The company said Monday it will establish a European subsidiary in Amsterdam as early as the end of this year and begin sales in France, Germany and Spain, marking its first major expansion into the bloc.

"Both companies and consumers showed great interest in our products at SIAL Paris 2024 and the recently concluded ANUGA 2025 in Germany. We've held concrete discussions and even reached agreements with global warehouse discount chains," a company spokesperson said.

The timing reflects Europe's accelerating shift toward greener diets. A survey released in May by the Good Food Institute Europe found that 60 percent of respondents in Germany and 56 percent in the UK consume plant-based products at least once a month. While the survey confirmed strong interest in meat alternatives, it also noted that product familiarity and improved taste remain critical for wider adoption.

Tofu, already recognized as a protein-rich and versatile food, is expected to benefit from this trend as it makes a broader push into European grocery aisles.

Pulmuone's expansion also coincides with a major upgrade of its Ayer, Massachusetts plant, scheduled for completion in the first quarter of next year. The Boston-area facility, buoyed by robust U.S. tofu sales, will more than double its output to 9,000 blocks per hour from 4,500 currently. Products from the expanded plant will supply both North American and European markets.

The company is pushing ahead even as its overseas business remains in the red. Pulmuone plans to streamline operations by shedding unprofitable units, including its Chinese subsidiary.

At home, tofu consumption has stagnated as the domestic market remains oversaturated. Tofu exports peaked in 2020 at 7,770 tons worth $11.92 million before plunging during the pandemic to less than one-third of that level by 2022. Exports have since recovered to pre-COVID levels, supported by renewed interest in plant-based protein and Korean cuisine.

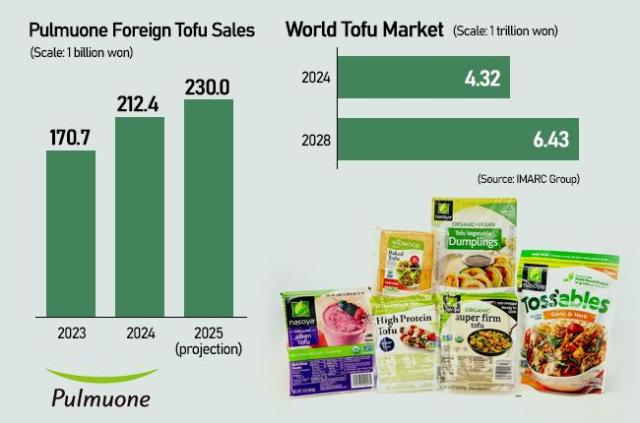

Although several Korean firms export tofu, Pulmuone far outpaces its rivals with dominant overseas sales and holds about 42 percent of the domestic market. Overseas revenue has steadily increased, rising from 11.9 percent of total sales in 2019 to 19.8 percent last year. The company generated 635.1 billion won in overseas sales in 2024.

In the United States, Pulmuone controls roughly 75 percent of the tofu market and has maintained its No. 1 position for a decade. Its success has been driven by extensive product localization—eliminating the bean odor disliked by Western consumers while improving freshness through upgraded logistics and cold-chain systems.

The company has set a long-term goal of achieving 1 trillion won in U.S. tofu sales, aiming to increase household penetration across the market.

"Much of our U.S. tofu is drier and higher in protein, less silky than domestic varieties. We even sell cheese-like mini tofu cubes, as Western consumers tend to dislike the pudding-like texture of Korean tofu," the spokesperson said.

Pulmuone plans to apply the same formula in Europe, with high-protein, extra-firm tofu leading its initial lineup.

The company is regarded as a pioneer in exporting Korean food culture. It opened its first U.S. tofu plant in Los Angeles in 1995 and now operates factories in Fullerton, California; Tappan and Ayer in New York; two facilities in Beijing; and five plants across Japan. It is also accelerating expansion into Southeast Asia, including Vietnam.

Copyright ⓒ Aju Press All rights reserved.

![[K-Tech] From creepy-crawly to culinary contender: Companies bet big on edible insects](https://image.ajunews.com/content/image/2025/07/24/20250724084507564010_278_163.png)