component for transmitting and regulating the plant’s electricity output. That expectation sent transformer-related stocks higher across the KOSPI.

Hyosung Heavy Industries rose 4.4 percent to close at 1.99 million won ($1,396), extending gains after recent strong earnings. The company, already a major supplier to North America and Europe, has steadily expanded its footprint in the Middle East, where second-quarter 2025 sales accounted for about 6 percent of total revenue. HD Hyundai Electric added 1.6 percent to 852,000 won, while LS Electric jumped 9.2 percent to 420,000 won, leading the rally as investors anticipated potential new orders from the KEPCO-led project.

The surge reflects both optimism surrounding Saudi contracts and the sector’s robust fundamentals.

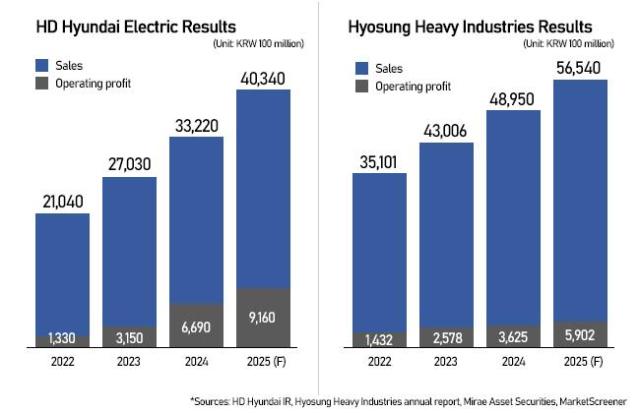

HD Hyundai Electric reported 3.32 trillion won in revenue and 669 billion won in operating profit last year — more than double the previous year’s figures. Hyosung Heavy Industries posted 4.9 trillion won in revenue and 363 billion won in operating profit. Analysts expect the trend to continue: Mirae Asset Securities projects HD Hyundai Electric’s 2025 revenue will reach 4.03 trillion won, with profit margins rising to 22.7 percent.

Investor sentiment also drew strength from expectations of deepening Korea–U.S. energy cooperation. Seoul and Washington are reportedly discussing a policy initiative known as “Make American Nuclear Cooperation Great Again,” or MANUGA, aimed at revitalizing America’s nuclear industry. Extra-high-voltage transformers — a specialty of South Korean firms — are critical for distributing power from nuclear plants, positioning Korean manufacturers as likely beneficiaries of the proposed collaboration.

President Lee Jae Myung and President Donald Trump discussed energy cooperation on Wednesday during the APEC 2025 summit in Gyeongju, further bolstering market enthusiasm.

“South Korea will contribute its expertise in nuclear construction, equipment, and operations to new U.S. reactor projects,” said Hwang Sung-hyun, a researcher at Eugene Investment & Securities. “In return, the U.S. aims to rebuild its nuclear infrastructure and enhance energy security — positioning Korea not just as an exporter, but as a strategic partner in America’s nuclear renaissance.”

Copyright ⓒ Aju Press All rights reserved.