SEOUL, October 30 (AJP) - Samsung Electronics’ chip division staged a decisive turnaround in the July–September quarter, with profit from its core memory operation jumping to 7 trillion won ($4.9 billion) — nearly 18 times from the last quarter — on the back of record memory revenue fueled by high-value server demand.

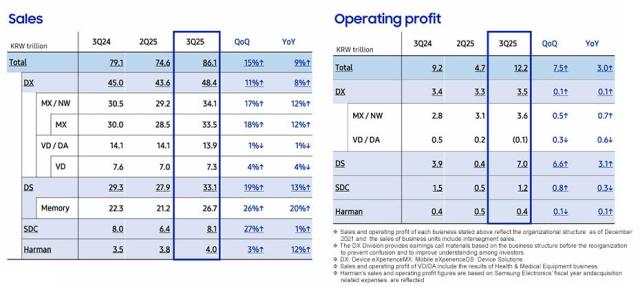

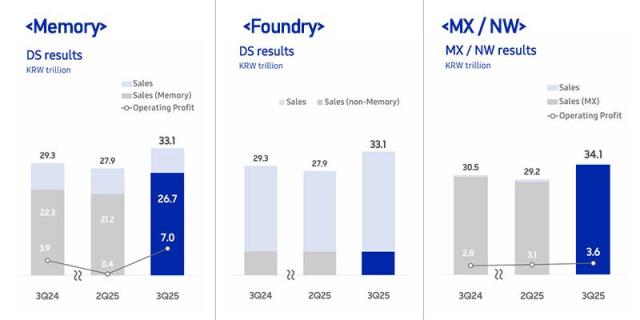

Memory sales climbed 26 percent on quarter and 20 percent on year to a fresh quarterly high of 26.7 trillion won. Including non-memory operations, revenue from Device Solution overseeing all chipmaking operation reached 33.1 trillion won, reflecting narrowing losses in logic and foundry segments as contract manufacturing activity picked up.

Samsung shares rose 3 percent to 103,100 won in Thursday trading after the better-than-expected memory results.

Even with the rebound, Samsung’s memory performance remains laggard behind SK hynix, which delivered 11.4 trillion won in operating profit and a 47 percent margin in the third quarter. The gap reflects hynix’s dominance in high-bandwidth memory (HBM) — the defining component for premium AI servers — where it held 62 percent of the market as of June.

Samsung, once unrivaled in DRAM, remains a distant third in HBM, falling short of a breakthrough on HBM4 shipments for the fourth quarter, while SK hynix begins supplying Nvidia.

While expecting stronger HBM4 demand and broader AI-driven memory momentum next year, Samsung is still awaiting customer clearance for mass production after delivering HBM4 prototypes, said Kim Jae-jun, memory division vice president, during a conference call.

Samsung reportedly cleared Nvidia’s HBM3E tests last month, but its position in the next-generation HBM4 supply chain remains uncertain.

To prepare for future demand, the company said it is making aggressive, preemptive investments. R&D spending reached a record 26.9 trillion won as of September. Capital investment totaled 32.3 trillion won, down 6.3 trillion won from a year earlier, with memory-infrastructure spending reduced but high-end chip production investment increased.

Capex next year will again center on AI-related memory and return to 2024 levels, Kim added — signaling a deepening shortage in legacy chip supply. Samsung Electronics allotted around 57 trillion won for expansion in 2024.

Outside its chip division, Samsung’s MX and networks business — home to its smartphone operations — reported 3.6 trillion won in operating profit, steady from 3.1 trillion won in the second quarter and 2.8 trillion won a year earlier on strong demand for new foldables. Mobile revenue rose 18 percent on quarter and 12 percent on year to 33.5 trillion won.

On a consolidated basis, Samsung confirmed third-quarter operating profit at 12.2 trillion won, more than double the previous quarter and up 32.5 percent on year, the strongest performance since the second quarter of 2022. Sales rose 15.4 percent on quarter and 9 percent on year to 86.1 trillion won. Net profit came in at 1.22 trillion won, sharply higher than 51 billion won last quarter and 21 percent above a year earlier.

Looking ahead, Samsung echoed SK hynix’s upbeat chip outlook, pledging to accelerate sales of high-performance AI and data-center products and push HBM4 mass production. While it reiterated the industry view that supply will remain tight amid surging, broad-based demand for generative AI, Samsung said it will focus on ramping output from its 2-nanometer fabrication line and readying its next-generation Taylor, Texas fab for start-up next year.

Copyright ⓒ Aju Press All rights reserved.