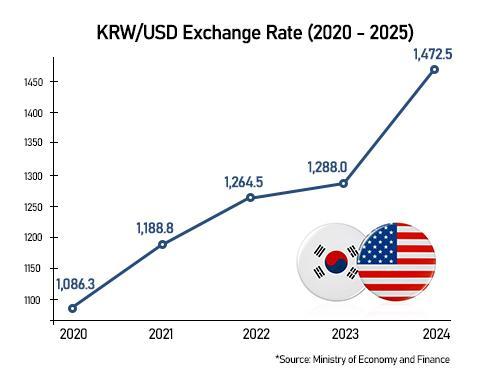

SEOUL, November 10 (AJP) - South Koreans involved in trade settlements or overseas spending may need to brace for the U.S. dollar staying above 1,400 won for an extended period, as structural vulnerabilities in the Korean economy and a strong preference for dollar-denominated assets continue to undermine the local currency.

The dollar eased to 1,451.50 won on Monday after briefly topping 1,460 late last week — its highest since last April when the country grappled with the presidential impeachment process and tariff threats that escalated under U.S. President Donald Trump.

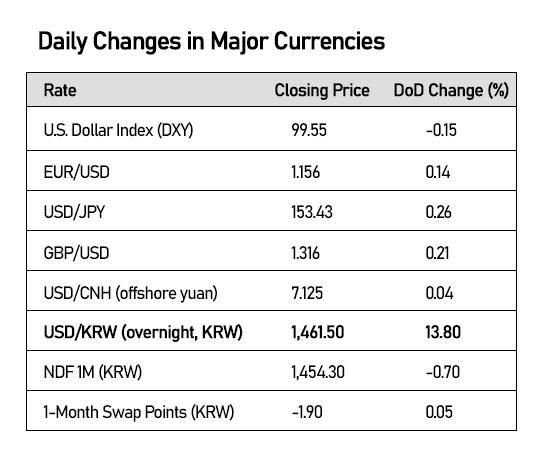

Despite a broadly steady greenback, the Korean won lost nearly 2 percent last week, marking the steepest decline among major currencies. The dollar index edged up just 0.15 percent. The euro strengthened 0.23 percent against the dollar, the yen 0.33 percent, and the pound 0.11 percent. Even currencies that weakened — the Swiss franc (-0.10%), Swedish krona (-0.42%) and Canadian dollar (-0.14%) — fell far less than the won.

The immediate catalyst for the won’s sharp slide was heavy foreign selling of Korean equities. Overseas investors offloaded 7.26 trillion won ($5.2 billion) worth of shares on the Korea Exchange between Nov. 3 and 7 — the largest weekly net outflow on record.

The amount exceeded the entire October outflow of 5.34 trillion won and almost erased September’s 7.44 trillion won net inflow.

The Kospi, which had broken above 4,200 earlier this month, quickly reversed as foreigners dumped chipmakers amid renewed concerns over an AI-driven overvaluation. The selloff added further downside pressure on the won.

Another source of structural depreciation is Koreans’ powerful appetite for overseas securities. Between January and September, Korean residents invested $99.85 billion in foreign stocks and bonds — more than triple the $29.65 billion that foreigners poured into Korean securities.

Although Korea posted a large current account surplus of $82.77 billion in the first nine months, outbound net assets — driven by direct and portfolio investment — reached $80.99 billion, nearly offsetting the surplus. The promise of government-driven direct investments in the U.S., capped at $20 billion annually as part of a bilateral trade deal, means further outflow.

“It’s the substantial outflow of dollars for financial investment,” said Kwon Ah-min, a researcher at NH Investment & Securities. “That’s the only clear direct explanation, given that current-account and capital-market conditions are otherwise favorable.”

She added: “The dollar globally is softening, the yuan is strong, and trade conditions are favorable — yet the dollar-won rate hasn’t dropped. That tells the story.” Kwon said a move toward the 1,500 level cannot be ruled out, though it is unlikely this year. “When the rate hit 1,485 earlier this year, Treasury yields were at 4.5 percent and tariff risk was higher. Now yields are more stable and the Fed tone is relatively dovish.”

She noted that authorities would likely prevent a break above 1,500, using National Pension Service hedging bands around 1,470–1,480 and conducting smoothing operations if needed.

Market consensus is divided on whether the pair will test 1,500 — but most agree that a return below 1,400 will be difficult. The forex market has stabilized somewhat on expectations that the 40-day U.S. federal government shutdown — the longest in history — may soon end.

But the relief is likely temporary, analysts say, because the won’s fragility is rooted in Korea’s over-reliance on semiconductor exports and susceptibility to U.S.-driven tariff and policy risks.

“It’s no longer a situation that can be controlled by domestic factors,” said Cho Yong-ku, an analyst at Shinyoung Securities. “Stabilization depends on the dollar index easing and foreign funds returning.” Cho added that a Fed rate cut, if it comes, could slow the pace of depreciation, but would not resolve structural vulnerabilities.

Copyright ⓒ Aju Press All rights reserved.