SEOUL, October 31 (AJP) - South Korea’s biopharmaceutical sector has expanded rapidly over the past decade, yet new breakthrough drugs have been scarce and the country has produced no Nobel Prize winners in science — a stark contrast to neighboring Japan’s 22 laureates in natural sciences this century. But there may be hope as global pharmaceutical giants ramp up investment and clinical activity in Korea.

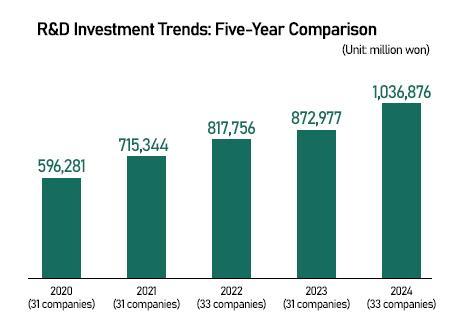

The Korean Research-based Pharma Industry Association (KRPIA) said Thursday that 33 multinational drugmakers invested 1.0369 trillion won ($745 million) in clinical research here last year, an 18.8 percent increase from a year earlier.

The figure reflects spending made through their Korean subsidiaries only, excluding direct funding from global headquarters — marking the first time locally executed clinical R&D investment has surpassed the 1 trillion won threshold.

Over the past five years, R&D spending by global pharma companies in Korea has grown at an average annual rate of 14.8 percent.

Clinical-stage research accounted for 42.9 percent, or roughly 445 billion won, the largest share of all R&D categories.

The number of R&D personnel reached 2,470, up 7.4 percent, with more than half (52.6%) directly involved in clinical trials — underscoring Korea’s strengthening position as a clinical development hub.

Pfizer Korea, the local unit of the New York-based drug giant, for one, has sharply increased R&D spending from 9.3 billion won ($6.7 million) in 2022 to 10 billion won in 2023, and to about 10.5 billion won in 2024, up roughly 5% from the previous year.

Pfizer’s R&D investment in Korea has been steadily growing since 2021, a spokesman in Korea said, adding, "We expect this trend to continue."

In the investment segment, cancer and rare disease treatments dominated clinical activity.

In 2024, 974 trials (69.4%) were oncology-related, while 184 trials (13.1%) focused on rare diseases. Over the last five years, oncology trials increased by 5.7 percent annually, and rare-disease trials rose by 10.1 percent, driven by Korea’s advanced hospitals, efficient clinical trial networks, strong patient participation, and robust medical data infrastructure. These factors have made Korea one of the most attractive sites globally for late-stage clinical studies.

According to the Korea Health Industry Development Institute (KHIDI), the global pharmaceutical market, valued at $1.6 trillion in 2023, is expected to expand to $2.24 trillion by 2028.

Global R&D spending is projected to grow from $306 billion to $377 billion over the same period.

The world’s top 10 pharmaceutical firms now account for 38.1 percent of all global R&D expenditure, with many allocating over 20 percent of their revenue to research and development — intensifying global competition for innovative drug pipelines.

Against this backdrop, South Korea is rising as Asia’s premier clinical trial hub. “Over the past decade, Korea has become a major player in clinical research thanks to its rapidly growing biopharmaceutical sector, advanced medical infrastructure, and high patient participation rates,” KRPIA said.

The association added that Korea’s strong research networks and skilled professionals are helping patients gain earlier access to innovative treatments and that the country is poised to solidify its role as a regional R&D base for global drug development.

Copyright ⓒ Aju Press All rights reserved.