SEOUL, November 06 (AJP) - Koreans are the world's most avid coffee consumers, and the market has now grown so dense that smaller franchises are increasingly looking abroad to survive.

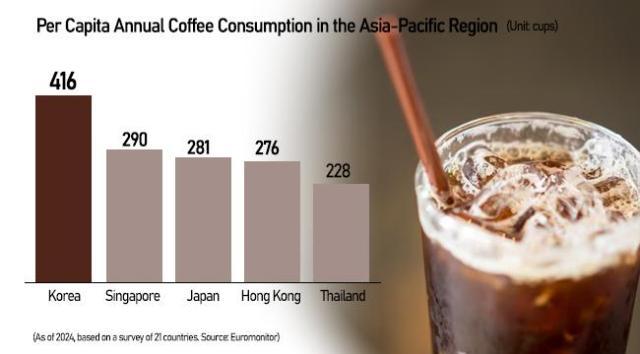

According to Euromonitor, Koreans on average drank 416 cups of coffee per person last year, the highest in the Asia-Pacific region. Consumption far outstripped Singapore's 290 cups and Japan's 281 cups, and was nearly six times the regional average of 57.

By the end of 2022, Korea had around 100,000 coffee shops nationwide — almost double the 52,000 stores operated collectively by the country's four major convenience-store chains (GS25, CU, 7-Eleven, Emart24). Coffee shops also outnumbered chicken restaurants, which totaled 81,000. Coffee franchise brands numbered 886, exceeding the 669 chicken franchises.

With such density, prices vary widely: budget chains sell Americanos for 1,500–2,000 won ($1.38), while premium cafés charge 4,500–5,500 won.

Budget chains have expanded rapidly amid long-running economic pressures and high youth unemployment. The top five value brands — Mega MGC, Compose Coffee, Paik’s Coffee, The Venti, and Mammoth Coffee — operate around 11,000 stores nationwide, more than double the 4,800 outlets run by the top five premium chains: Starbucks, Twosome Place, Hollys, Coffee Bean, and Angel-in-us.

Even market heavyweight Starbucks Korea shows signs of plateauing. Its store count edged up from 2,009 at the end of 2023 to 2,050 in the first half of 2024. Twosome Place saw similarly modest growth, rising from 1,670 to 1,700 stores.

By contrast, Mega MGC Coffee is racing toward the 4,000-store milestone. After passing 3,000 stores in May 2023, it reached 3,500 by March and more than 3,800 by August 2024 — adding roughly 800 locations in just over a year.

Its operator, N-House, has posted solid financial gains: revenue grew from 315.8 billion won in 2022 to 455.8 billion won in 2023 and is estimated to reach 545.9 billion won this year. Operating profit jumped from 54.5 billion won in 2022 to 104.3 billion won in 2023 and 118.1 billion won in 2024, keeping margins near 20 percent for three consecutive years.

Starbucks Korea, operated by SCK Company, recorded 3.1 trillion won in sales last year, up 5.8 percent from 2022. But its store expansion rate has declined sharply — from 8.7 percent in 2021, when Emart acquired the company, to 6.1 percent in 2023.

With domestic expansion reaching its limits, small and mid-sized franchises are turning overseas.

Mega MGC Coffee opened its first overseas branch in Ulaanbaatar, Mongolia, last May and has grown to five locations within a year. Paik's Coffee has focused on Southeast Asia, expanding from its first Manila store in 2016 to 18 outlets across the Philippines and Singapore.

Compose Coffee launched its third store in Singapore this year and is expected to accelerate expansion after management rights were acquired by Jollibee Foods, a major Philippine restaurant conglomerate.

The Venti embarked on global expansion this year with its first store in Canada, followed by openings in Vietnam and Jordan, tailoring Korean-style menus to local tastes.

Mammoth Coffee entered Japan with its first store, marking the brand's overseas debut.

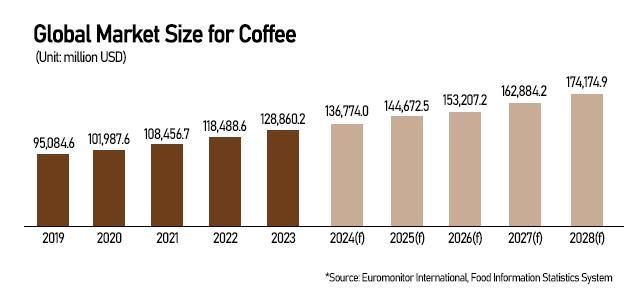

According to the Food Information Statistics System, the global coffee market has grown steadily since 2019 and is projected to reach $174.1 billion by 2028, up 20 percent from 2025 — offering headroom for Korean franchises seeking growth beyond a home market that has little space left to fill.

Copyright ⓒ Aju Press All rights reserved.