SEOUL, October 30 (AJP) - Hyundai Motor reported a sharp retreat in third-quarter operating profit Thursday as the spike in U.S. auto tariffs wiped more than $1 billion from the automaker’s bottom line, but reiterated that its EV and expansion strategy in the U.S. remains intact regardless of setbacks.

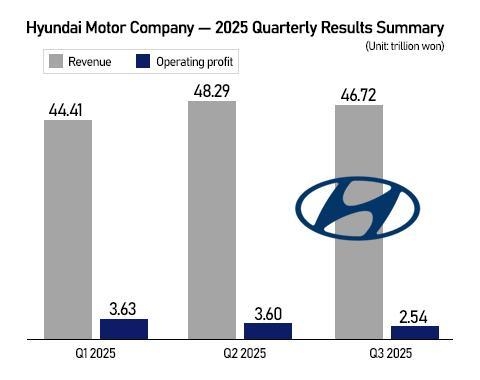

South Korea’s largest automaker — and the world’s No. 3 as of March — said operating profit fell 29.6 percent on quarter and 29.2 percent on year to 2.54 trillion won ($1.78 billion).

Revenue climbed to 46.72 trillion won, the highest for any third quarter, down 3.2 percent from the previous quarter but up 8.8 percent from a year earlier. The operating margin slumped to a three-year low of 5.4 percent.

The company attributed the earnings shock to Washington’s hike of U.S. auto tariffs to 25 percent, a rate that remained in place for Korean exports even as the U.S. lowered duties on Japanese and European cars to 15 percent under separate bilateral agreements.

Investors, however, looked past the weak results after Seoul and Washington reached an overnight deal to cut Korean auto tariffs to 15 percent as part of a broader $350 billion investment package from Korean companies.

Hyundai Motor shares traded 2.8 percent higher at 265,250 won as of 2:45 p.m. in Seoul.

Global shipments stayed resilient, with Hyundai cars selling 1,038,353 units in July-September period, up 2.6 percent from a year earlier but down 28,000 units from the previous quarter.

SUVs accounted for the largest share with 659,000 units sold, followed by 327,000 passenger cars and 52,000 commercial vehicles.

Eco-friendly models remained a key growth driver. Hyundai sold 252,000 eco-friendly vehicles, including 76,000 electric vehicles (EVs) and 161,000 hybrid electric vehicles (HEVs).

While EV demand softened globally, sales in North America surged 90.3 percent as the company moved aggressively to clear remaining inventory after U.S. President Donald Trump scrapped federal EV subsidies.

Fuel-cell electric vehicle (FCEV) sales also rose sharply to 4,000 units, driven by the launch of The All-New NEXO, up from 1,000 units in the second quarter. Hyundai also broke ground on Korea’s first hydrogen fuel-cell plant in Ulsan the same day, signaling its intention to accelerate growth in the FCEV segment.

Despite the tariff relief, the company predicted sales setback in the U.S. in the fourth quarter due to the end of federal subsidy. To bridge the EV gap, Hyundai is rolling out hybrid version of Palisade SUV in North America.

“The Palisade has always been one of our most profitable models,” Hyundai said. “With the tariff agreement lowering reciprocal rates to 15 percent, we expect even higher operating margins.”

EV demand remains robust in Europe, supported by strict environmental regulations, generous subsidies, and the region’s planned 2035 ban on internal combustion engines, will likely offset the losses.

The auto giant affirmed it will maintain on track in long-term EV pivot strategy, the company said in a conference call. The EV roadmap with battery partners LG Energy Solution and SK on including joint-venture plants also remains intact.

Copyright ⓒ Aju Press All rights reserved.